Super Micro Expands Liquid-Cooled AI Servers With Nvidia Power

Artificial intelligence server company Super Micro Computer, Inc (NASDAQ:SMCI) is accelerating the shift to liquid-cooled data centers.

Supermicro’s latest offering, powered by the Nvidia Corp (NASDAQ:NVDA) GB200 NVL72 platform, introduces a highly energy-efficient system designed to meet the increasing energy demands of AI infrastructures. This solution, which supports exascale computing in a single rack, has shipped samples to select customers, with full-scale production slated for the late fourth quarter of 2024.

Supermicro is also ready for production with its recently announced X14 and H14 liquid-cooled systems and 10U air-cooled systems, which support the Nvidia HGX B200 8-GPU system.

Also Read: Marvell Showcases Next-Gen 3nm Technology, Doubling Data Speeds for AI Systems

These systems are part of a broader effort by the company to expand its liquid-cooled infrastructure solutions to provide enhanced computational power and energy efficiency for AI projects.

According to Supermicro’s CEO, Charles Liang, the company has shipped over 2,000 liquid-cooled racks since June 2024.

The Supermicro Nvidia GB200 NVL72 delivers exascale AI capabilities in a single rack, integrating 72 Nvidia Blackwell GPUs and 32 Nvidia Grace CPUs.

Supermicro also launched a new high-performance storage system for AI training, inference, and HPC (High-Performance Computing) workloads.

The Just a Bunch of Flash (JBOF) system integrates Nvidia BlueField-3 Data Processing Units (DPUs) into a 2U form factor, offering advanced storage and networking features that support software-defined storage workloads. This innovation includes capabilities such as encryption, compression, erasure coding, and AI storage expansion.

The new dual-port JBOF architecture delivers active-active clustering, ensuring high availability for both mission-critical scale-up storage and scale-out storage systems.

Last week, Supermicro deployed over 100,000 GPUs with liquid cooling solutions (DLC) for some of the largest AI factories and other Cloud Service Providers (CSPs).

At the same time, the company has battled with regulatory attention from the U.S. Department of Justice following Hindenburg Research’s short report. The report flagged the company’s inappropriate revenue recognition policies and the re-hiring of employees charged with past accounting violations.

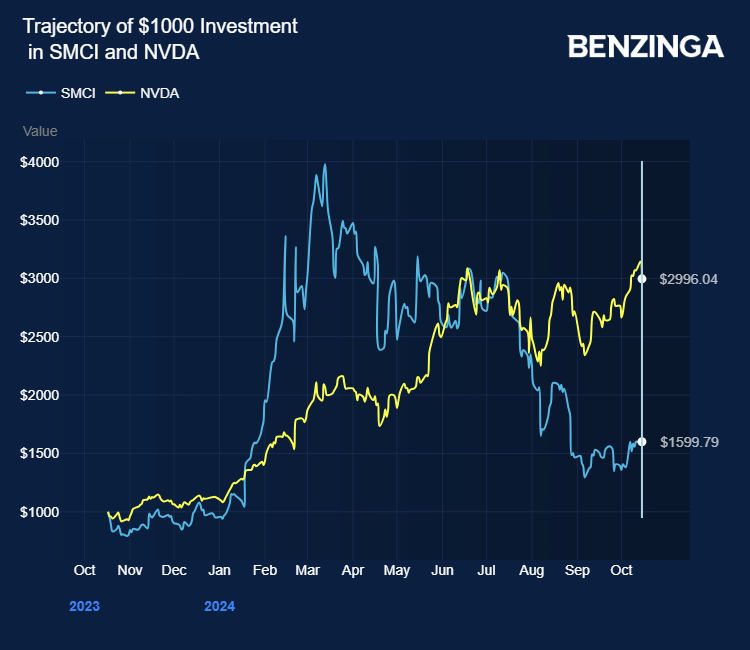

Supermicro stock gained over 67% in the last 12 months despite losing 42% in the previous three months due to the short report.

Needham analyst Quinn Bolton praised the AI server company as a pioneer in rack-level liquid cooling solutions.

Investors can gain exposure to Supermicro through Invesco QQQ Trust, Series 1 (NASDAQ:QQQ) and SPDR S&P 500 (NYSE:SPY).

Price Action: SMCI stock is up 0.55% at $48.02 premarket at the last check on Wednesday.

Also Read:

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal