ASX Growth Stocks Insiders Are Banking On

Over the last 7 days, the Australian market has risen by 1.7% and is up 18% over the past year, with earnings expected to grow by 12% annually in the coming years. In this robust environment, stocks with high insider ownership can be particularly attractive as they often indicate confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| Catalyst Metals (ASX:CYL) | 17% | 45.4% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Liontown Resources (ASX:LTR) | 14.7% | 59.8% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.2% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Pointerra (ASX:3DP) | 20.1% | 126.4% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Capricorn Metals (ASX:CMM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capricorn Metals Ltd is involved in the evaluation, exploration, development, and production of gold properties in Australia, with a market capitalization of A$2.43 billion.

Operations: The company's revenue primarily comes from its Karlawinda gold operations, amounting to A$359.73 million.

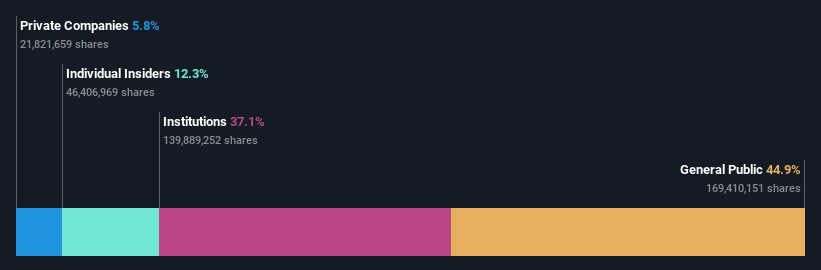

Insider Ownership: 11.9%

Capricorn Metals is experiencing robust revenue growth, forecasted at 18.8% annually, outpacing the Australian market's 5.6%. The company's earnings surged dramatically over the past year and are expected to grow at 17.9% per annum, surpassing market averages. Recent developments include a significant expansion study for the Karlawinda Gold Project, which could increase throughput by up to 55%, further supporting its growth trajectory amidst high insider ownership and strategic resource upgrades.

- Dive into the specifics of Capricorn Metals here with our thorough growth forecast report.

- Our expertly prepared valuation report Capricorn Metals implies its share price may be too high.

Emerald Resources (ASX:EMR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.73 billion.

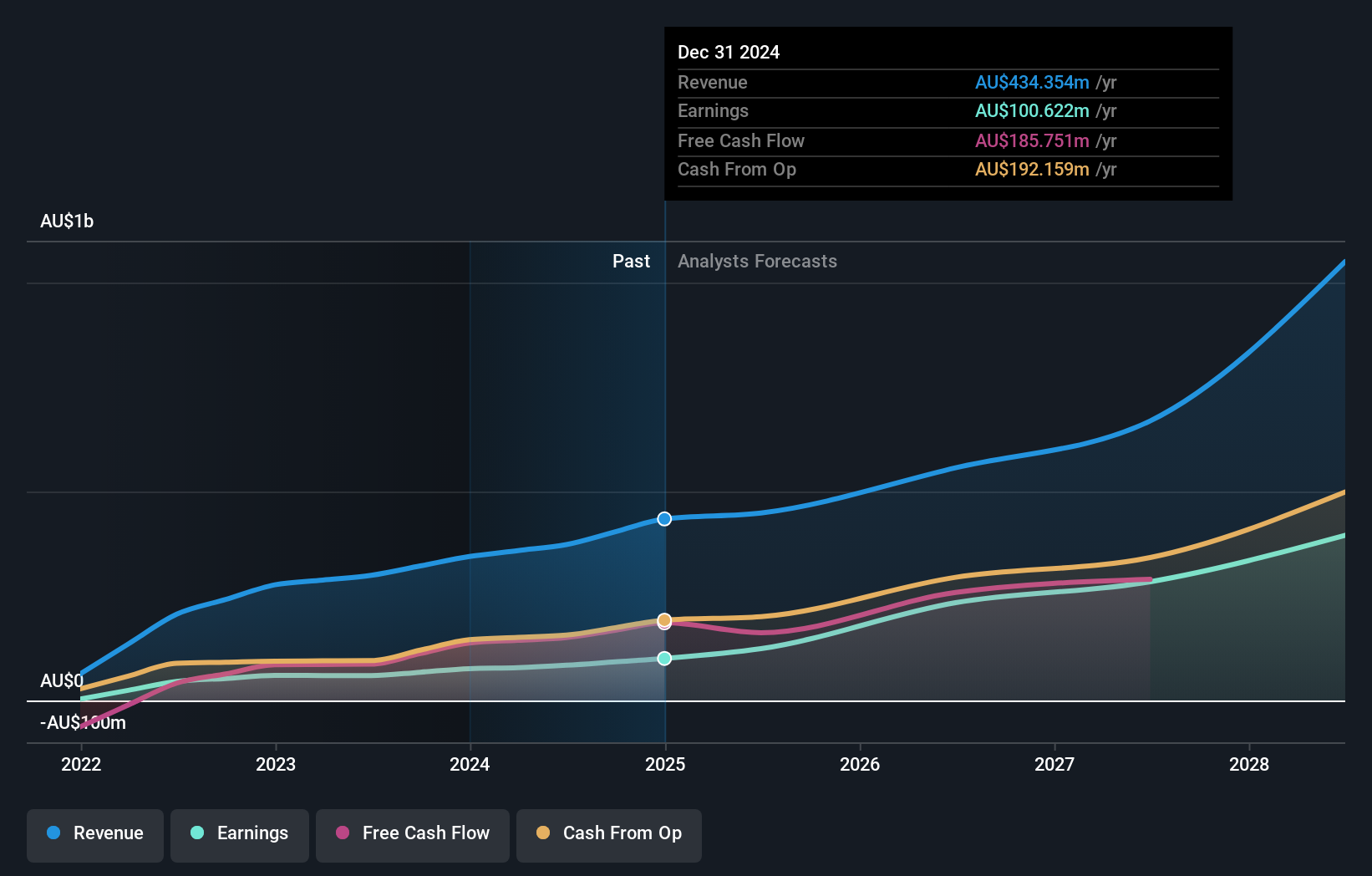

Operations: The company's revenue primarily comes from mine operations, totaling A$366.04 million.

Insider Ownership: 18%

Emerald Resources demonstrates strong growth potential with forecasted revenue growth of 35.2% annually, significantly outpacing the market average of 5.6%. Its earnings grew by 41.9% last year and are expected to continue growing at 16.2% per annum, above the market's rate of 12.2%. Recent financial results showed increased sales and net income, while leadership changes include Simon Lee AO's retirement from the board after a decade of impactful contributions.

- Get an in-depth perspective on Emerald Resources' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Emerald Resources' share price might be too optimistic.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

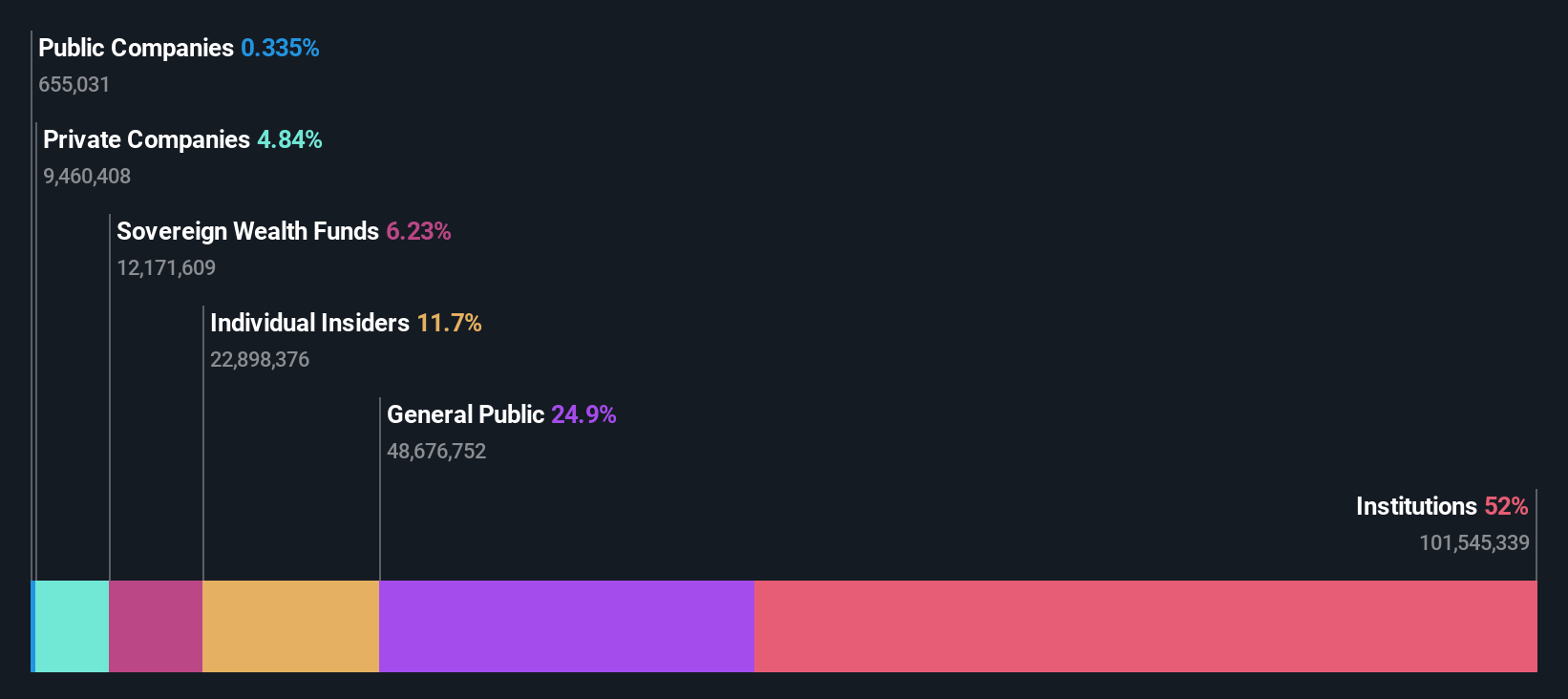

Overview: Mineral Resources Limited, along with its subsidiaries, operates as a mining services company in Australia, Asia, and internationally, with a market cap of A$9.58 billion.

Operations: The company's revenue segments include A$16 million from Energy, A$1.41 billion from Lithium, A$2.58 billion from Iron Ore, and A$3.38 billion from Mining Services, along with A$19 million from Other Commodities.

Insider Ownership: 11.7%

Mineral Resources faces challenges with low profit margins and high net debt of A$4.4 billion, but it demonstrates potential through significant forecasted earnings growth of 38.7% annually. Insider activity has been more buying than selling recently, indicating confidence in its prospects. The company is exploring asset sales and joint ventures to bolster its financial position, particularly regarding the Perth Basin assets, amidst interest from major industry players like Mitsui & Co., Hancock Energy, and private equity groups.

- Click to explore a detailed breakdown of our findings in Mineral Resources' earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Mineral Resources shares in the market.

Make It Happen

- Dive into all 98 of the Fast Growing ASX Companies With High Insider Ownership we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal