3 ASX Stocks That May Be Trading Below Their Intrinsic Value Estimates

The Australian market has shown positive momentum, rising 1.7% over the last week and 18% over the past year, with earnings expected to grow by 12% annually. In this environment of growth, identifying stocks that may be trading below their intrinsic value can offer potential opportunities for investors seeking to capitalize on undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Data#3 (ASX:DTL) | A$7.36 | A$13.47 | 45.4% |

| Mader Group (ASX:MAD) | A$5.57 | A$10.43 | 46.6% |

| Accent Group (ASX:AX1) | A$2.43 | A$4.81 | 49.4% |

| Ansell (ASX:ANN) | A$31.20 | A$57.93 | 46.1% |

| MLG Oz (ASX:MLG) | A$0.64 | A$1.16 | 45% |

| Charter Hall Group (ASX:CHC) | A$16.21 | A$31.34 | 48.3% |

| Ingenia Communities Group (ASX:INA) | A$4.96 | A$9.40 | 47.3% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Little Green Pharma (ASX:LGP) | A$0.088 | A$0.17 | 48% |

| Mineral Resources (ASX:MIN) | A$49.11 | A$95.88 | 48.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

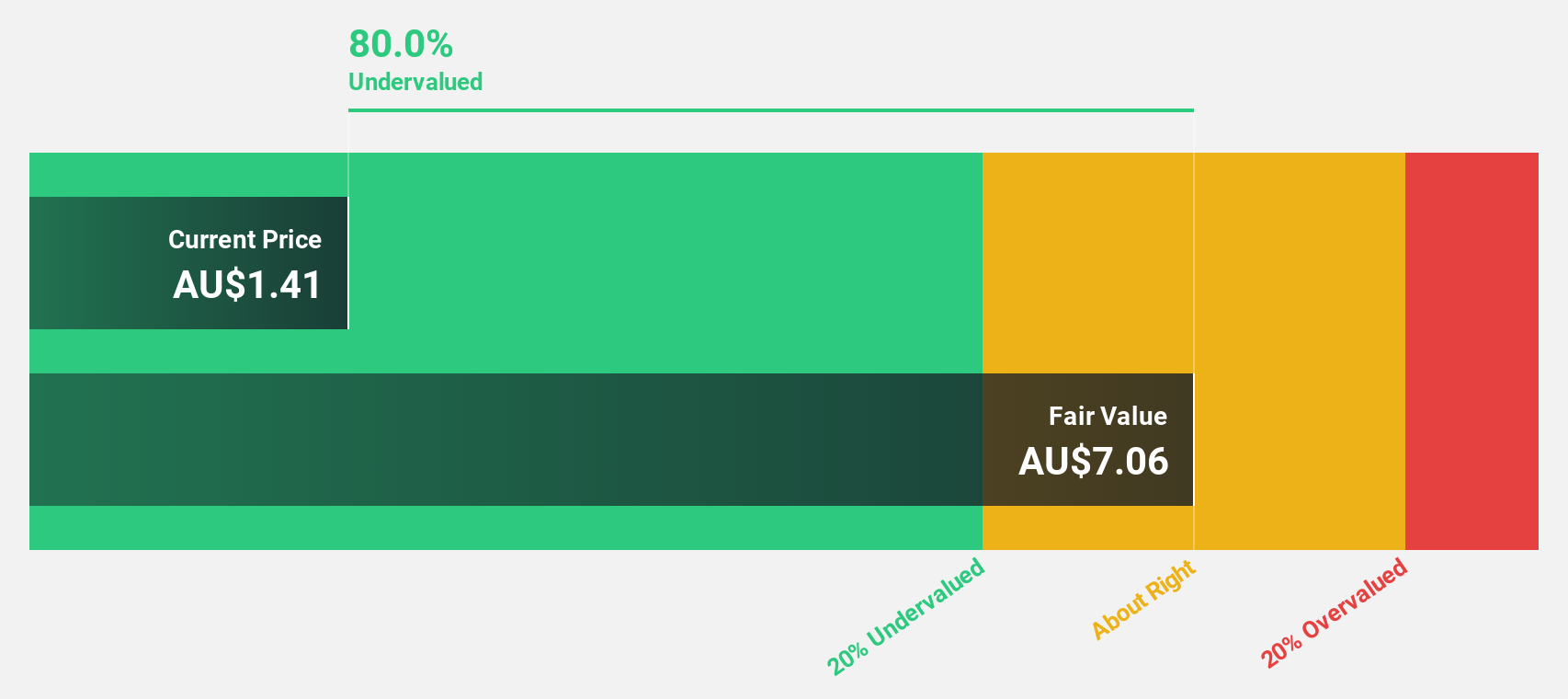

Accent Group (ASX:AX1)

Overview: Accent Group Limited operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand with a market capitalization of A$1.38 billion.

Operations: The company's revenue is derived from its Retail segment, which generated A$1.27 billion, and its Wholesale segment, contributing A$463.20 million.

Estimated Discount To Fair Value: 49.4%

Accent Group is trading at A$2.43, significantly below its estimated fair value of A$4.81, suggesting it may be undervalued based on cash flows. Despite a forecasted revenue growth of 6.4% per year and earnings growth of 14.6%, profit margins have declined from 6.2% to 4.1%. Recent board changes and private placements indicate strategic shifts, but significant insider selling raises caution regarding internal confidence in future performance.

- The growth report we've compiled suggests that Accent Group's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Accent Group.

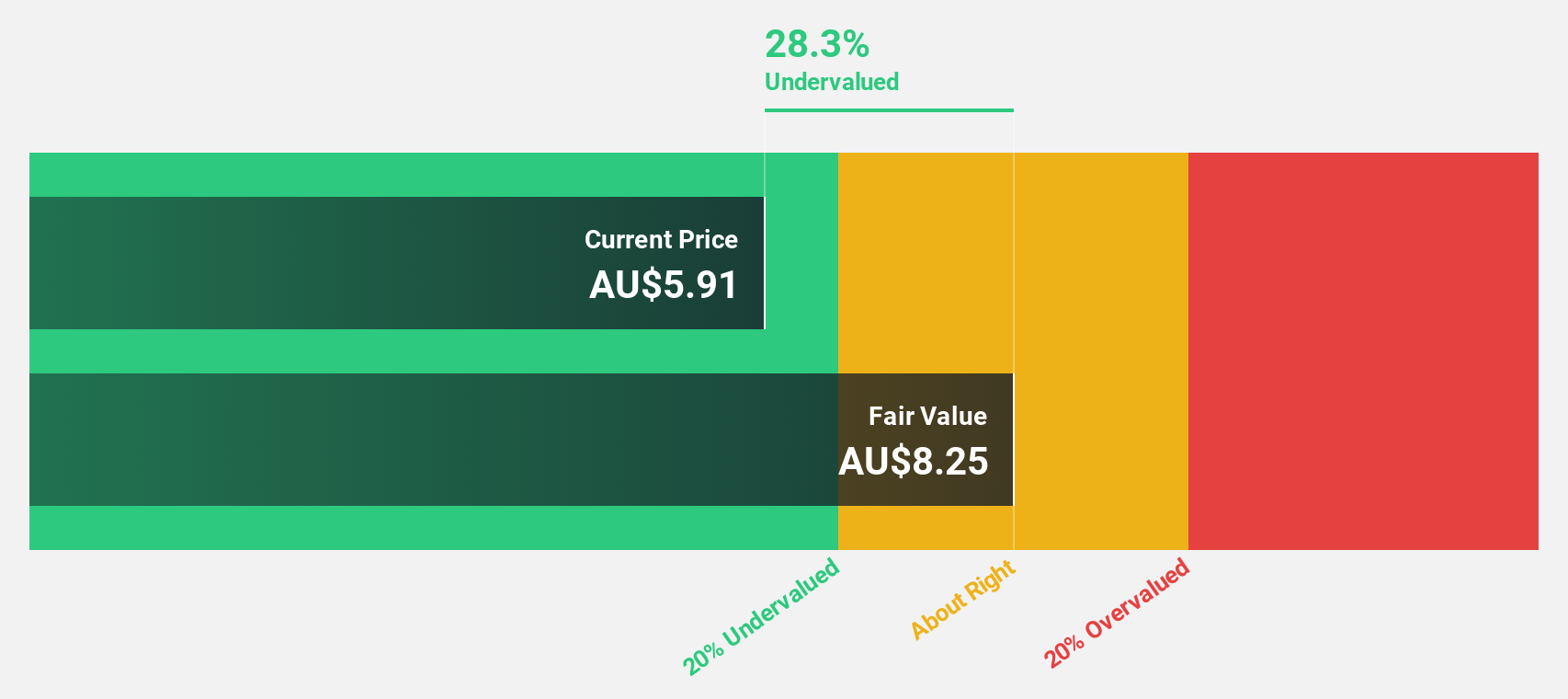

Mader Group (ASX:MAD)

Overview: Mader Group Limited is a contracting company that offers specialist technical services in the mining, energy, and industrial sectors both in Australia and internationally, with a market cap of A$1.12 billion.

Operations: The company's revenue primarily comes from its Staffing & Outsourcing Services segment, which generated A$774.47 million.

Estimated Discount To Fair Value: 46.6%

Mader Group, trading at A$5.57, is valued below its estimated fair value of A$10.43, highlighting potential undervaluation based on cash flows. The company reported fiscal 2024 revenue of A$774.47 million and net income of A$50.42 million, with earnings expected to grow faster than the Australian market at 13.5% annually. Recent inclusion in the S&P Global BMI Index and increased dividends reflect positive momentum, yet growth forecasts remain moderate compared to significant benchmarks.

- In light of our recent growth report, it seems possible that Mader Group's financial performance will exceed current levels.

- Navigate through the intricacies of Mader Group with our comprehensive financial health report here.

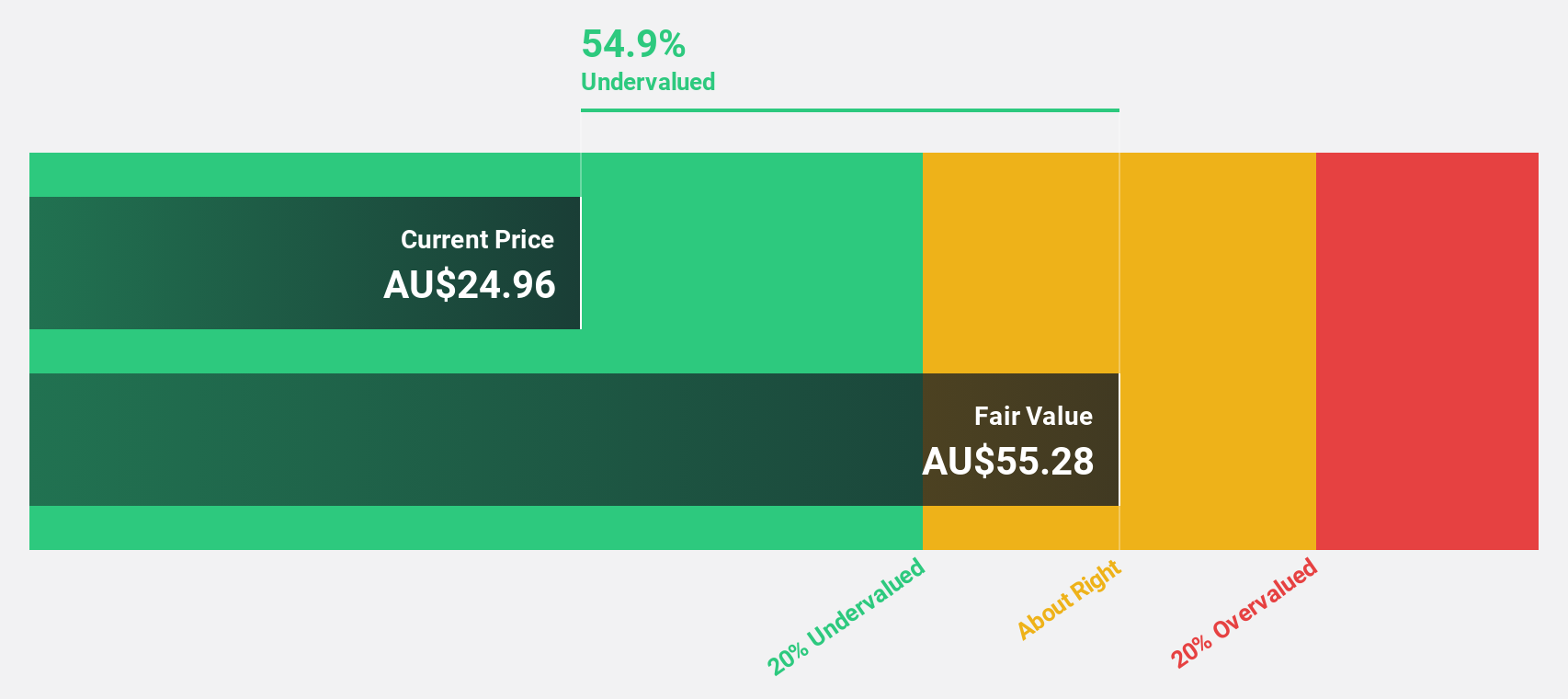

Mineral Resources (ASX:MIN)

Overview: Mineral Resources Limited operates as a mining services company with operations in Australia, Asia, and internationally, and has a market cap of A$9.58 billion.

Operations: The company's revenue is primarily derived from its Mining Services segment at A$3.38 billion, followed by Iron Ore at A$2.58 billion, Lithium at A$1.41 billion, Energy at A$16 million, and Other Commodities at A$19 million.

Estimated Discount To Fair Value: 48.8%

Mineral Resources, trading at A$49.11, is significantly undervalued with a fair value estimate of A$95.88. Despite slower revenue growth forecasts of 7.3% annually, earnings are expected to grow substantially at 38.7%. However, profit margins have decreased from last year and interest payments are not well covered by earnings. Recent M&A activity involving its Perth Basin assets could impact cash flows positively if a sale materializes, potentially strengthening its balance sheet amidst high net debt levels.

- Insights from our recent growth report point to a promising forecast for Mineral Resources' business outlook.

- Delve into the full analysis health report here for a deeper understanding of Mineral Resources.

Key Takeaways

- Navigate through the entire inventory of 44 Undervalued ASX Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal