3 Japanese Growth Stocks With Significant Insider Ownership

Japan's stock markets have shown resilience, with the Nikkei 225 Index and TOPIX Index both rising recently, supported by a weaker yen which has improved the profit outlook for exporters. As investors navigate this favorable backdrop, identifying growth companies with significant insider ownership can offer insights into potential opportunities, as such ownership often signals confidence in a company's future prospects.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Micronics Japan (TSE:6871) | 15.3% | 31.5% |

| Hottolink (TSE:3680) | 26.1% | 61.5% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.7% | 40.2% |

| Medley (TSE:4480) | 34% | 30.4% |

| Inforich (TSE:9338) | 19.1% | 29.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.3% |

| ExaWizards (TSE:4259) | 22% | 75.2% |

| Money Forward (TSE:3994) | 21.4% | 68.4% |

| AeroEdge (TSE:7409) | 10.7% | 25.3% |

| freee K.K (TSE:4478) | 23.9% | 74.1% |

Underneath we present a selection of stocks filtered out by our screen.

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

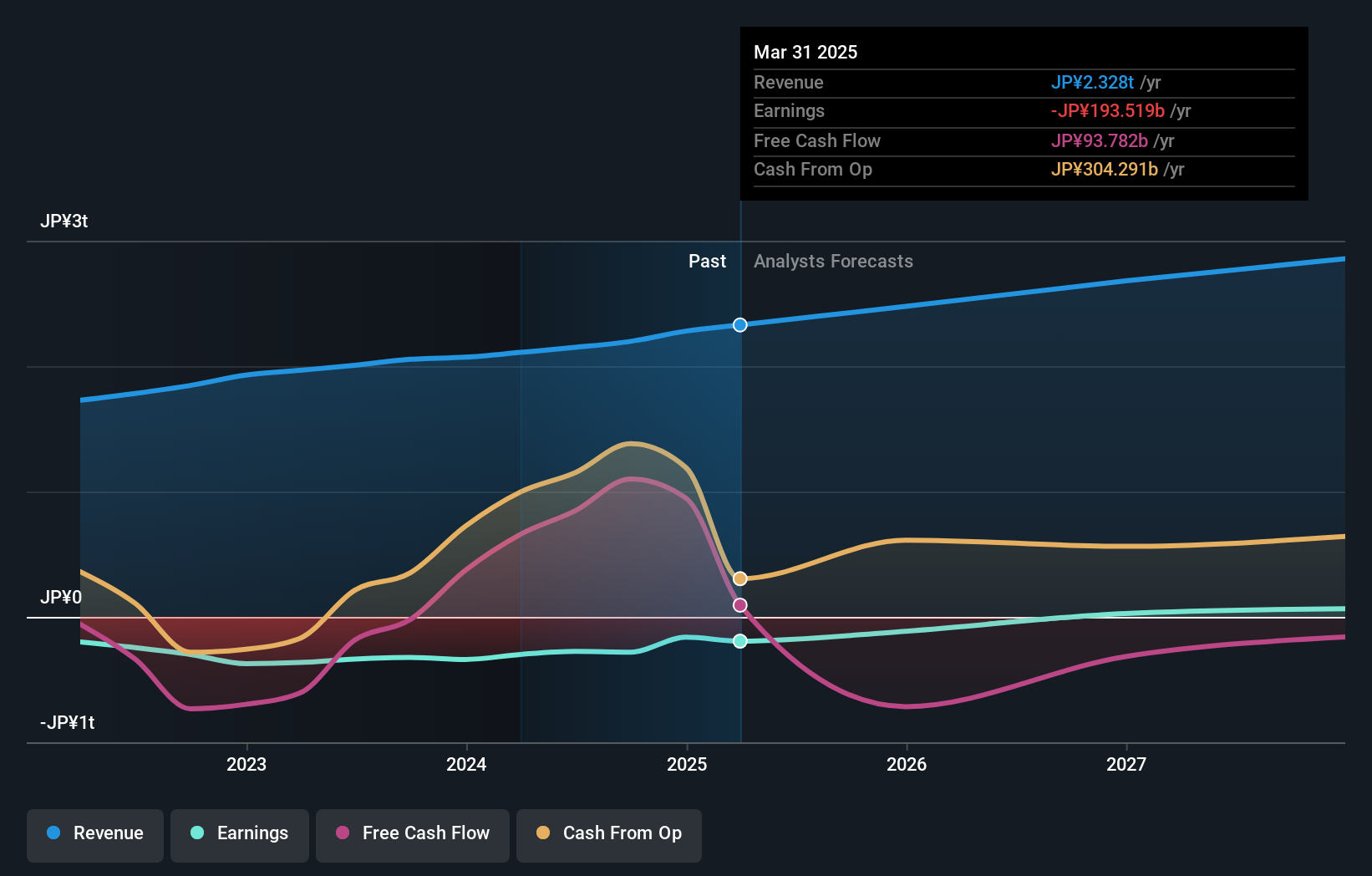

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors both in Japan and internationally with a market cap of ¥2.07 trillion.

Operations: The company's revenue segments include Mobile services at ¥382.95 million, Fin Tech at ¥772.29 million, and Internet Services at ¥1.24 billion.

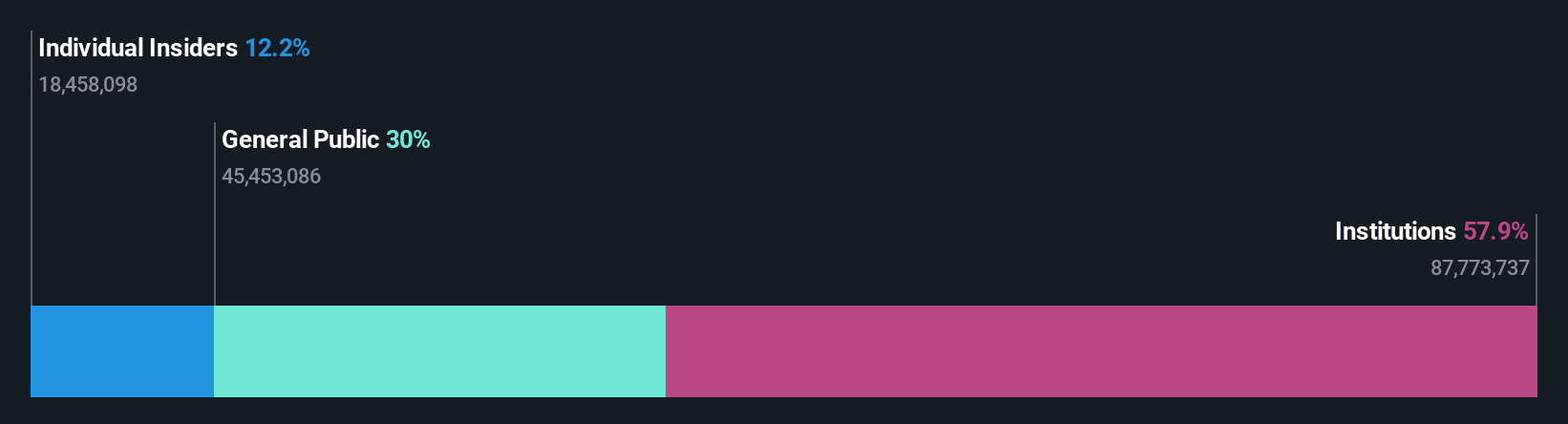

Insider Ownership: 17.3%

Rakuten Group is forecast to achieve profitability within the next three years, outpacing average market growth. The company's revenue is expected to grow at 7.5% annually, faster than the Japanese market's 4.3%. However, its Return on Equity is projected to remain low at 9.5% in three years. Despite trading significantly below estimated fair value, Rakuten's share price has been highly volatile recently and lacks recent insider trading activity insights.

- Take a closer look at Rakuten Group's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Rakuten Group shares in the market.

BayCurrent Consulting (TSE:6532)

Simply Wall St Growth Rating: ★★★★☆☆

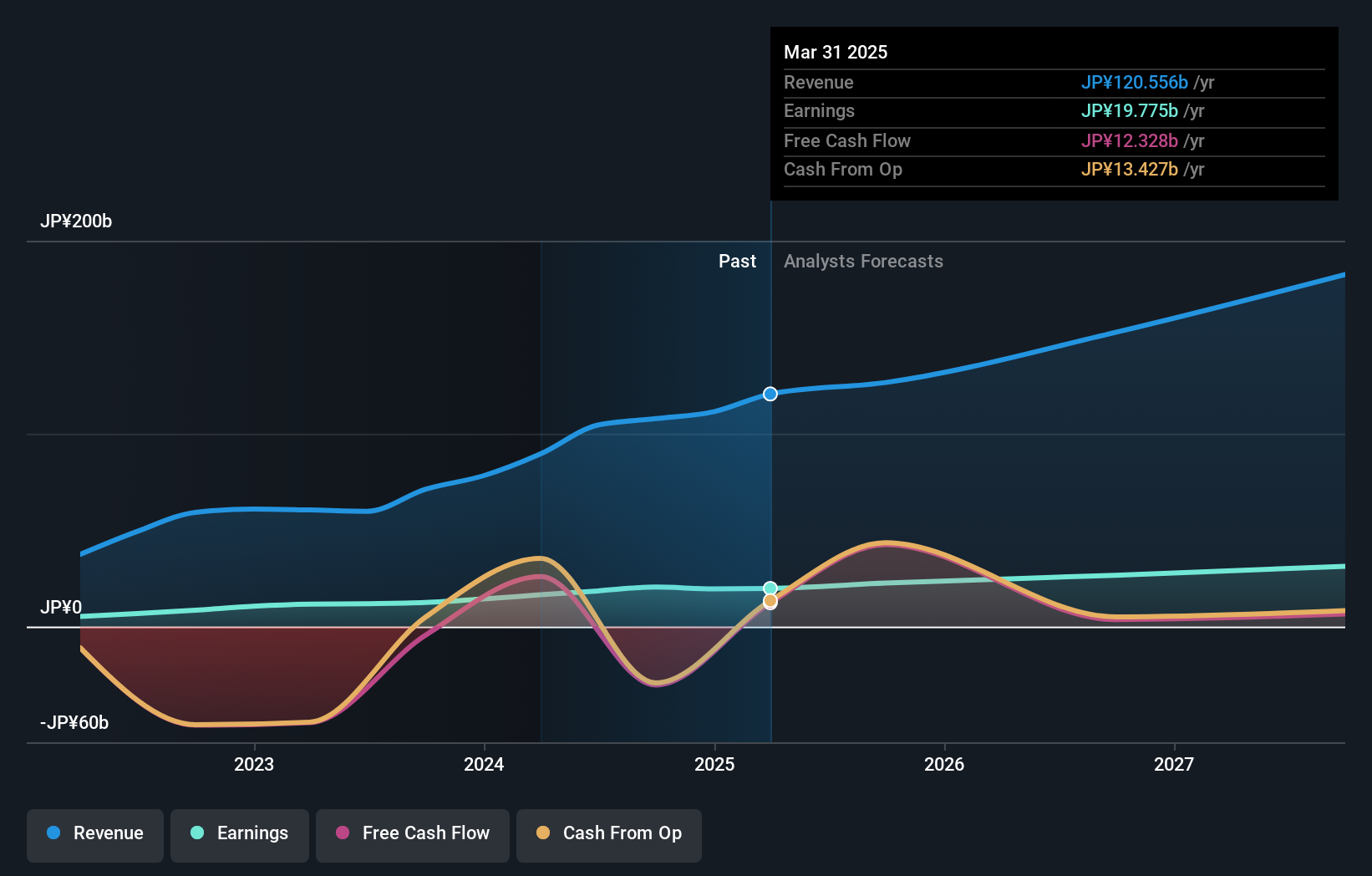

Overview: BayCurrent Consulting, Inc. offers consulting services in Japan and has a market capitalization of approximately ¥826.88 billion.

Operations: The company generates revenue through its consulting services in Japan.

Insider Ownership: 13.9%

BayCurrent Consulting is trading at 35.7% below its estimated fair value, with earnings forecast to grow at 18.4% annually, surpassing the Japanese market's average growth rate. The company's revenue is expected to increase by 17.8% per year, also outpacing the market's 4.3%. Although there has been no recent insider trading activity, BayCurrent's Return on Equity is projected to be high at 35.4% in three years' time.

- Navigate through the intricacies of BayCurrent Consulting with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, BayCurrent Consulting's share price might be too optimistic.

Financial Partners GroupLtd (TSE:7148)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Financial Partners Group Co., Ltd., along with its subsidiaries, offers a range of financial products and services in Japan, with a market capitalization of approximately ¥208.23 billion.

Operations: Financial Partners Group Co., Ltd. generates revenue through its subsidiaries by offering diverse financial products and services within Japan.

Insider Ownership: 31.3%

Financial Partners Group Ltd. demonstrates potential as a growth company with substantial insider ownership, despite its high debt levels. Its earnings are forecast to grow at 17% annually, outpacing the Japanese market's average of 8.8%, while revenue is expected to increase by 15.4% yearly. Recent strategic expansions include opening a new sales office and acquiring prime real estate in Fukuoka for fractional ownership investments, supporting future growth prospects amidst volatile share prices and an unstable dividend track record.

- Get an in-depth perspective on Financial Partners GroupLtd's performance by reading our analyst estimates report here.

- Our valuation report here indicates Financial Partners GroupLtd may be undervalued.

Where To Now?

- Dive into all 101 of the Fast Growing Japanese Companies With High Insider Ownership we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal