Simply Good Foods (NASDAQ:SMPL) shareholders have earned a 6.8% CAGR over the last five years

The main point of investing for the long term is to make money. Furthermore, you'd generally like to see the share price rise faster than the market. But The Simply Good Foods Company (NASDAQ:SMPL) has fallen short of that second goal, with a share price rise of 39% over five years, which is below the market return. Zooming in, the stock is up just 3.9% in the last year.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for Simply Good Foods

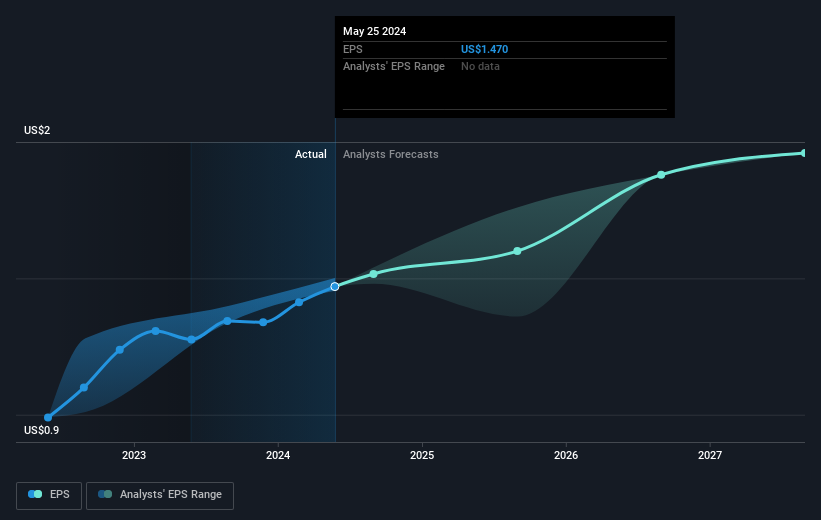

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last half decade, Simply Good Foods became profitable. That would generally be considered a positive, so we'd hope to see the share price to rise.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Simply Good Foods has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Simply Good Foods' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Simply Good Foods shareholders gained a total return of 3.9% during the year. But that return falls short of the market. If we look back over five years, the returns are even better, coming in at 7% per year for five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. Before spending more time on Simply Good Foods it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal