Undiscovered Gems in the United States for October 2024

The United States market has shown robust performance, climbing 1.1% in the last week and surging 32% over the past year, with earnings expected to grow by 15% annually. In such a dynamic environment, identifying stocks that are not only poised for growth but also remain underappreciated can offer unique opportunities for investors seeking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| QDM International | 36.42% | 107.08% | 78.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

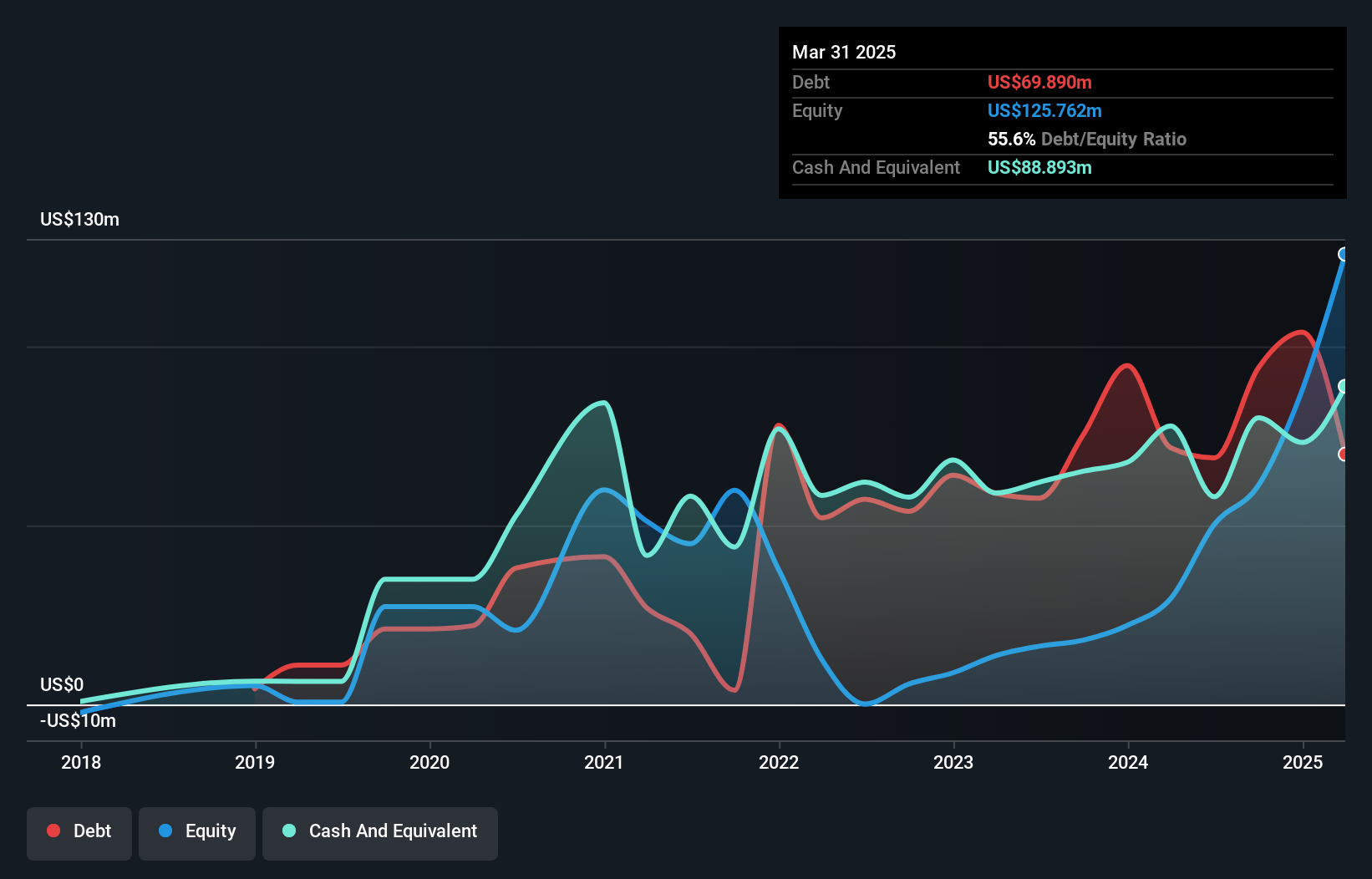

Sezzle (NasdaqCM:SEZL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sezzle Inc. is a technology-enabled payments company operating mainly in the United States and Canada with a market cap of $1.12 billion.

Operations: Sezzle generates revenue primarily through lending to end-customers, amounting to $192.69 million.

Sezzle, a dynamic player in the financial sector, has shown impressive earnings growth of 434.8% over the past year, outpacing its industry significantly. The company's debt to equity ratio has improved dramatically from 1676.6% to 137% in five years, indicating better financial health. With a net debt to equity ratio of 21.6%, Sezzle's interest payments are well-covered by EBIT at 4.9x coverage, reflecting strong operational efficiency and prudent fiscal management amidst recent strategic partnerships and initiatives aimed at expanding market reach.

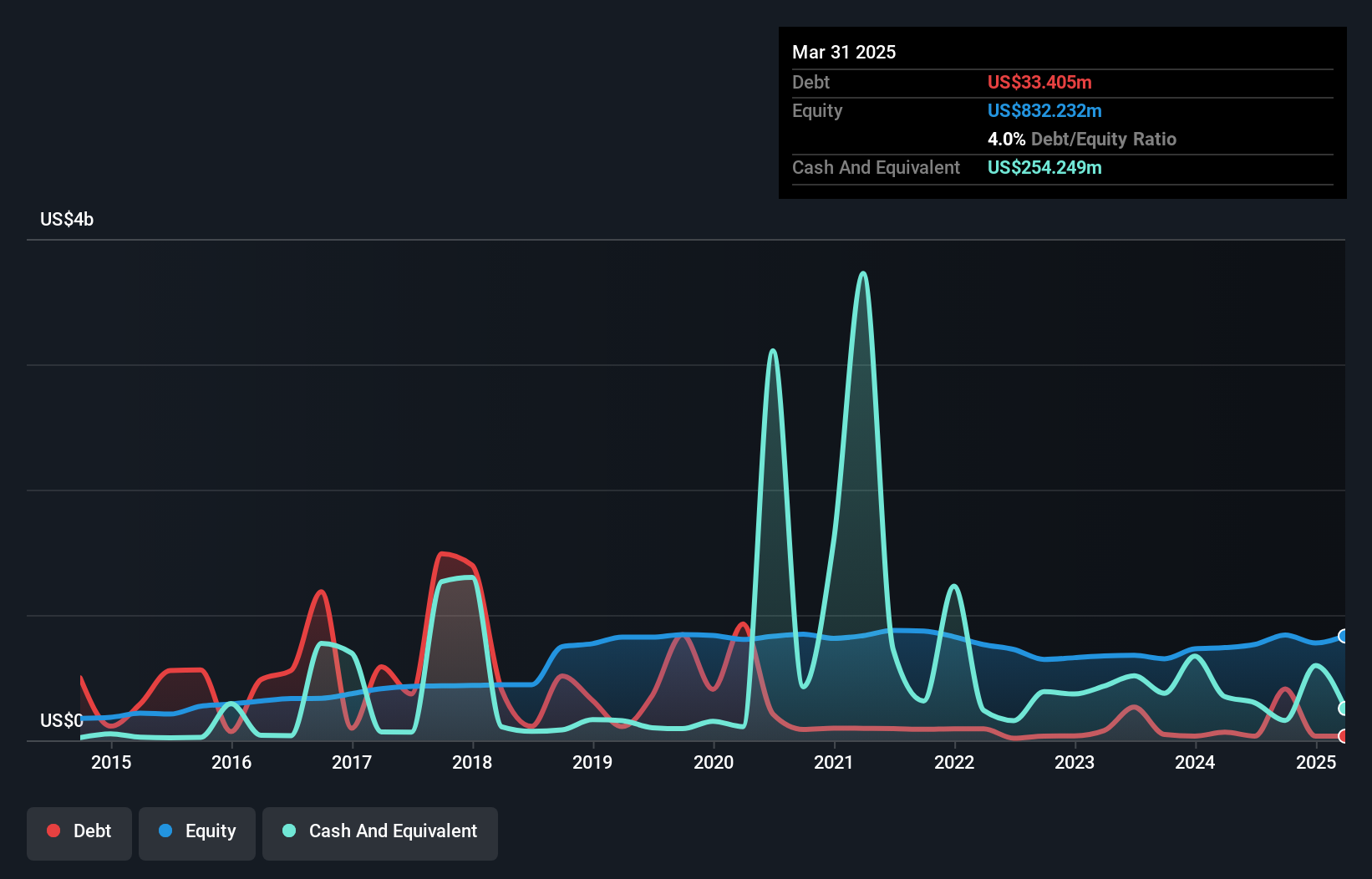

Pathward Financial (NasdaqGS:CASH)

Simply Wall St Value Rating: ★★★★★★

Overview: Pathward Financial, Inc. is a bank holding company for Pathward, National Association, offering a range of banking products and services in the United States with a market capitalization of approximately $1.83 billion.

Operations: Pathward Financial generates revenue primarily from its Consumer and Commercial segments, contributing $401.69 million and $248.43 million, respectively. The company also reports additional income from Corporate Services amounting to $46.78 million.

Pathward Financial, with assets totaling US$7.5 billion and equity of US$765.2 million, stands out for its robust financial health. The company boasts total deposits of US$6.4 billion against loans of US$4.5 billion, maintaining a net interest margin of 6.1%. It has a sufficient allowance for bad loans at 179%, covering the current 1% non-performing loan ratio effectively. Recently, Pathward repurchased shares worth US$14.99 million and announced a dividend payout of $0.05 per share, underscoring shareholder value initiatives amidst steady earnings growth exceeding industry averages by 13.5%.

- Click here to discover the nuances of Pathward Financial with our detailed analytical health report.

Examine Pathward Financial's past performance report to understand how it has performed in the past.

IDT (NYSE:IDT)

Simply Wall St Value Rating: ★★★★★★

Overview: IDT Corporation is a company that offers communications and payment services across the United States, the United Kingdom, and internationally, with a market capitalization of approximately $1.18 billion.

Operations: IDT generates revenue primarily from its Traditional Communications segment, contributing $899.60 million, followed by Fintech at $120.70 million, and Net2phone at $82.30 million. National Retail Solutions adds another $103.10 million to the revenue stream.

IDT, a nimble player in the telecom sector, has demonstrated impressive financial health with its earnings surging by 59.2% over the past year, outpacing the industry's -18.2%. The company is debt-free and boasts high-quality earnings. Recent buybacks saw them repurchase 132,028 shares for $4.71 million between May and October 2024. Despite a slight dip in sales to $1.21 billion from $1.24 billion last year, net income rose to $64.45 million from $40.49 million, indicating robust performance amidst market challenges.

- Click here and access our complete health analysis report to understand the dynamics of IDT.

Evaluate IDT's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Discover the full array of 223 US Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal