Dycom Industries' (NYSE:DY) investors will be pleased with their splendid 276% return over the last five years

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But when you pick a company that is really flourishing, you can make more than 100%. For instance, the price of Dycom Industries, Inc. (NYSE:DY) stock is up an impressive 276% over the last five years. In the last week shares have slid back 1.1%.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

Check out our latest analysis for Dycom Industries

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

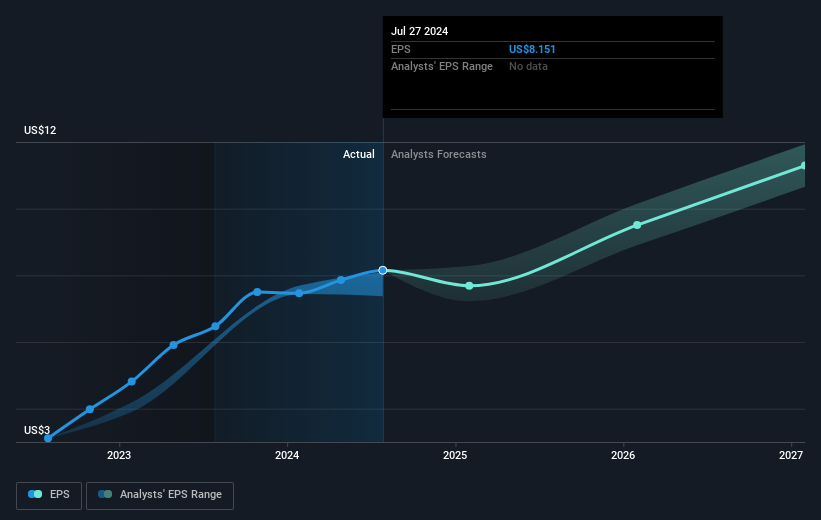

During five years of share price growth, Dycom Industries achieved compound earnings per share (EPS) growth of 34% per year. This EPS growth is reasonably close to the 30% average annual increase in the share price. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. Indeed, it would appear the share price is reacting to the EPS.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Dycom Industries has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Dycom Industries stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Dycom Industries has rewarded shareholders with a total shareholder return of 123% in the last twelve months. That's better than the annualised return of 30% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with Dycom Industries .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal