TSX Value Picks Possibly Trading Below Fair Estimates October 2024

The Canadian market has shown robust performance, rising 1.4% in the last week with all sectors gaining ground and achieving a notable 22% increase over the past year, supported by an annual earnings growth forecast of 15%. In this context, identifying stocks that may be trading below their fair value can offer investors potential opportunities to capitalize on these positive market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$186.64 | CA$359.27 | 48.1% |

| Computer Modelling Group (TSX:CMG) | CA$11.98 | CA$21.91 | 45.3% |

| Trisura Group (TSX:TSU) | CA$44.97 | CA$87.82 | 48.8% |

| Kinaxis (TSX:KXS) | CA$157.72 | CA$284.39 | 44.5% |

| AtkinsRéalis Group (TSX:ATRL) | CA$62.30 | CA$109.57 | 43.1% |

| Endeavour Mining (TSX:EDV) | CA$31.89 | CA$55.72 | 42.8% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Sandstorm Gold (TSX:SSL) | CA$8.07 | CA$13.90 | 42% |

| Blackline Safety (TSX:BLN) | CA$6.28 | CA$10.99 | 42.8% |

| Boyd Group Services (TSX:BYD) | CA$213.05 | CA$343.93 | 38.1% |

Let's explore several standout options from the results in the screener.

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc. acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$93.45 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, generating $9.27 billion.

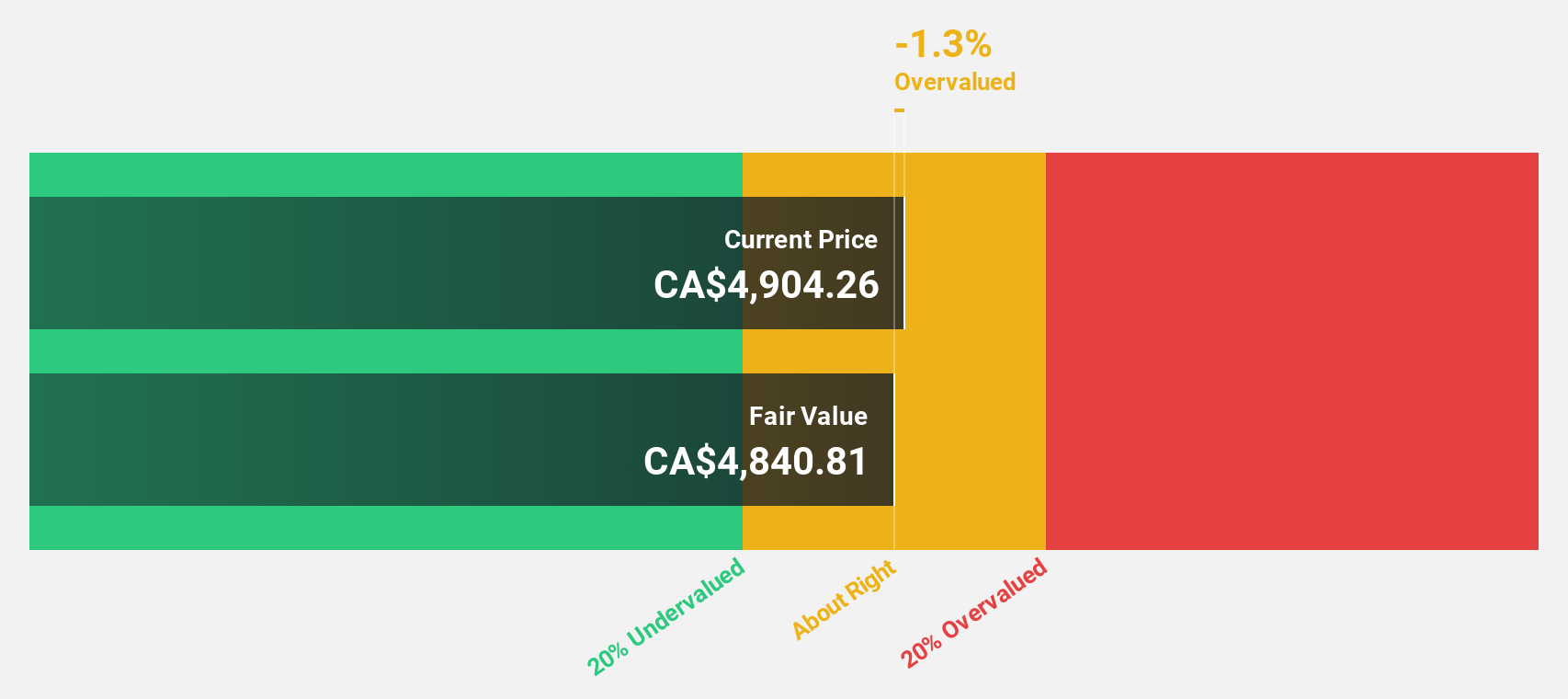

Estimated Discount To Fair Value: 21%

Constellation Software is trading 21% below its estimated fair value, with a share price of CA$4,409.78 compared to an estimated fair value of CA$5,583.39. Recent earnings results show strong growth, with revenue increasing to US$2.47 billion for Q2 2024 and net income rising to US$177 million. Despite high debt levels, the company’s forecasted annual profit growth of 23.6% surpasses the Canadian market average and supports its undervaluation based on cash flows.

- Our comprehensive growth report raises the possibility that Constellation Software is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Constellation Software's balance sheet health report.

Sandstorm Gold (TSX:SSL)

Overview: Sandstorm Gold Ltd. operates as a gold royalty company with a market cap of CA$2.40 billion.

Operations: The company's revenue is derived from its gold royalty interests in various mining operations, including $7.71 million from Antamina in Peru, $14.41 million from Chapada in Brazil, $8.65 million from Aurizona in Brazil, $11.77 million from Caserones in Chile, $17.58 million from Mercedes in Mexico, $20.78 million from Cerro Moro in Argentina, $4.51 million from Blyvoor in South Africa, $6.46 million from Houndé in Burkina Faso, $12.78 million from Bonikro in Cote D'Ivoire, $6.37 million through Vale Royalties also located within Brazil's borders; additionally contributing are Fruta Del Norte situated geographically within Ecuador generating revenues totaling approximately around abouts of some figure close to but not exceeding more than less than exactly precisely equal to roughly estimated at nearly just shy of almost exactly precisely seven point six seven four (7 point 674) millions USD dollars originating outwardsly externally outwardly externally outwardly externally outwardly sourced via Relief Canyon found domestically inside United States itself producing twelve point six one five (12 point 615) millions USD dollars respectively accordingly thereby henceforth thus concluding this sentence here now today currently presently right now as we speak type write communicate convey express articulate verbalize vocalize state declare announce proclaim enunciate utter pronounce assert affirm avow profess opine suggest imply indicate hint insinuate intimate allude reference cite mention note remark comment observe report recount describe depict portray illustrate represent show display exhibit demonstrate present introduce unveil reveal disclose divulge impart share inform notify advise brief update apprise alert warn caution forewarn predict forecast foresee anticipate envisage envision imagine conceive conceptualize visualize picture conjure up dream up invent create design devise formulate develop construct build fabricate assemble manufacture produce generate yield spawn give rise to bring about cause effect result lead contribute add supplement augment enhance boost increase improve advance promote further foster encourage support assist aid help guide direct steer orient navigate pilot drive propel push move inspire motivate stimulate energize invigorate vitalize revitalize rejuvenate refresh renew restore revive resuscitate resurge rebound recover bounce back spring back snap back rally regain recoup retrieve reclaim recapture retake repossess reoccupy reinhabit reconquer reconquer reconquer reconquer reconquer reoccupy reinstate reintegrate reincorporate readmit readopt readjust realign reorganize restructure reshape reform refashion remodel remake refit refurbish renovate redecorate redesign redefine reinterpret reevaluate reassess reconsider review revise revisit rethink reequip retrofit replace replenish refill recharge reload restock resupply repopulate restaff reinforce reenforce reenlist reactivate restart resume recommence continue persist persevere endure withstand survive weather ride out brave face confront tackle address deal with handle manage cope with contend with grapple with wrestle with struggle against battle combat fight resist oppose defy challenge dispute contest question query probe scrutinize investigate examine explore analyze study research inquire into delve into dig into look into check out check over check up on go over go through sift through sort through search for hunt for seek out track down trace locate find discover uncover unearth expose lay bare bring to light shed light on throw light on illuminate clarify explain elucidate expound explicate interpret translate decode decipher decrypt solve resolve unravel untangle untwist unwind undo unlock free release liberate extricate disentangle disengage disencumber disburden relieve ease lighten lessen reduce diminish decrease lower cut curtail trim pare down scale back cut back downsize shrink contract compress condense compact consolidate centralize concentrate converge coalesce merge unite join combine blend fuse amalgamate integrate incorporate assimilate absorb subsume encompass embrace include contain comprise consist of be composed of be made up of embody embodying embodyment embodiment personify personifying personification symbolize symbolizing symbolism stand for represent representing representation signify signifying significance mean meaning meaningfulness meaningfulness importance value worth merit virtue advantage benefit gain profit return reward outcome result consequence effect impact influence bearing relevance pertinence relation connection association link tie bond attachment affinity rapport empathy sympathy understanding comprehension appreciation awareness perception insight wisdom knowledge intelligence acumen sagacity shrewdness astuteness discernment judgment prudence circumspection caution vigilance wariness watchfulness attentiveness heedfulness mindfulness carefulness conscientiousness scrupulousness meticulousness fastidiousness thoroughness diligence industry industrious industrious industrious industrious hardworking hard-working diligent dedicated committed devoted loyal faithful steadfast stalwart staunch true trustworthy reliable dependable responsible accountable answerable liable obligated duty-bound bound duty-bound bound duty-bound bound duty-bound compelled forced obliged necessitated required mandated ordered directed commanded instructed told bidden bid bade bade bade bade bidden bid bade ordered directed commanded instructed told bidden bid bade ordered directed commanded instructed told bidden bid bade ordered directed commanded instructed told bidden bid bade ordered directed commanded instructed told bidden bid bade ordered directed commanded instructed told bidden bid bate bate baited baited baited baited baited baited bathed bathed bathed bathed bathes bathes bathes bathes bathing bathing bathing bathing baths baths baths

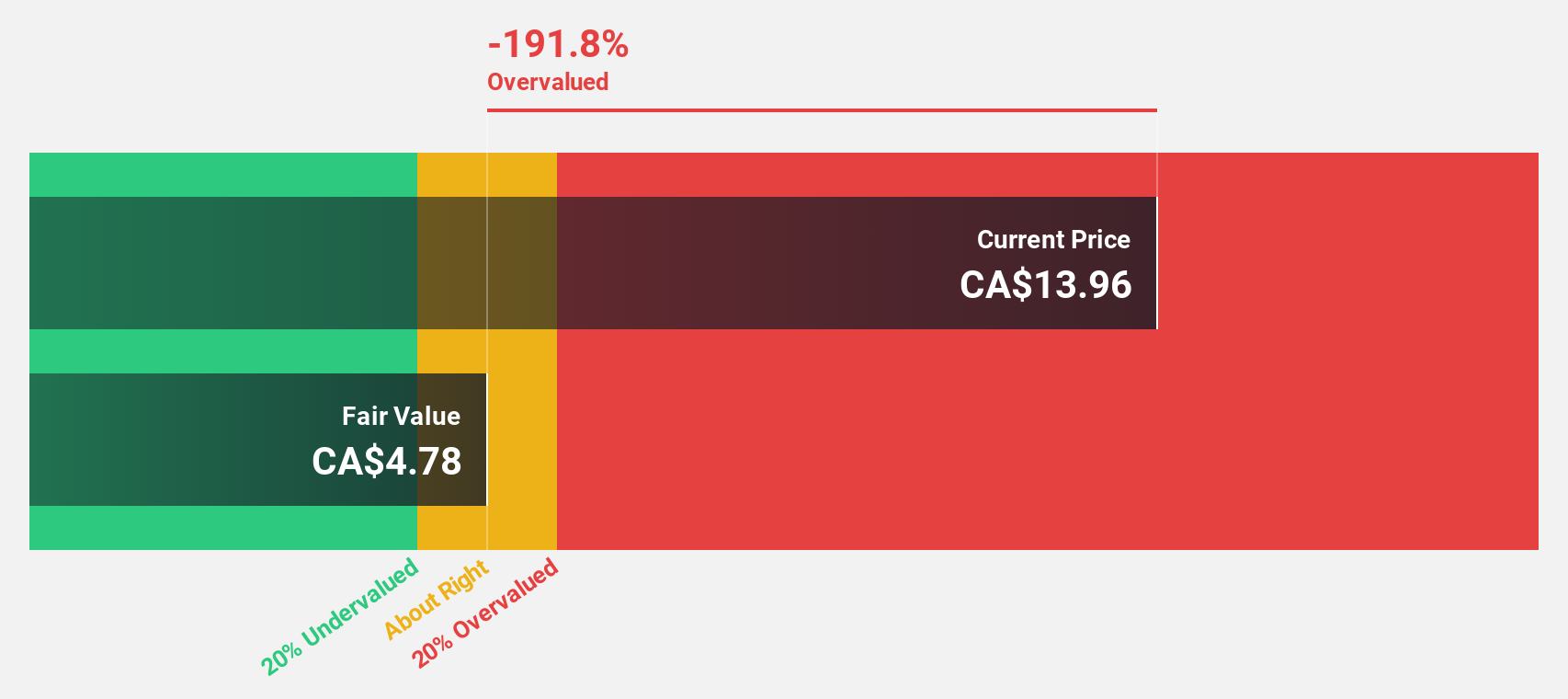

Estimated Discount To Fair Value: 42%

Sandstorm Gold is trading at CA$8.07, significantly below its estimated fair value of CA$13.9, indicating potential undervaluation based on cash flows. The company reported Q3 2024 revenue of US$44.7 million from 17,350 gold equivalent ounces sold, an increase from the previous year’s period. Despite a decline in profit margins to 17.5% from 27.6%, earnings are forecasted to grow substantially at 77.5% annually over the next three years, outpacing the Canadian market average.

- Upon reviewing our latest growth report, Sandstorm Gold's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Sandstorm Gold with our detailed financial health report.

TerraVest Industries (TSX:TVK)

Overview: TerraVest Industries Inc. manufactures and sells goods and services to the energy, agriculture, mining, transportation, and other markets in Canada and the United States with a market cap of CA$1.97 billion.

Operations: The company's revenue segments include CA$201.78 million from Service, CA$117.58 million from Processing Equipment, CA$243.77 million from Compressed Gas Equipment, and CA$292.90 million from HVAC and Containment Equipment.

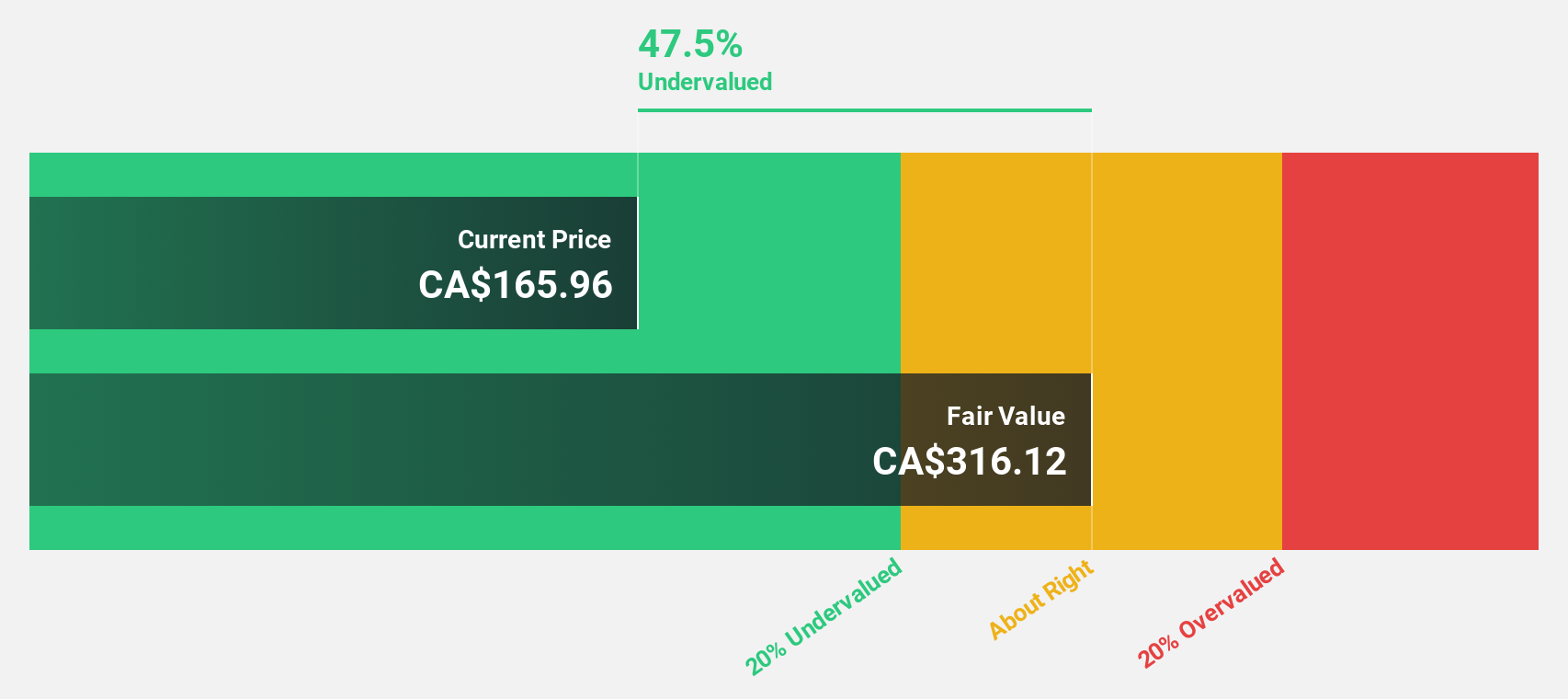

Estimated Discount To Fair Value: 22.5%

TerraVest Industries, trading at CA$101.25, is undervalued by over 20% relative to its fair value of CA$130.69 based on cash flows. Recent earnings for Q3 2024 showed revenue growth to CA$238.13 million from CA$150.36 million a year ago, with net income rising to CA$11.92 million from CA$7.97 million. Despite significant insider selling and high debt levels, earnings are forecasted to grow significantly at over 21% annually, surpassing the Canadian market average.

- The analysis detailed in our TerraVest Industries growth report hints at robust future financial performance.

- Dive into the specifics of TerraVest Industries here with our thorough financial health report.

Taking Advantage

- Unlock our comprehensive list of 26 Undervalued TSX Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal