Avadel Pharmaceuticals plc's (NASDAQ:AVDL) P/S Still Appears To Be Reasonable

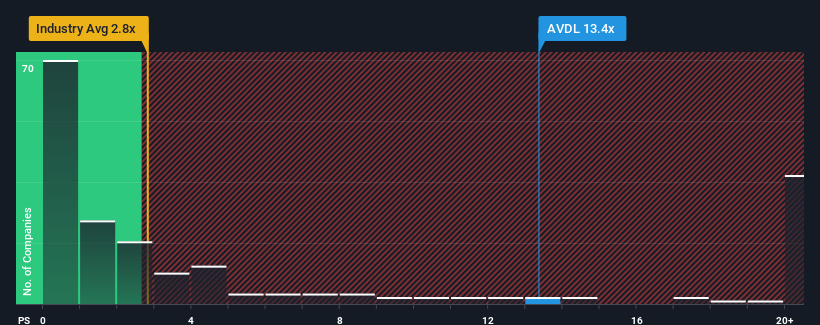

When you see that almost half of the companies in the Pharmaceuticals industry in the United States have price-to-sales ratios (or "P/S") below 2.8x, Avadel Pharmaceuticals plc (NASDAQ:AVDL) looks to be giving off strong sell signals with its 13.4x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Avadel Pharmaceuticals

What Does Avadel Pharmaceuticals' Recent Performance Look Like?

Recent times have been advantageous for Avadel Pharmaceuticals as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Avadel Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Avadel Pharmaceuticals' to be considered reasonable.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. In spite of this unbelievable short-term growth, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 65% per year as estimated by the nine analysts watching the company. With the industry only predicted to deliver 17% per annum, the company is positioned for a stronger revenue result.

With this information, we can see why Avadel Pharmaceuticals is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Avadel Pharmaceuticals shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Avadel Pharmaceuticals you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal