Primo Water Declares Special Dividend in Connection With Merger Deal

Primo Water PRMW announced that its board of directors has approved a special dividend of 82 cents, which reflects an increase of 811% from its quarterly dividend rate of 9 cents. It will be payable on Nov. 21, 2024, to stockholders of record as of Nov. 5, 2024.

Rationale Behind PRMW’s Special Dividend

The special dividend came after Primo Water announced the receipt of regulatory approval under the Investment Canada Act in connection with the previously announced all-stock combination of Primo Water and BlueTriton, Inc. The transaction is expected to be closed by the end of 2024.

According to Primo Water, the combination of Primo Water and BlueTriton and their extensive brand and product portfolios should better position the companies to meet their customers' demands and provide quality customer service.

Can PRMW Continue to Increase Shareholders' Value?

The company continues to benefit from organic customer growth and strategic investment plans. The increasing water demand should also boost the company’s performance. The second-quarter 2024 revenues increased 7.6% year over year. Organic growth contributed 6.6% to the top line.

Primo Water is still performing well on the basis of its precise and targeted plan. Consequently, the company is achieving balanced and broad-based rapid top-line growth. Strong profit growth can be attributed to its productivity and growth initiatives, which also enable margin improvement.

Since the beginning of this year, the company has embraced a new strategy that includes a focus on customer-centric initiatives, must-win priorities, and a commercial and growth mindset leveraging its portfolio of hydration solutions.

PRMW is continuously investing in improving its infrastructure. Between 2021 and 2023, the company invested nearly $437.6 million, and it aims to invest $154.1 million in 2024.

Primo Water has the potential to expand and improve even further, which suggests that management will have sufficient funds to continue with its shareholder-friendly initiatives in the future.

Utilities’ Legacy of Dividend Payment

Utility service companies often have steady operations and earnings. Due to their capacity to create cash flows, manage returns and perform consistently, utilities can pay dividends to shareholders on a regular basis.

In the past few months, IDACORP IDA, New Jersey Resources NJR and American States Water AWR have raised their quarterly dividend rate by 3.6%, 7.1% and 8.3%, respectively.

The Zacks Consensus Estimate for IDACORP’s 2024 earnings is pegged at $5.39 per share, implying a year-over-year increase of 4.9%. IDA’s current dividend yield is 3.2%.

The Zacks Consensus Estimate for New Jersey Resources’ fiscal 2024 earnings is pegged at $2.95 per share, implying a year-over-year increase of 10.1%. NJR’s current dividend yield is 3.86%.

The Zacks Consensus Estimate for American States Water’s 2024 earnings is pegged at $3.03 per share, implying a year-over-year increase of 6.3%. AWR’s current dividend yield is 2.17%.

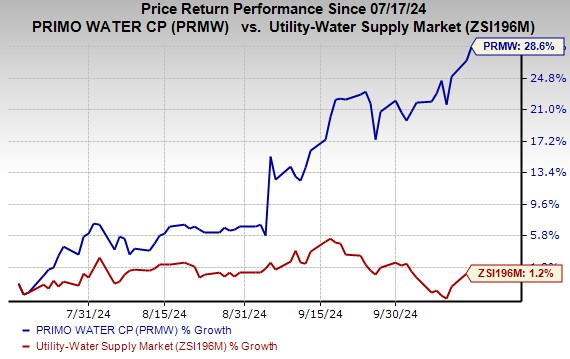

PRMW’s Stock Price Performance

In the past three months, PRMW’s shares have risen 28.6% compared with the industry’s growth of 1.2%.

Image Source: Zacks Investment Research

PRMW’s Zacks Rank

The company currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

IDACORP, Inc. (IDA): Free Stock Analysis Report

American States Water Company (AWR): Free Stock Analysis Report

NewJersey Resources Corporation (NJR): Free Stock Analysis Report

Primo Water Corporation (PRMW): Free Stock Analysis Report

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal