High Growth Tech Stocks In Hong Kong To Watch For Potential Expansion

As global markets experience fluctuations, with Chinese equities recently declining amid concerns over stimulus measures, Hong Kong's tech sector presents intriguing opportunities for potential growth. In this dynamic environment, a good stock to watch in the high-growth tech space often demonstrates resilience and innovation, positioning itself to capitalize on evolving market trends and technological advancements.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Cowell e Holdings | 31.68% | 35.44% | ★★★★★★ |

| Innovent Biologics | 21.74% | 59.60% | ★★★★★☆ |

| Akeso | 33.44% | 53.00% | ★★★★★★ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our SEHK High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

BYD Electronic (International) (SEHK:285)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Electronic (International) Company Limited is an investment holding company focused on the design, manufacture, assembly, and sale of mobile handset components and modules both in China and globally, with a market capitalization of approximately HK$73 billion.

Operations: The company generates revenue primarily from the manufacture, assembly, and sale of mobile handset components and modules, with reported revenues of CN¥152.36 billion. The business operates both within China and internationally.

BYD Electronic (International) demonstrates a robust growth trajectory, with earnings surging by 47.6% over the past year, significantly outpacing the Communications industry's decline of 14.5%. This performance is underpinned by substantial R&D investments, aligning with a 24.9% forecasted annual earnings growth over the next three years—twice the rate of Hong Kong's market average at 12.1%. Additionally, revenue projections show a promising increase of 12% annually, surpassing the local market forecast of 7.3%. Recent financials reveal sales jumping to CNY 78.58 billion from CNY 56.18 billion year-over-year in the first half of 2024, supporting sustained profitability and innovation-driven expansion in high-growth tech sectors.

FIT Hon Teng (SEHK:6088)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FIT Hon Teng Limited is a company that manufactures and sells mobile and wireless devices and connectors both in Taiwan and internationally, with a market capitalization of HK$20.41 billion.

Operations: The company generates revenue primarily from two segments: Consumer Products and Intermediate Products, with the latter contributing significantly more to total revenue. The Consumer Products segment accounts for $690.95 million, while Intermediate Products bring in $3.94 billion.

FIT Hon Teng's recent performance underscores its potential in the competitive tech landscape of Hong Kong. The company reported a significant turnaround with sales rising to USD 2.07 billion, up from USD 1.78 billion, and transitioning from a net loss of USD 8.95 million to a net income of USD 32.52 million in the first half of 2024. This rebound is particularly noteworthy as it aligns with an earnings growth forecast of 32.2% annually, sharply outpacing the broader Hong Kong market's expectation of 12.1%. Additionally, FIT Hon Teng's commitment to innovation is evident in its R&D strategy, which supports anticipated revenue growth at an annual rate of 18.4%, well above the local market average forecasted at 7.3%. These figures not only reflect robust financial health but also strategic positioning for sustained growth amid evolving technological demands.

- Click here to discover the nuances of FIT Hon Teng with our detailed analytical health report.

Understand FIT Hon Teng's track record by examining our Past report.

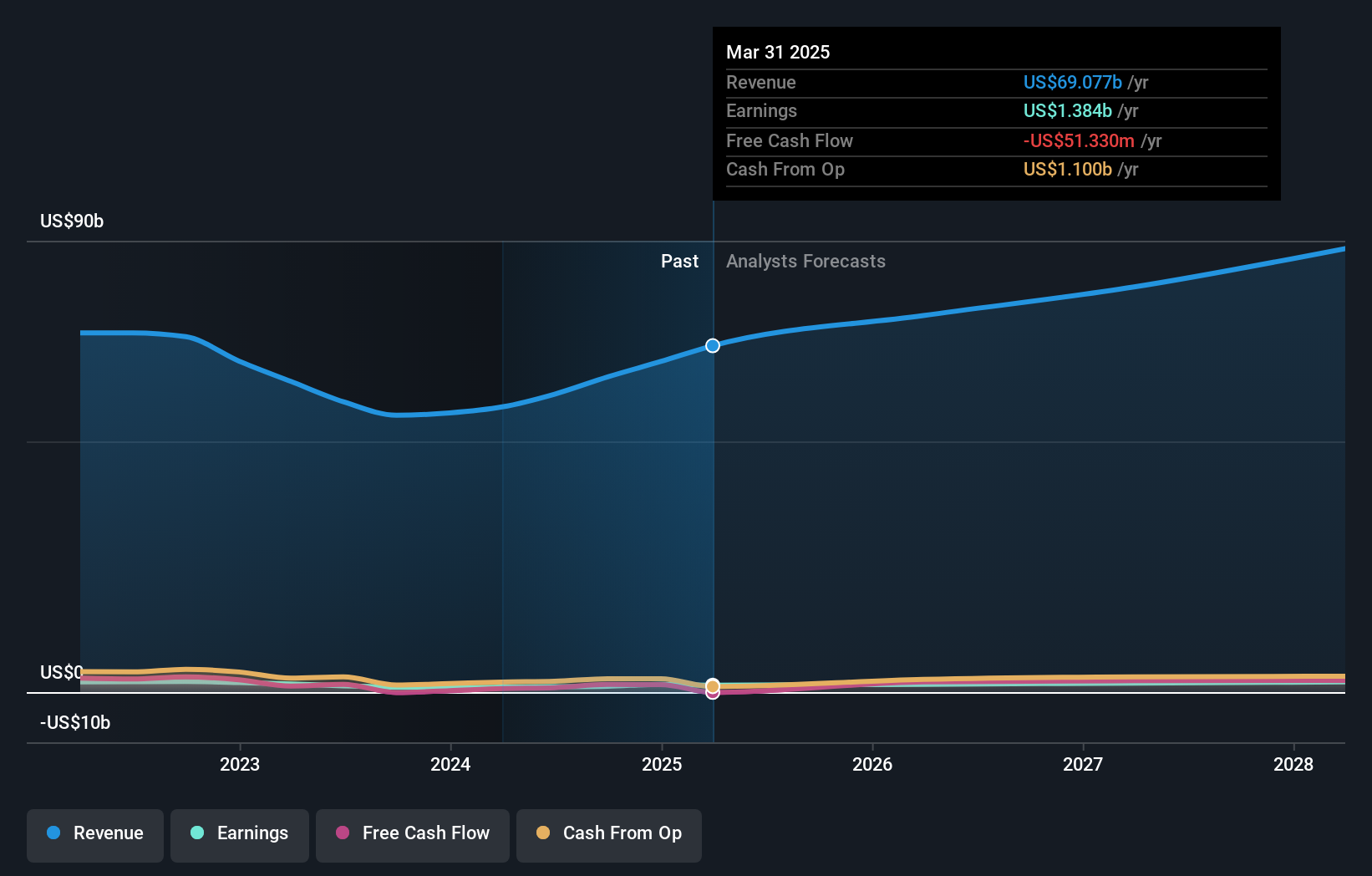

Lenovo Group (SEHK:992)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services with a market capitalization of HK$135.46 billion.

Operations: The company generates revenue primarily from three segments: Intelligent Devices Group (IDG) at $45.76 billion, Solutions and Services Group (SSG) at $7.64 billion, and Infrastructure Solutions Group (ISG) at $10.17 billion.

Lenovo Group has been actively enhancing its position in the high-growth tech sector through significant R&D investments and strategic initiatives. In the recent fiscal year, Lenovo allocated 7.9% of its revenue to R&D, underscoring a robust commitment to innovation, particularly in AI technologies. This investment is part of why the company forecasts an earnings growth rate of 18.8% annually, outpacing the broader Hong Kong market's average. Moreover, Lenovo’s recent unveiling of Alzheimer’s Intelligence at Lenovo Tech World highlights its pioneering efforts in AI applications for healthcare, leveraging extensive R&D to create impactful solutions beyond traditional tech boundaries.

Make It Happen

- Take a closer look at our SEHK High Growth Tech and AI Stocks list of 43 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal