Exploring Three Undervalued Small Caps With Insider Buying In None Region

As global markets navigate a landscape marked by record highs in major U.S. indices and modest inflation surprises, small-cap stocks have faced unique challenges and opportunities. The S&P MidCap 400 Index's recent performance highlights the growing interest in smaller companies amid a shifting economic backdrop, where rising bond yields and fluctuating consumer sentiment play pivotal roles. In this environment, identifying promising small-cap stocks involves examining factors such as insider buying trends and potential undervaluation, which can signal confidence in a company's future prospects despite broader market volatility.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Senior | 18.1x | 0.6x | 37.25% | ★★★★★★ |

| Collins Foods | 18.1x | 0.7x | 7.53% | ★★★★☆☆ |

| Nexus Industrial REIT | 3.7x | 3.7x | 17.05% | ★★★★☆☆ |

| Studsvik | 19.9x | 1.2x | 43.10% | ★★★★☆☆ |

| Marlowe | NA | 0.7x | 40.87% | ★★★★☆☆ |

| Optima Health | NA | 1.3x | 37.17% | ★★★★☆☆ |

| German American Bancorp | 14.5x | 4.8x | 45.32% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Petra Diamonds | NA | 0.2x | -32.82% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | -222.36% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

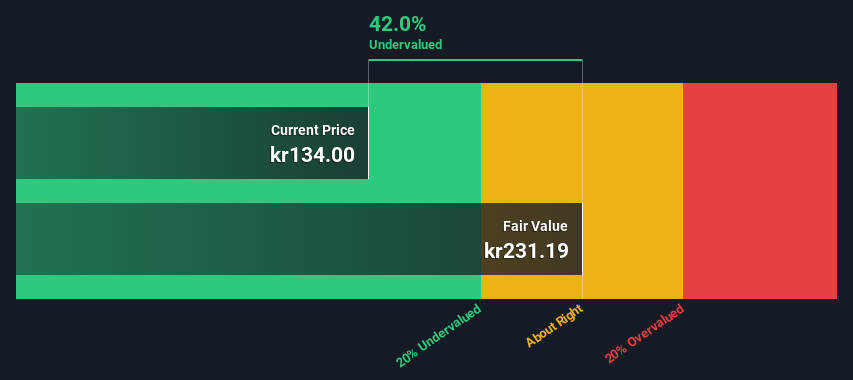

Atea (OB:ATEA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Atea is an IT infrastructure company operating in Norway, Sweden, Denmark, Finland, and the Baltics with a focus on providing technology products and services.

Operations: The company's revenue streams are primarily derived from operations in Norway, Sweden, Denmark, Finland, and the Baltics. Over recent periods, the gross profit margin has shown an upward trend reaching 31.04% by June 2024. Operating expenses have consistently been a significant part of the cost structure, with general and administrative expenses being a notable component.

PE: 20.5x

Atea, operating in the IT services sector, is positioned as a potentially undervalued stock. The company's earnings are projected to grow by 18.92% annually, suggesting promising future prospects despite its reliance on higher-risk external borrowing for funding. Insider confidence is evident with recent share purchases in 2024. A significant win for Atea Finland includes a four-year frame agreement with Tiera Oy valued between €780 million and €1.16 billion, doubling the previous contract's size and enhancing revenue potential through expanded public sector engagements in Finland.

- Click here to discover the nuances of Atea with our detailed analytical valuation report.

Gain insights into Atea's past trends and performance with our Past report.

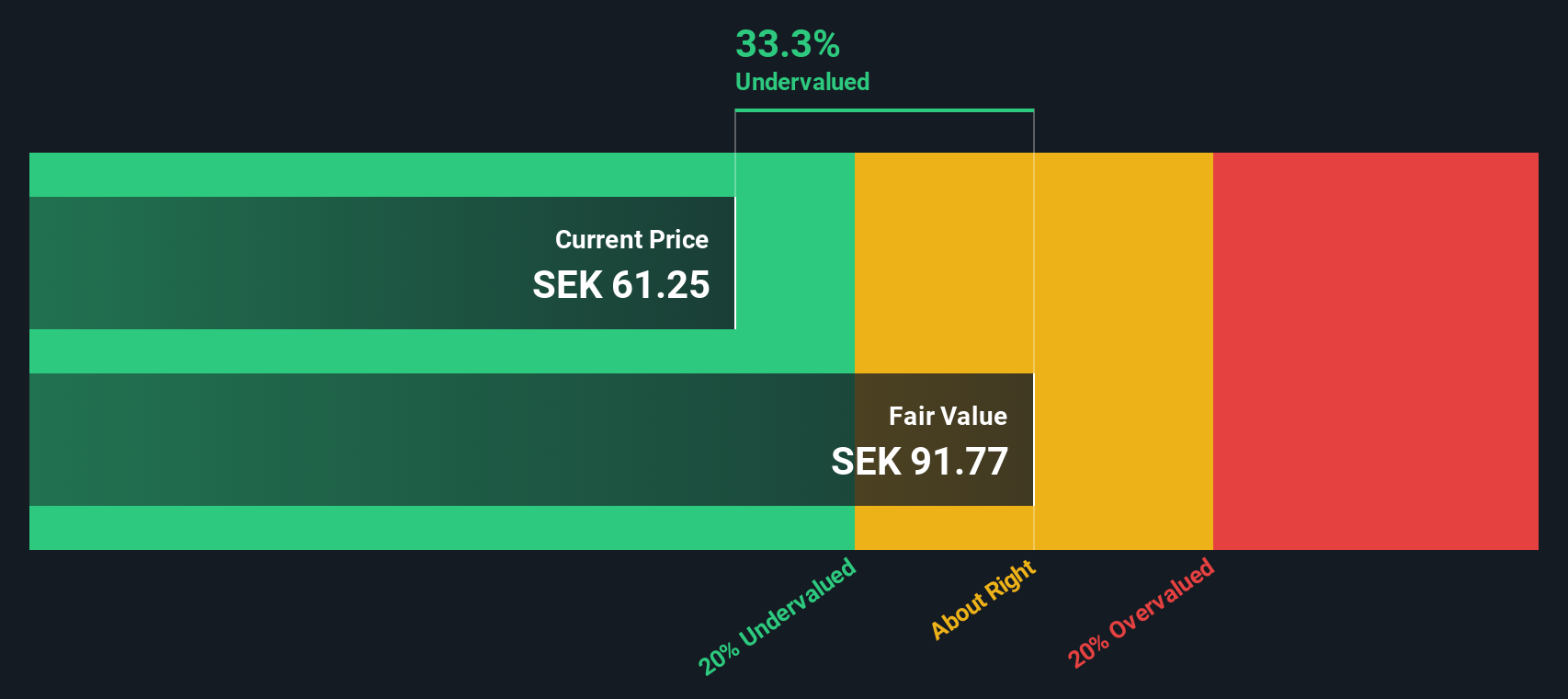

Truecaller (OM:TRUE B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Truecaller is a communications software company that focuses on caller identification and spam blocking services, with a market capitalization of approximately SEK 21.14 billion.

Operations: The company generates revenue primarily from its communications software, with recent figures reaching SEK 1.72 billion. The cost of goods sold (COGS) amounted to SEK 418.58 million, resulting in a gross profit margin of 75.64%. Operating expenses include significant allocations for general and administrative costs and non-operating expenses, impacting net income margins which have varied over time but recently stood at 27.78%.

PE: 32.7x

Truecaller, a company with a focus on enhancing communication security, has shown insider confidence through recent share purchases. Despite facing challenges like declining sales and net income in the second quarter of 2024, it remains committed to growth with earnings projected to rise by 21.73% annually. A strategic partnership with Halan highlights its innovative approach in verifying business calls, boosting trust and safety for millions of users globally.

- Click to explore a detailed breakdown of our findings in Truecaller's valuation report.

Gain insights into Truecaller's historical performance by reviewing our past performance report.

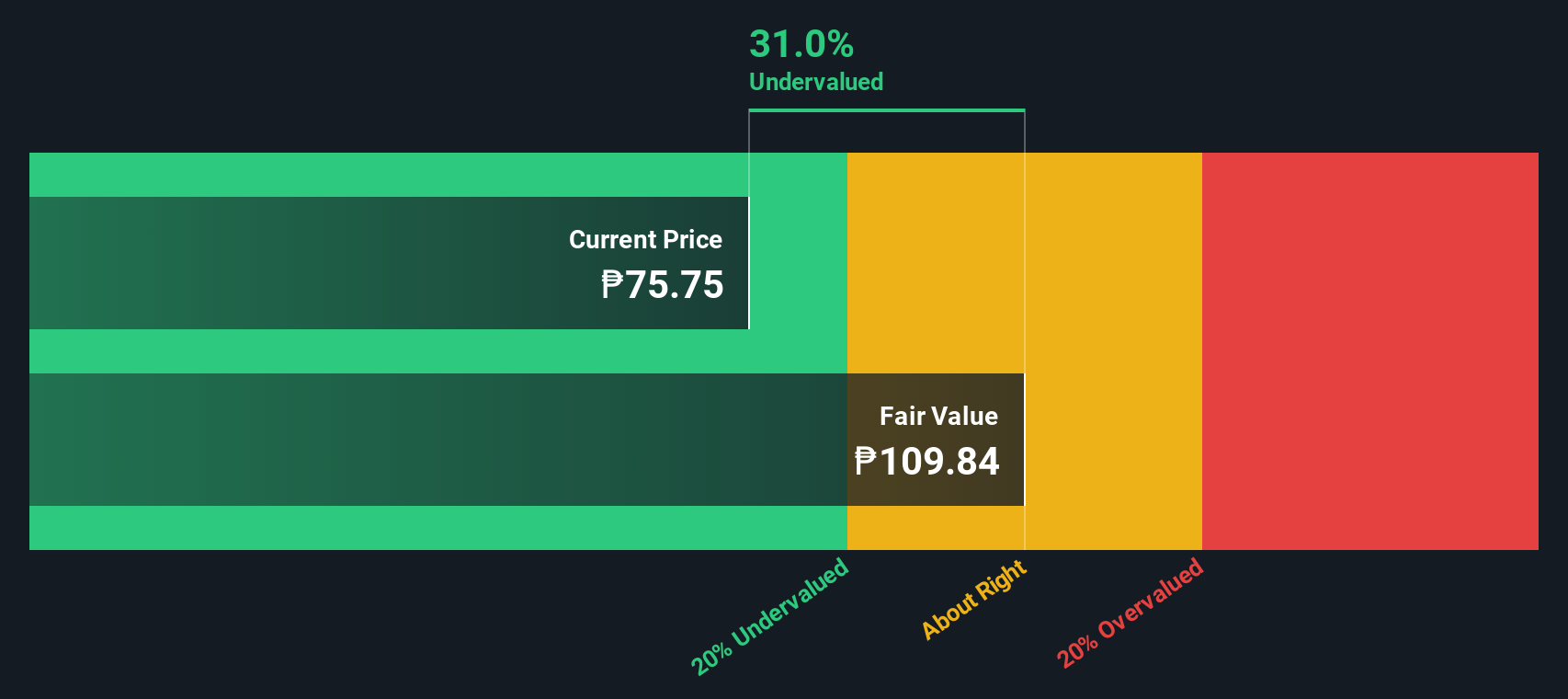

Security Bank (PSE:SECB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Security Bank operates as a financial institution providing retail banking, business banking, and wholesale banking services, with a market capitalization of ₱109.45 billion.

Operations: The company's revenue primarily stems from Wholesale Banking, Retail Banking, and Business Banking. Operating expenses have shown a consistent upward trend over the periods reviewed, with general and administrative expenses being a significant component. The net income margin has varied across different periods, reaching as high as 48.86% in early 2015 and more recently recorded at 23.14% by mid-2024.

PE: 7.7x

Security Bank, a smaller player in the financial sector, is drawing attention due to its potential value. Recent insider confidence is evident as an independent director acquired 49,000 shares for approximately PHP 2.9 million between August and October 2024. Despite challenges with high bad loans at 3.4% and low allowance coverage of 83%, earnings are projected to grow by over 17% annually. The bank's recent PHP 20 billion fixed-income offering and executive appointments aim to bolster risk management and strategic growth initiatives.

- Take a closer look at Security Bank's potential here in our valuation report.

Review our historical performance report to gain insights into Security Bank's's past performance.

Key Takeaways

- Unlock our comprehensive list of 191 Undervalued Small Caps With Insider Buying by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal