Undiscovered Gems In Australia Featuring Three Promising Small Cap Stocks

The Australian market has shown robust performance, rising 1.7% over the last week and 18% over the past year, with earnings expected to grow by 12% annually. In this thriving environment, identifying promising small-cap stocks can offer unique opportunities for investors seeking to capitalize on potential growth beyond the well-trodden paths of larger companies.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Schaffer | 24.98% | 2.97% | -6.23% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

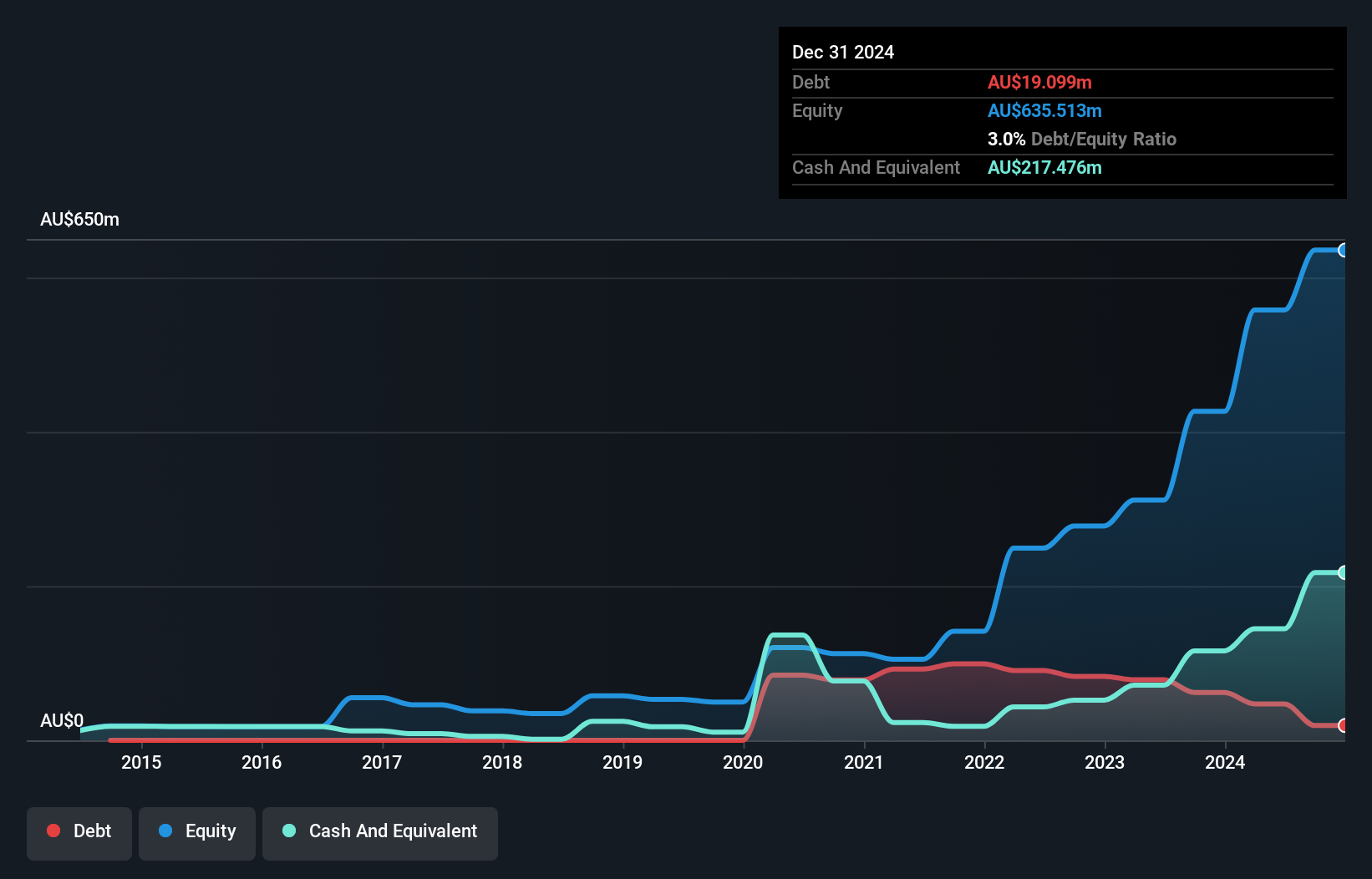

Emerald Resources (ASX:EMR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of A$2.73 billion.

Operations: Emerald Resources generates revenue primarily from its mine operations, amounting to A$366.04 million.

Emerald Resources, a growing player in the mining sector, has seen its earnings surge by 41.9% over the past year, outpacing industry growth. Despite shareholder dilution last year, Emerald remains free cash flow positive with A$150.49 million as of October 2024. The company's debt to equity ratio increased to 8.5% over five years but is manageable given its cash surplus and strong EBIT interest coverage at 18.6x. Recent leadership changes include Simon Lee's retirement from the board after significant contributions to its evolution into a gold producer with projects in Cambodia and Australia.

- Navigate through the intricacies of Emerald Resources with our comprehensive health report here.

Examine Emerald Resources' past performance report to understand how it has performed in the past.

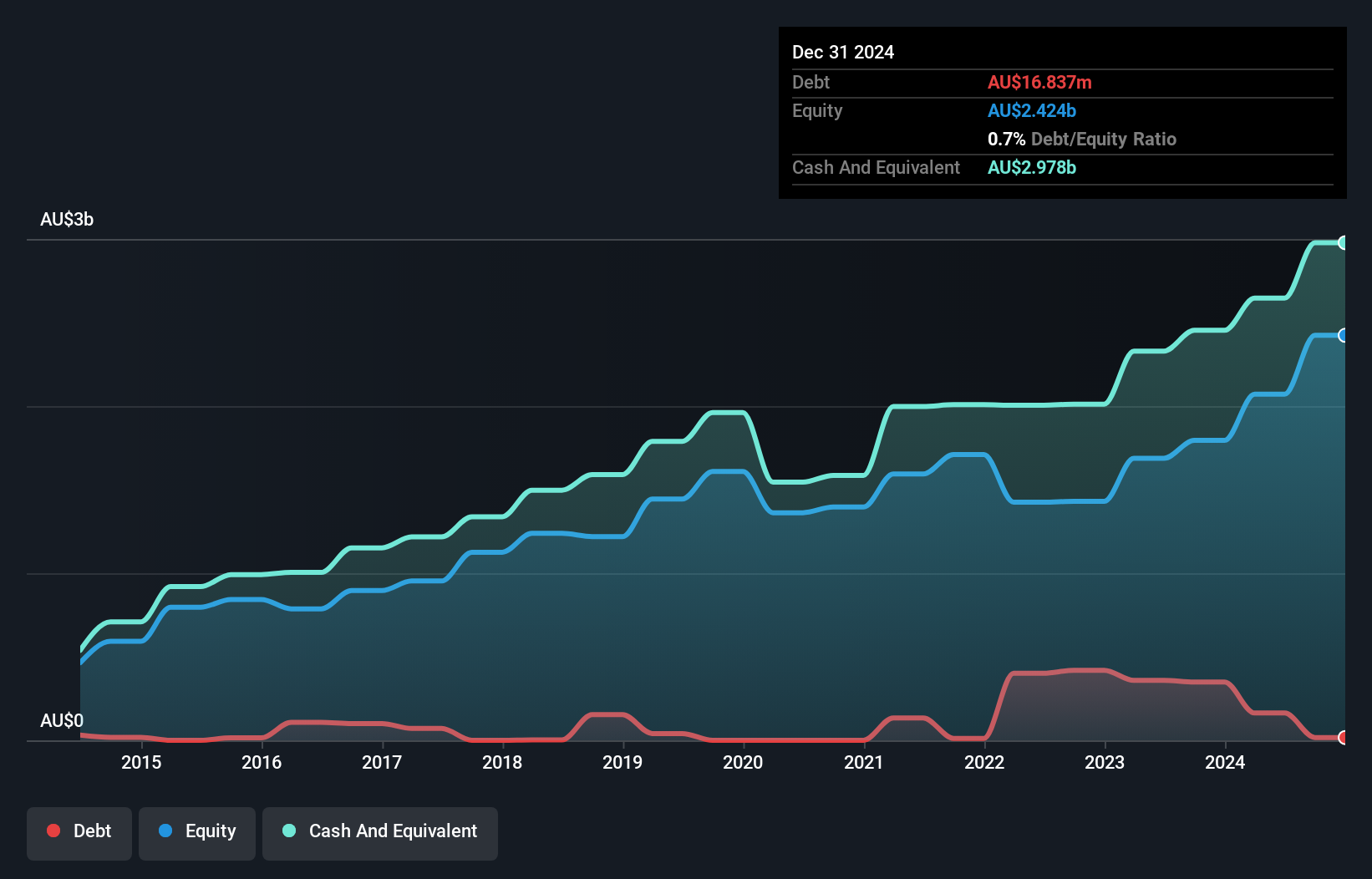

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market capitalization of A$2.28 billion.

Operations: MFF Capital Investments generates revenue primarily from its equity investments, amounting to A$659.96 million.

MFF Capital Investments, a smaller player in the Australian market, is trading at a significant 44.3% discount to its estimated fair value. Over the past year, earnings growth of 38.3% has outpaced the industry average of 15.6%, showcasing robust performance. With net income climbing to A$447 million from A$324 million and basic earnings per share rising to A$0.77 from A$0.55, MFF's financial health appears solid despite an increased debt-to-equity ratio over five years reaching 7.9%.

- Delve into the full analysis health report here for a deeper understanding of MFF Capital Investments.

Evaluate MFF Capital Investments' historical performance by accessing our past performance report.

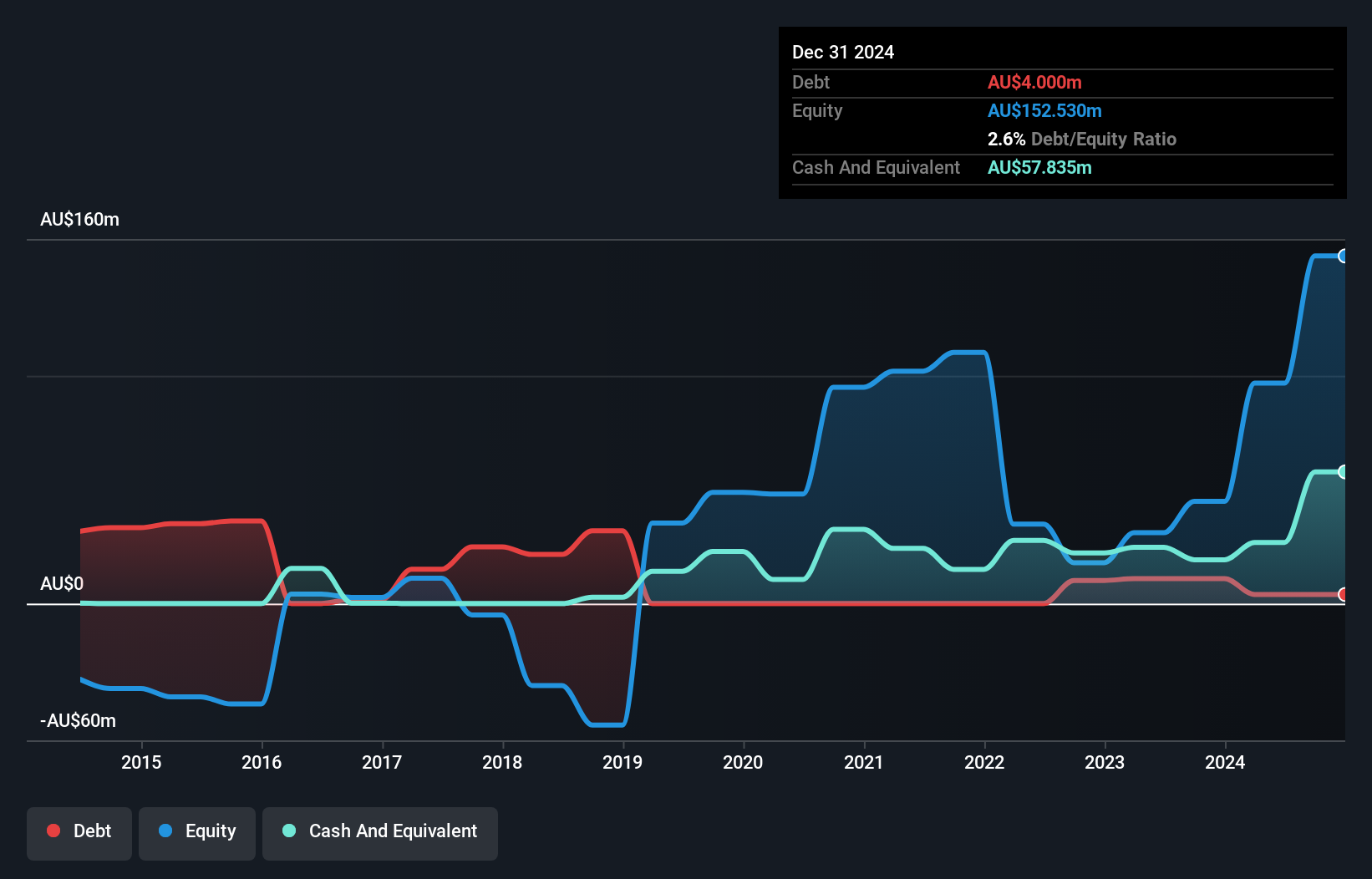

Ora Banda Mining (ASX:OBM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ora Banda Mining Limited is involved in the exploration, operation, and development of mineral properties in Australia with a market capitalization of A$1.25 billion.

Operations: The primary revenue stream for Ora Banda Mining Limited is derived from its gold mining operations, generating A$214.24 million.

Ora Banda Mining, a promising player in the Australian mining sector, recently reported sales of A$214.24 million for the year ending June 2024, up from A$135.89 million previously. It turned a corner with net income hitting A$27.57 million compared to last year's net loss of A$44.13 million, reflecting its newfound profitability and high-quality earnings marked by significant non-cash components. Despite shareholder dilution over the past year, OBM is trading at 91.7% below its estimated fair value and has strong interest coverage with EBIT covering debt payments 7.8 times over.

Next Steps

- Delve into our full catalog of 53 ASX Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal