Moderna Stock Falls 20% in a Month: Time to Sell or Hold?

Despite giving the world one of the first and most widely used COVID-19 vaccines, shares of Moderna MRNA have lost significantly in the past couple of years due to declining sales amid low demand for the vaccine.

In the past month, MRNA stock fell more than 20% after management provided an update on its business outlook for the next four years. It also announced plans to slash its research and development (R&D) budget during this period.

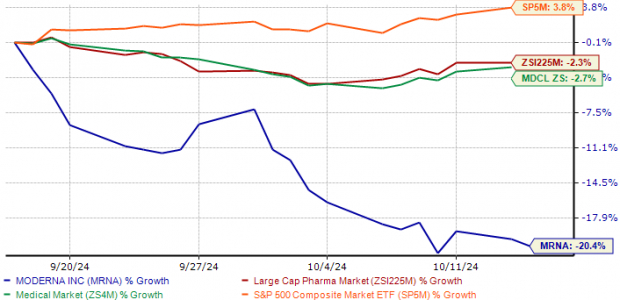

In the past month, the stock has underperformed the industry’s 2.3% fall, as seen in the chart below. It has also underperformed the sector and the S&P 500. Shares of Moderna are currently trading below its 200-day and 50-day moving averages.

MRNA Stock Underperforms Industry, Sector & S&P 500

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Moderna’s Updated Sales Guidance Falls Below Expectations

On Sept. 12, management issued fresh sales guidance for the full year 2025 and also revised the previously issued sales outlook for 2028.

Moderna expects to generate revenues between $2.5 billion and $3.5 billion in 2025. For 2026-2028, management expects sales to witness a CAGR of more than 25%, driven by new product launches. This revised long-term outlook was much lower than that announced last year. Management had previously expected to generate an additional $10-$15 billion in annual sales from cancer, rare and latent disease therapies by 2028.

The company projects selling, general and administrative (SG&A) expenses for 2025 to be between $1.0 billion and $1.2 billion. For 2026-2028, management expects selling expenses to rise incrementally. The general and administrative expenses are expected to remain flat.

Moderna also stated that it plans to break even on an operating cash cost basis in 2028, two years later than the previously announced goal of 2026.

MRNA Slashes R&D Budget, Stops Five Pipeline Programs

Alongside the guidance cut, management also implemented a portfolio prioritization and cost efficiency program to reduce annual R&D expenses and focus on products that are either nearing approval or already in the market.

The company reduced its overall R&D budget for the next four years (2025 to 2028) by nearly 20% to $16 billion. To meet these numbers, management decided to discontinue five pipeline programs as part of this prioritization program. This includes a preclinical vaccine candidate against endemic human coronaviruses and four early-stage programs — a study on RSV vaccine in infants, a KRAS-targeting cancer vaccine, a cancer drug and a drug for congestive heart failure.

For 2025, MRNA expects R&D expenses to be between $4.2 billion and $4.5 billion. Management expects to reduce costs in 2027. It anticipates R&D costs to be between $3.6 billion and $3.8 billion in the year.

Moderna’s Targeted Market Space Has Significant Competition

While Moderna's mRNA technology gives it a competitive edge, its products face competition from those of several large pharmaceutical players, such as Pfizer PFE and GSK plc GSK.

Recently, Moderna secured its first product approval outside the COVID-19 vaccine space when the FDA approved the company’s RSV vaccine mResvia. This has put the company in direct competition with RSV vaccines Arexvy and Abrysvo, which are marketed by pharma giants GSK and Pfizer, respectively.

MRNA Stock’s Valuation & Estimates

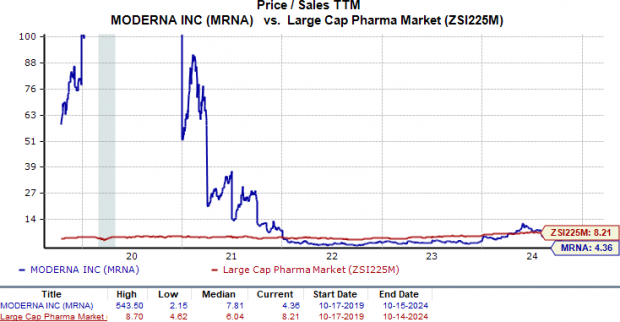

From a valuation standpoint, Moderna appears attractive compared to the industry. Going by the price/sales (P/S) ratio, the company’s shares currently trade at 4.36, trailing 12-month sales value, lower than 8.21 for the industry.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

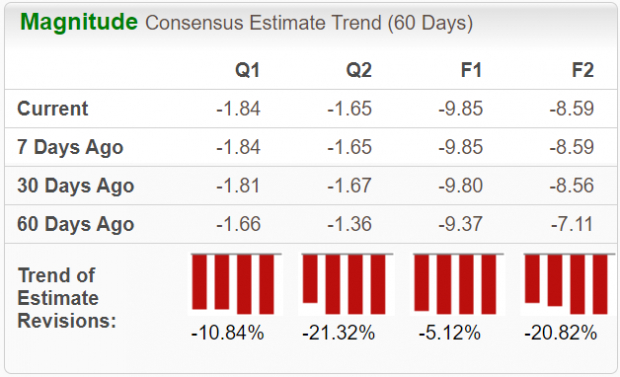

Estimates for Moderna’s 2024 loss per share have increased from $9.37 to $9.85 in the past 60 days. During the same period, estimates for 2025 loss per share have risen from $7.11 to $8.59.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Short-term Investors May Sell MRNA Stock

Moderna, once a financial powerhouse due to its COVID-19 vaccine, feels uncertain regarding its top-line growth after declining sales of the vaccine. The company's revenue forecasts for its RSV vaccines also remain uncertain, given the recently issued recommendations by the U.S. Centers for Disease Control and Prevention (CDC), which trim down a market that already has two major competitors — GSK and Pfizer.

Though this Zacks Rank #4 (Sell) company appears to be trading a discount to the industry, we advise new investors to steer clear of the stock at present. While management boasts a pipeline of more than 40 mRNA-based investigational candidates, the delay in the company’s plans of achieving its breakeven point by another two years shows a lack of clarity in management’s execution plans. The consistently declining earnings estimates highlight analysts’ pessimistic outlook for the stock.

For those who already own the stock, the next major catalyst for MRNA would likely be its upcoming third-quarter results. The company will start recording revenues from its RSV vaccine mResvia in the quarter. It will also provide us with an insight into the demand and market potential for the new vaccine.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK): Free Stock Analysis Report

Pfizer Inc. (PFE): Free Stock Analysis Report

Moderna, Inc. (MRNA): Free Stock Analysis Report

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal