Inflation has fallen below 2%! The Bank of England is expected to restart interest rate cuts. Is the pound in jeopardy?

On Wednesday, data showed that the UK inflation rate fell sharply beyond expectations, and the key price indicators that the Bank of England is concerned about also fell. This supported investors' aggressive bets on the path of interest rate cuts. Since then, the pound has plummeted.

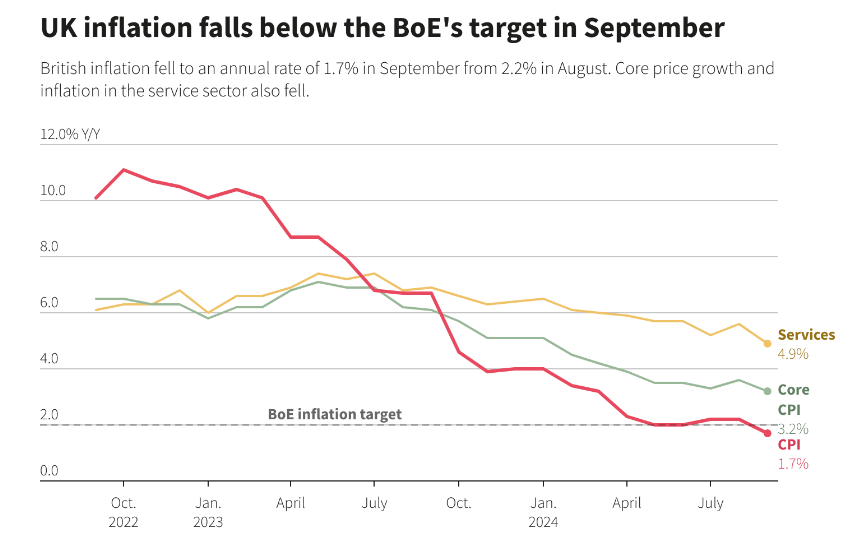

According to data released by the UK Office for National Statistics, the consumer price index (CPI) fell to 1.7% in September from 2.2% in August, below the Bank of England's target level of 2% and the 1.9% generally expected by economists. This is the lowest level since April 2021, mainly driven by falling airline tickets and gasoline prices.

Core CPI, which excludes energy, food, alcohol, and tobacco, fell to 3.2% in September from 3.6% in August. Meanwhile, the Bank of England sees the most important measure of domestic price pressure — the inflation rate in the service sector fell from 5.6% in August to 4.9% in September, the lowest level since May 2022.

This reading fell short of the market's consensus expectations. According to the forecast released in August, the Bank of England expects that the service sector inflation rate will not fall below 5% this year.

There are also signs that inflationary pressure will abate in the future. In the year ending September, the prices charged by factories for their products fell by 0.7%, the biggest drop since the COVID-19 pandemic in October 2020.

GBP/USD is down more than 3% from the two-year high hit in September. Previously, the British pound became the leader among G10 currencies as investors bet that the Bank of England would cut interest rates more carefully than other countries. However, as price pressure eased, the latest data further questioned this claim, weakening the currency's appeal.

The Bank of England began cutting interest rates for the first time in the year in August, but it only cut interest rates by 25 basis points to 5%. At the September meeting, the Bank of England announced the suspension of interest rate cuts with an 8:1 vote, while reaffirming that “monetary policy needs to remain restrictive for a long enough period of time.

Francesco Pesole, strategist at ING, said, “The data is certainly dovish for the Bank of England, paves the way for interest rate cuts for the remaining two sessions of the year, and also opens the door to the British pound's poor performance over a period of time.”

Yael Selfin, KPMG's UK chief economist, said inflation is likely to rebound due to rising oil prices and rising domestic energy prices driven by the Middle East conflict. However, she added that this will not stop the Bank of England from cutting interest rates.

“Further weakening of the labour market and continued progress in potential inflation should provide room for [the Bank of England) to further relax monetary policy,” she said.

The UK Treasury welcomed the fall in inflation, which provided a favorable backdrop for Reeves to prepare his first budget to be submitted on October 30.

The outlook for lower inflation will slightly improve the budget's economic and fiscal prospects, as Reeves is struggling to find additional funding to invest in public services and new infrastructure without scaring investors. Her spending plans will be closely watched by the Bank of England.

Suren Thiru, head of economics at the accounting agency ICAEW, said, “Although the signs of interest rate cuts in November are clear, the upcoming budget is the last hurdle because interest rate makers will want to evaluate the impact of any measures announced on inflation before easing policies again.”

For several months, people have been expecting the Bank of England to lag behind other central banks in cutting interest rates. However, Bank of England Governor Bailey told the “Guardian” (Guardian) earlier this month that the Bank of England may become “more aggressive” and “more active” in cutting interest rates, thus triggering a sharp fall in the pound.

As interest rate makers consider how quickly to reduce borrowing costs, the latest data may make them more confident that price pressures are under control.

Jordan Rochester, head of macro strategy at Mizuho EMEA, said that the inflation report “may change the narrative of the UK market” and “there will be more negative surprises in the future.”

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal