October 2024's Top Undervalued Small Caps In United States With Insider Buying

The United States market has shown robust performance recently, rising 1.1% over the last week and an impressive 32% over the past year, with earnings projected to grow by 15% annually. In such a dynamic environment, identifying small-cap stocks that are perceived as undervalued and exhibit insider buying can offer intriguing opportunities for investors seeking potential value plays.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanover Bancorp | 9.5x | 2.2x | 47.36% | ★★★★★☆ |

| Columbus McKinnon | 21.8x | 1.0x | 40.67% | ★★★★★☆ |

| Franklin Financial Services | 9.8x | 1.9x | 37.53% | ★★★★☆☆ |

| HighPeak Energy | 11.8x | 1.5x | 36.60% | ★★★★☆☆ |

| Delek US Holdings | NA | 0.1x | -675.65% | ★★★★☆☆ |

| German American Bancorp | 14.5x | 4.8x | 45.32% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -100.21% | ★★★☆☆☆ |

| Sabre | NA | 0.4x | -35.11% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | -222.36% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

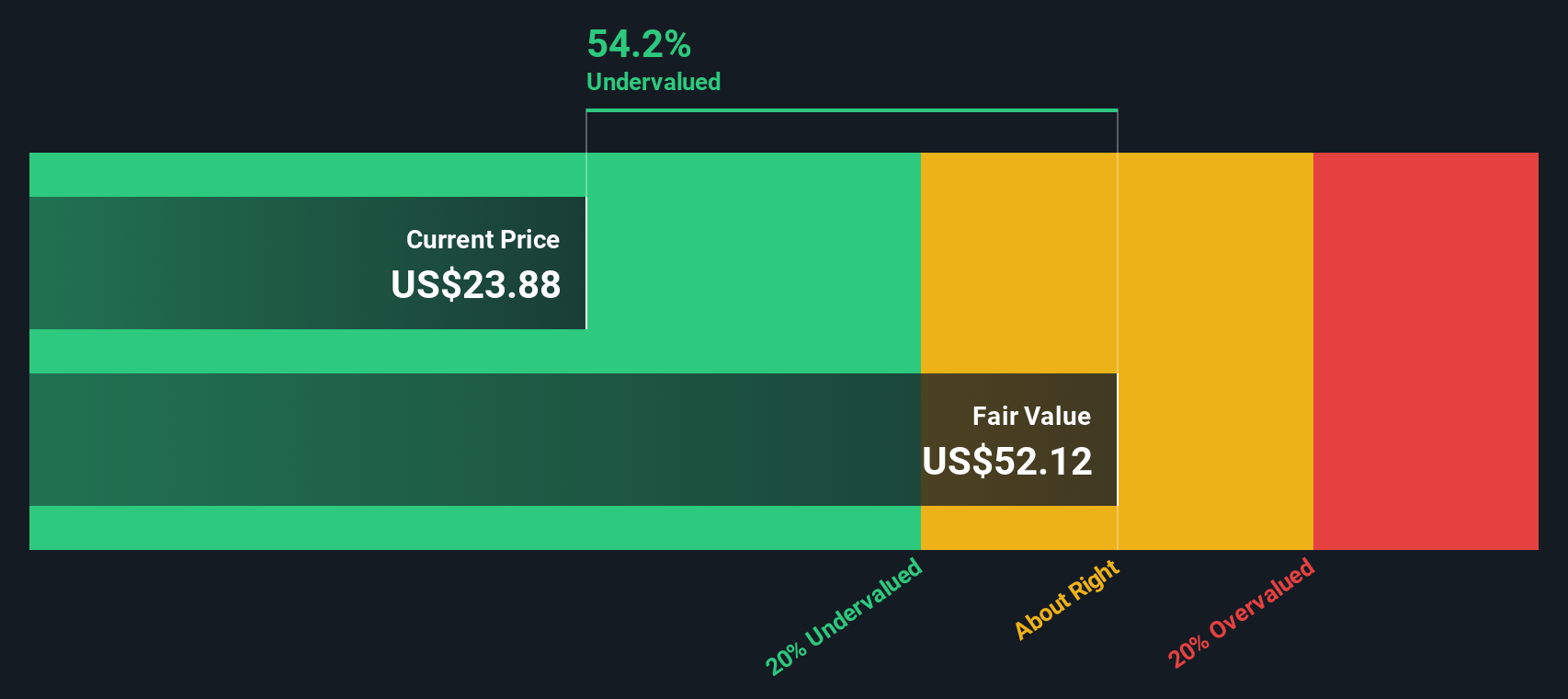

Phibro Animal Health (NasdaqGM:PAHC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Phibro Animal Health is a company that specializes in animal health products, mineral nutrition, and performance products with a market capitalization of approximately $0.54 billion.

Operations: Phibro Animal Health generates revenue primarily from three segments: Animal Health, Mineral Nutrition, and Performance Products. The company's gross profit margin has shown a varied trend over the periods, reaching 30.82% in June 2024. Operating expenses have increased over time, impacting net income margins, which declined to 0.24% by June 2024.

PE: 404.9x

Phibro Animal Health, a smaller player in the U.S. market, is catching attention for its potential value. Recent insider confidence is evident as they purchased shares between July and August 2024. Despite challenges like a drop in net income to US$2.42 million for the year ending June 2024, Phibro projects sales growth of up to US$1.09 billion in fiscal 2025 driven by their Animal Health segment's expansion and recovery elsewhere.

- Click here and access our complete valuation analysis report to understand the dynamics of Phibro Animal Health.

Gain insights into Phibro Animal Health's past trends and performance with our Past report.

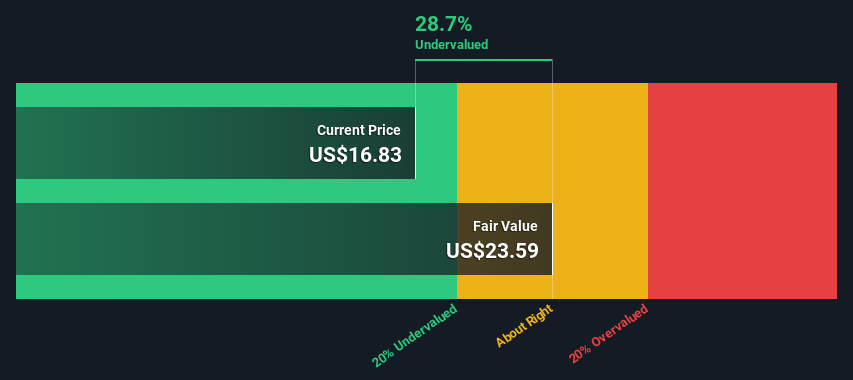

Couchbase (NasdaqGS:BASE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Couchbase is a software company specializing in NoSQL cloud database solutions with a market cap of $0.84 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, with recent figures reaching $198.82 million. Its cost structure includes significant operating expenses, notably in sales and marketing as well as research and development. The gross profit margin has shown fluctuations, recently recorded at 88.74%.

PE: -11.0x

Couchbase, a tech company in the U.S., showcases potential as an undervalued investment opportunity. Despite currently being unprofitable with no profitability forecast for the next three years, its revenue is projected to grow by 14.37% annually. Recent earnings showed a revenue increase to US$51.59 million for Q2 2024, with a reduced net loss of US$19.9 million compared to last year. Insider confidence is evident as Edward Anderson purchased 21,080 shares in August 2024 for approximately US$298K, indicating belief in future growth prospects despite current challenges and reliance on external funding sources without customer deposits.

- Click to explore a detailed breakdown of our findings in Couchbase's valuation report.

Review our historical performance report to gain insights into Couchbase's's past performance.

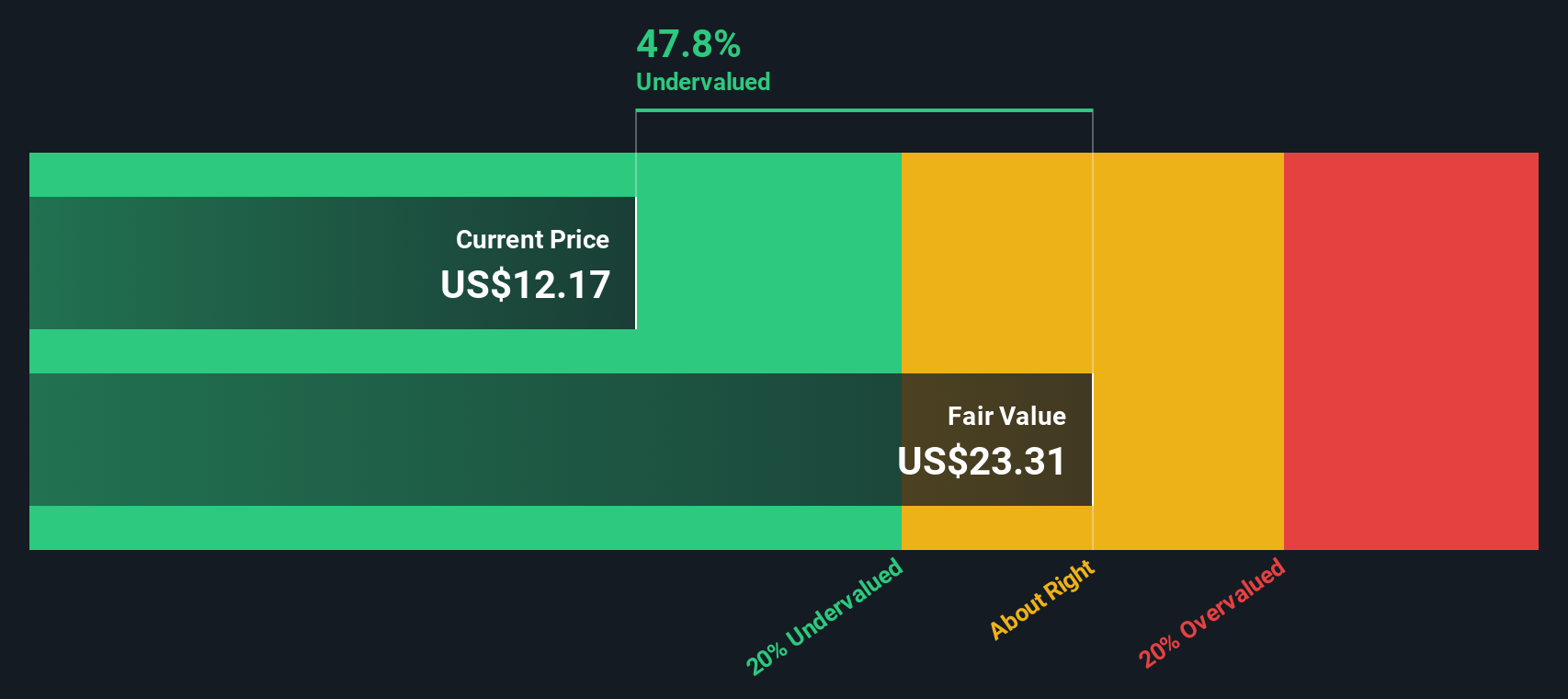

Northwest Bancshares (NasdaqGS:NWBI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Northwest Bancshares operates primarily in community banking, providing a range of financial services, and has a market capitalization of approximately $1.22 billion.

Operations: The company generates its revenue primarily from community banking, with a recent figure of $491.91 million. Operating expenses are significant, including general and administrative expenses which were $325.59 million in the latest period. The net income margin has shown variability, with the most recent figure at 20.72%.

PE: 16.9x

Northwest Bancshares, a smaller company in the U.S., exhibits potential for growth with earnings projected to rise 16.82% annually. Despite a dip in net income to US$4.75 million for Q2 2024 from US$33.04 million the previous year, insider confidence is evident as they continue purchasing shares, reinforcing belief in its prospects. The company declared a quarterly dividend of US$0.20 per share, highlighting commitment to returning value to shareholders amidst evolving financial dynamics.

- Click here to discover the nuances of Northwest Bancshares with our detailed analytical valuation report.

Understand Northwest Bancshares' track record by examining our Past report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 53 Undervalued US Small Caps With Insider Buying by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal