3 US Growth Companies Insiders Own With Up To 102% Earnings Growth

As the U.S. markets experience fluctuations, with major indexes recently tumbling due to declines in technology and energy stocks, investors are keenly observing corporate earnings reports for insights into potential growth opportunities. In this environment, companies with high insider ownership can be particularly appealing as they often signal strong internal confidence and alignment with shareholder interests, making them a noteworthy focus for those seeking resilient growth prospects amidst market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 40.9% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 26% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.4% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 33.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 37.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Let's review some notable picks from our screened stocks.

ChromaDex (NasdaqCM:CDXC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ChromaDex Corporation is a bioscience company that develops healthy aging products, with a market cap of $254.94 million.

Operations: The company's revenue is derived from three segments: Ingredients ($11.70 million), Consumer Products ($71.00 million), and Analytical Reference Standards and Services ($2.88 million).

Insider Ownership: 30.7%

Earnings Growth Forecast: 102.9% p.a.

ChromaDex is trading at a substantial discount to its estimated fair value, suggesting potential upside. The company is poised for significant growth, with earnings projected to increase over 100% annually and revenue expected to outpace the US market. Recent changes include the appointment of a new CFO, Ozan Pamir, who brings extensive financial expertise. Despite no recent insider trading activity, ChromaDex's strategic moves and innovative product launches position it well for future profitability.

- Dive into the specifics of ChromaDex here with our thorough growth forecast report.

- The analysis detailed in our ChromaDex valuation report hints at an deflated share price compared to its estimated value.

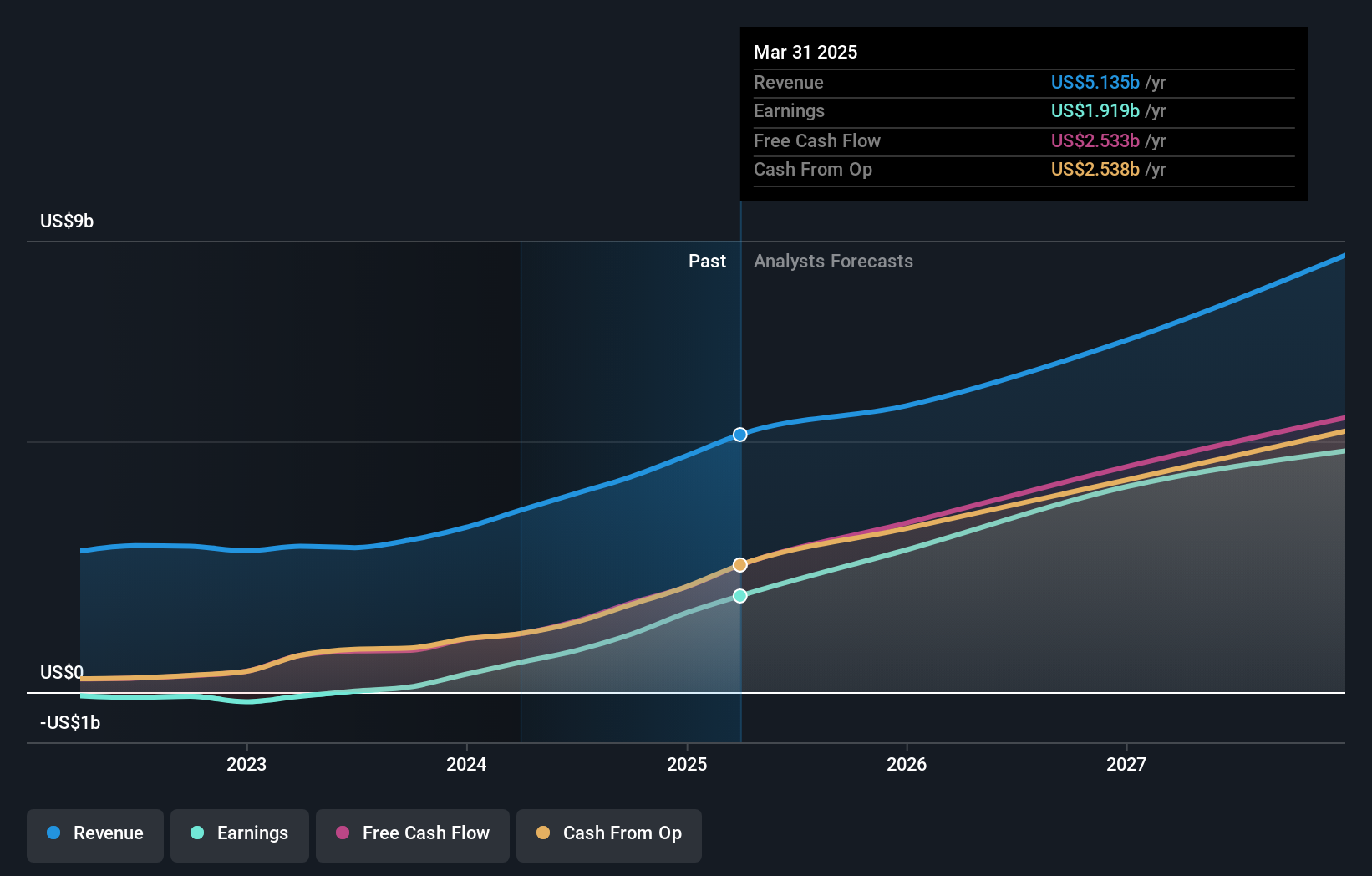

AppLovin (NasdaqGS:APP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppLovin Corporation operates a software-based platform designed to improve marketing and monetization for advertisers both in the United States and internationally, with a market cap of approximately $48.07 billion.

Operations: The company's revenue is derived from two main segments: Apps, generating $1.49 billion, and the Software Platform, contributing $2.47 billion.

Insider Ownership: 38.3%

Earnings Growth Forecast: 24.9% p.a.

AppLovin is trading significantly below its estimated fair value, indicating potential upside. The company forecasts robust earnings growth of 24.89% annually, outpacing the US market's average. Despite high debt levels and recent insider selling activity, AppLovin's inclusion in the FTSE All-World Index highlights its market relevance. Recent financial performance shows strong revenue and net income growth with second-quarter sales reaching US$1.08 billion compared to US$750 million a year ago.

- Get an in-depth perspective on AppLovin's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility AppLovin's shares may be trading at a discount.

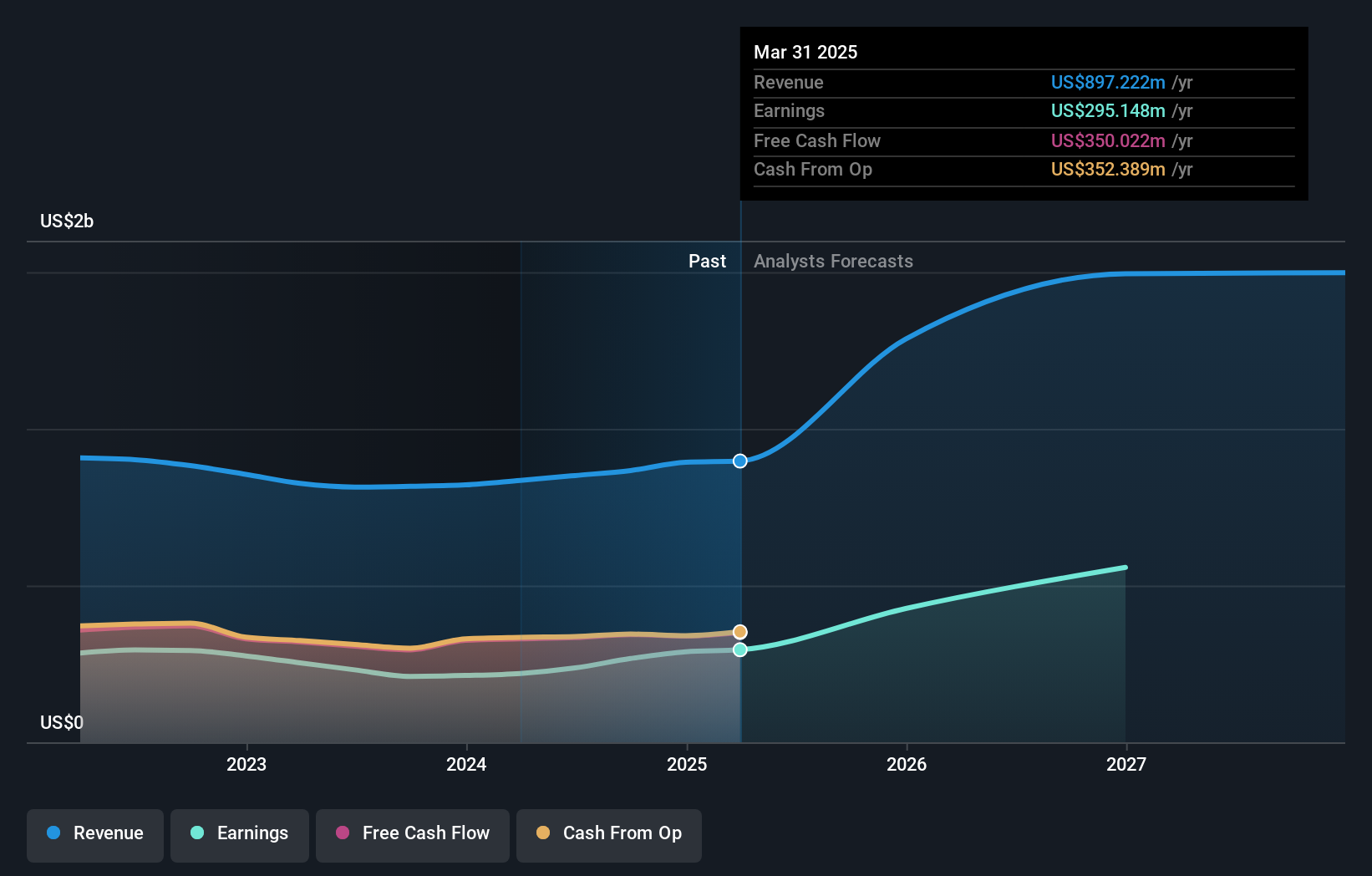

Victory Capital Holdings (NasdaqGS:VCTR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Victory Capital Holdings, Inc. operates as an asset management company both in the United States and internationally, with a market cap of approximately $3.87 billion.

Operations: The company generates revenue of $850.96 million from providing investment management services and products.

Insider Ownership: 10.2%

Earnings Growth Forecast: 33.2% p.a.

Victory Capital Holdings is trading well below its estimated fair value, suggesting potential for appreciation. The company is poised for strong earnings growth at 33.2% annually, surpassing the US market average. Despite a high debt level and an unstable dividend history, recent financials reflect solid performance with second-quarter revenue of US$219.62 million and net income of US$74.25 million, both up from the previous year. No significant insider trading activity noted recently.

- Click to explore a detailed breakdown of our findings in Victory Capital Holdings' earnings growth report.

- According our valuation report, there's an indication that Victory Capital Holdings' share price might be on the cheaper side.

Where To Now?

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 182 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal