Is there room for US stocks to rise? Nomura and Goldman Sachs all pointed out: many traders will be forced to rise!

For Wall Street's professional money managers, the biggest “painful trade” at present is that stocks continued to rise after a period of two years of sharp rise and bull market.

There is good reason to expect that stocks will continue to rise as buyer investors catch up, and they are eager to catch up with benchmark indices such as the S&P 500. As of Tuesday, the S&P 500 had risen nearly 23% since the beginning of 2024, according to FactSet data.

This is what Charlie McEligott, an American business strategist at Nomura Securities Global Markets, explained on Monday how hedge funds, systemic traders, CTAs, and other sophisticated investors are so focused on protecting their portfolios from the risk of sell-offs that they have neglected to prepare for the “right-hand tail” outcome, that is, a continued strong rise.

The Chicago Board Options Exchange Volatility Index (“Panic Index” or VIX) and other measures of hedging demand, such as the bias in options associated with the SPDR S&P 500 ETF, reflect this sentiment, which may have been imposed on portfolio managers by risk managers at some asset management companies.

Given the myriad risks that could arise and the two brief shocks that US stocks have experienced in recent months, this is not surprising.

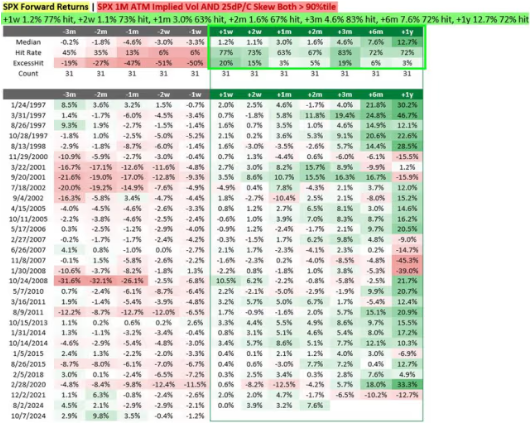

Nonetheless, this cautious stance will drag down the fund's performance, even if history shows that when implied volatility is at or above current levels, the stock's forward-looking returns look pretty good over the next year.

Even though the S&P 500 hit its 46th closing high this year on Monday, the VIX rose significantly, hovering around 20, slightly above its long-term average, according to FactSet data. This unusual combination shows that many on Wall Street are still uneasy about the potential risks of a rise, particularly the upcoming US presidential election.

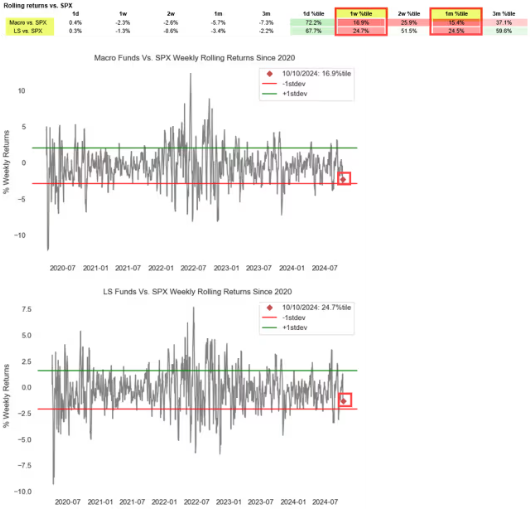

According to data from Nomura Securities, macro funds and long and short hedge funds have lagged behind the S&P 500 index in the past three months, by 7.3 percentage points and 2.2 percentage points, respectively. Compared to history, the extent of this kind of failure is quite large.

Nomura pointed out that if US stocks continue to rise, these companies and others may eventually be forced to catch up with the rise by buying call options outside of the price.

“FOMU”

Analysts at Goldman Sachs Trading Desk said in the latest report that the hedging activity of buyer companies has begun to change as demand for bullish options from portfolio managers has increased. The team has even created a new abbreviation to describe this behavior: “FOMU,” or “Fear of seriously losing” the stock market benchmark. (Fear of Materiality Underperforming)

According to Goldman Sachs, the company has every reason to chase the rise in US stocks, because once most major US companies end the buyback ban period later this month, it is expected that some corporate buyers' capital will flow into the stock market at an accelerated pace.

But that's not all. American households usually increase their stock purchases after the presidential election. Considering that November and December have historically been strong months for stock market returns, it is expected that once the dust settles on the election, implied volatility will decrease. This may encourage systemic funds and multi-fund management companies to increase their stock holdings before the end of the year.

Meanwhile, the Goldman Sachs team said that at the same time, the tax-related selling pressure faced by mutual funds should ease at the end of this fiscal year.

As old hedging expires, traders need to open new bullish positions, and options traders will be forced to hedge their exposure by buying S&P 500 futures, thereby driving US stocks higher.

Goldman Sachs pointed out that ultimately, systemic funds and CTAs, and even fund managers with long and short discretion will be forced to increase their exposure to stocks and add more “fuel” to the “fused rise.”

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal