dentalcorp Holdings Ltd.'s (TSE:DNTL) Shareholders Might Be Looking For Exit

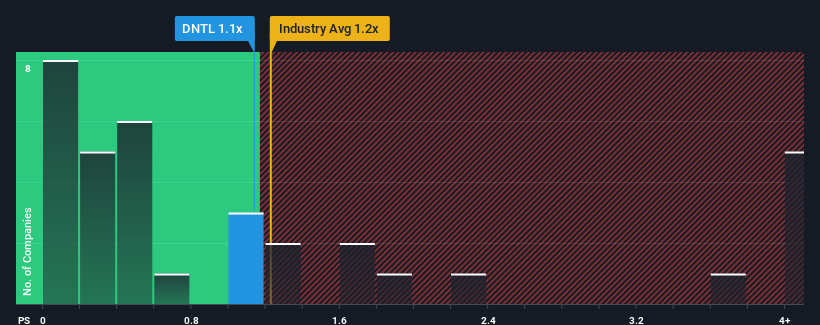

It's not a stretch to say that dentalcorp Holdings Ltd.'s (TSE:DNTL) price-to-sales (or "P/S") ratio of 1.1x seems quite "middle-of-the-road" for Healthcare companies in Canada, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for dentalcorp Holdings

What Does dentalcorp Holdings' P/S Mean For Shareholders?

Recent times haven't been great for dentalcorp Holdings as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on dentalcorp Holdings.How Is dentalcorp Holdings' Revenue Growth Trending?

dentalcorp Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.4% last year. The latest three year period has also seen an excellent 57% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 10% during the coming year according to the nine analysts following the company. With the industry predicted to deliver 20% growth, the company is positioned for a weaker revenue result.

In light of this, it's curious that dentalcorp Holdings' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that dentalcorp Holdings' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 1 warning sign for dentalcorp Holdings you should be aware of.

If you're unsure about the strength of dentalcorp Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal