3 Companies That May Be Trading Below Their Estimated Value

As global markets continue to navigate a complex landscape marked by record highs in U.S. stock indices and mixed economic signals, investors are keenly observing the implications of modest inflation increases and shifting interest rate expectations. Amidst these developments, identifying stocks that may be trading below their estimated value becomes crucial for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Apollo Pipes (BSE:531761) | ₹553.65 | ₹1106.50 | 50% |

| Management SolutionsLtd (TSE:7033) | ¥1921.00 | ¥3835.17 | 49.9% |

| Grupo Traxión. de (BMV:TRAXION A) | MX$21.14 | MX$42.10 | 49.8% |

| Neusoft (SHSE:600718) | CN¥9.69 | CN¥19.29 | 49.8% |

| Icon Offshore Berhad (KLSE:ICON) | MYR1.11 | MYR2.22 | 49.9% |

| Banca Sistema (BIT:BST) | €1.44 | €2.87 | 49.8% |

| Redcentric (AIM:RCN) | £1.20 | £2.39 | 49.8% |

| Securitas (OM:SECU B) | SEK129.95 | SEK258.69 | 49.8% |

| Loungers (AIM:LGRS) | £2.71 | £5.41 | 49.9% |

| SysGroup (AIM:SYS) | £0.325 | £0.65 | 49.9% |

Let's dive into some prime choices out of the screener.

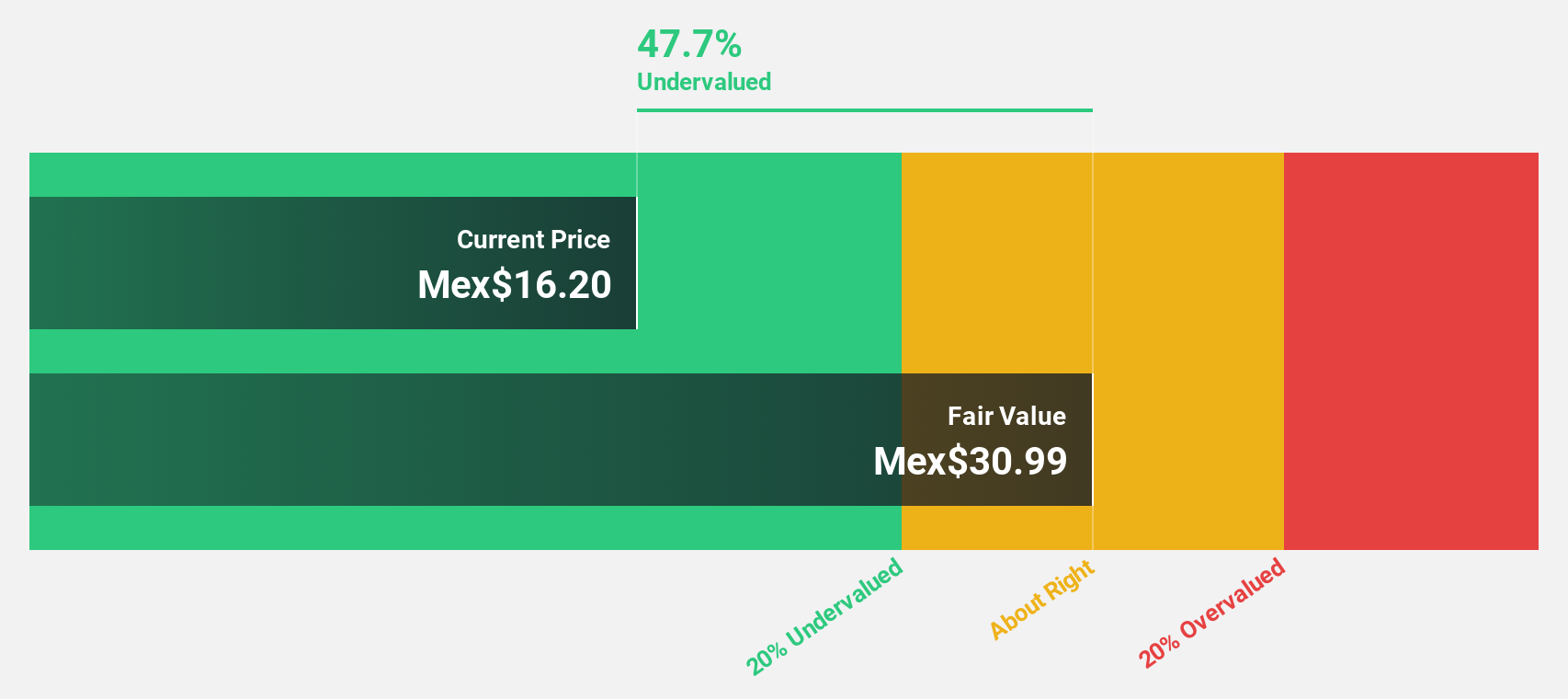

América Móvil. de (BMV:AMX B)

Overview: América Móvil, S.A.B. de C.V. is a telecommunications company offering services in Latin America and internationally, with a market cap of approximately MX$997.60 billion.

Operations: The company generates revenue from its telecommunications services, with cellular services contributing MX$813.38 billion.

Estimated Discount To Fair Value: 42.9%

América Móvil is trading at MX$16.26, significantly below its estimated fair value of MX$28.47, suggesting potential undervaluation based on discounted cash flows. Despite a forecasted earnings growth of 22.82% annually, which exceeds the market rate, revenue growth is slower than the Mexican market average. Recent quarterly results show improved sales and net income compared to last year but highlight reduced profit margins and high debt levels that may impact financial stability.

- Insights from our recent growth report point to a promising forecast for América Móvil. de's business outlook.

- Get an in-depth perspective on América Móvil. de's balance sheet by reading our health report here.

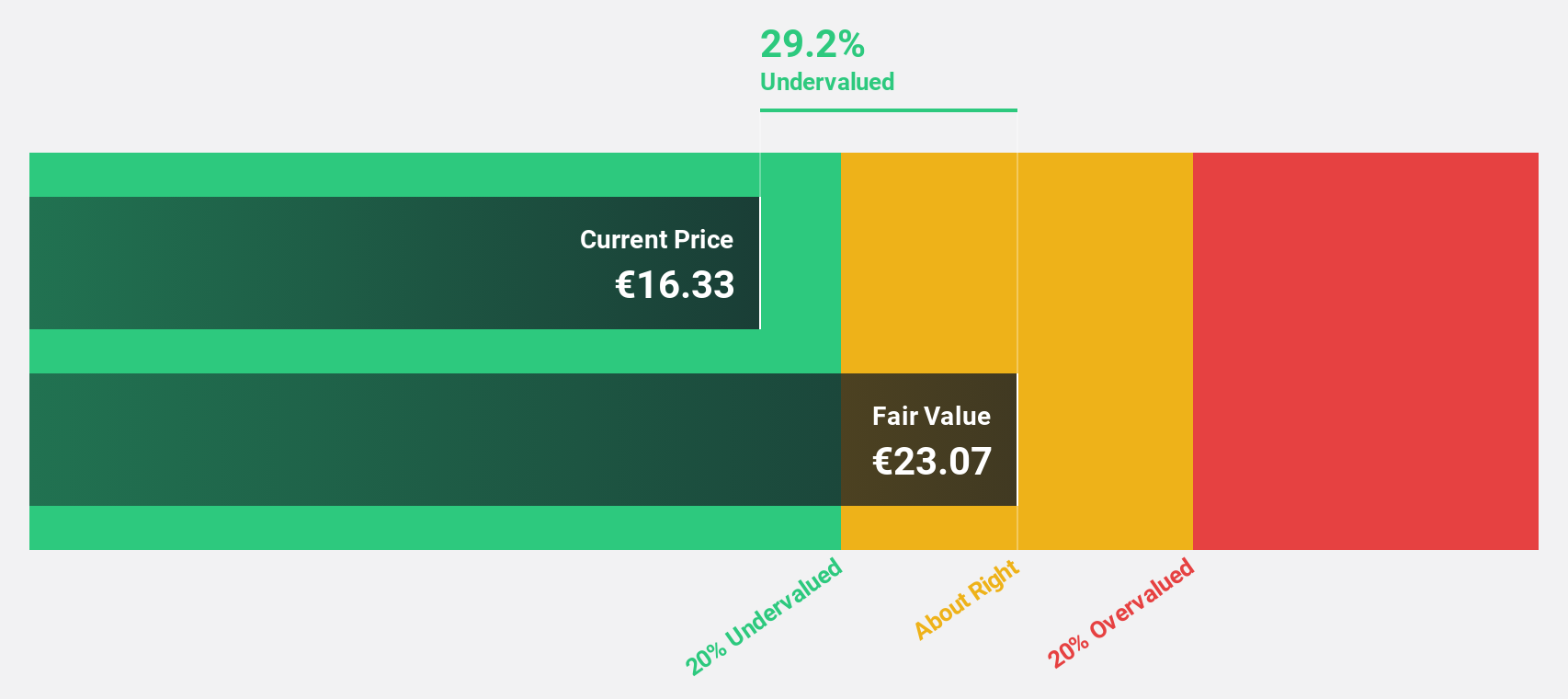

CVC Capital Partners (ENXTAM:CVC)

Overview: CVC Capital Partners plc is a private equity and venture capital firm focusing on middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales, and spinouts with a market cap of €21.50 billion.

Operations: CVC Capital Partners plc generates revenue through its involvement in private equity and venture capital activities, including middle market secondaries, infrastructure and credit investments, management buyouts, leveraged buyouts, growth equity initiatives, mature investments, recapitalizations, strip sales, and spinouts.

Estimated Discount To Fair Value: 21%

CVC Capital Partners, trading at €20.23, is valued over 20% below its estimated fair value of €25.62, indicating potential undervaluation based on cash flows. Despite carrying a high debt load, CVC's earnings are projected to grow significantly at 33.52% annually, outpacing the Dutch market average. However, revenue growth is expected to be slower than desired but still surpasses the market rate. The firm's return on equity is anticipated to be very high in three years.

- The growth report we've compiled suggests that CVC Capital Partners' future prospects could be on the up.

- Take a closer look at CVC Capital Partners' balance sheet health here in our report.

3M (NYSE:MMM)

Overview: 3M Company is a diversified technology services provider operating both in the United States and internationally, with a market cap of approximately $74.56 billion.

Operations: The company's revenue segments include Consumer ($4.94 billion), Safety and Industrial ($10.90 billion), and Transportation and Electronics ($8.51 billion).

Estimated Discount To Fair Value: 35.7%

3M, currently priced at US$135.73, trades significantly below its estimated fair value of US$211.1, highlighting potential undervaluation based on cash flows. Despite forecasted revenue declines of 5.5% annually over the next three years, earnings are expected to grow substantially at 21.2% per year, surpassing market averages. However, the company faces challenges with high debt levels and a dividend yield that is not well-covered by earnings.

- Our expertly prepared growth report on 3M implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of 3M.

Turning Ideas Into Actions

- Unlock our comprehensive list of 962 Undervalued Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal