Here's Why U.S. Energy (NASDAQ:USEG) Can Afford Some Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that U.S. Energy Corp. (NASDAQ:USEG) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for U.S. Energy

How Much Debt Does U.S. Energy Carry?

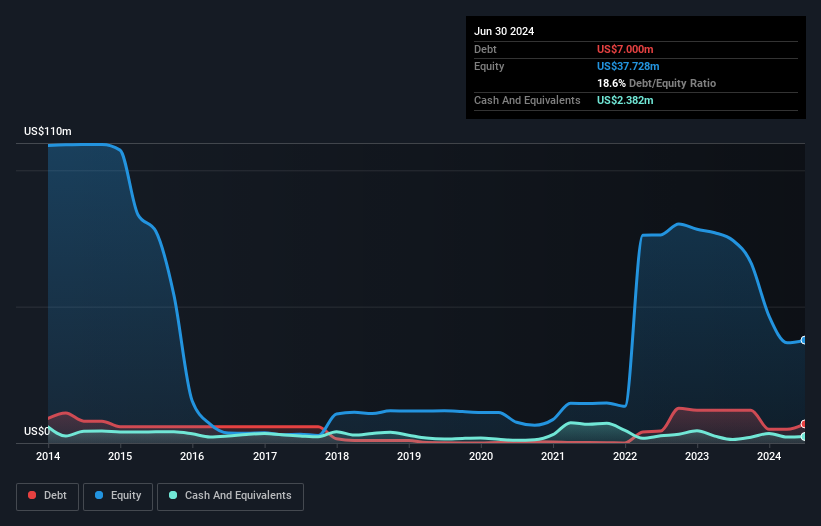

As you can see below, U.S. Energy had US$7.00m of debt at June 2024, down from US$12.0m a year prior. On the flip side, it has US$2.38m in cash leading to net debt of about US$4.62m.

A Look At U.S. Energy's Liabilities

We can see from the most recent balance sheet that U.S. Energy had liabilities of US$10.4m falling due within a year, and liabilities of US$25.6m due beyond that. Offsetting this, it had US$2.38m in cash and US$2.25m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$31.3m.

This deficit is considerable relative to its market capitalization of US$39.0m, so it does suggest shareholders should keep an eye on U.S. Energy's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine U.S. Energy's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, U.S. Energy made a loss at the EBIT level, and saw its revenue drop to US$26m, which is a fall of 28%. That makes us nervous, to say the least.

Caveat Emptor

Not only did U.S. Energy's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Its EBIT loss was a whopping US$40m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. For example, we would not want to see a repeat of last year's loss of US$40m. So to be blunt we do think it is risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 4 warning signs for U.S. Energy you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal