Undiscovered Gems Warpaint London And 2 Other Small Caps with Strong Fundamentals

Over the last 7 days, the United Kingdom market has remained flat, yet it has shown a promising increase of 6.5% over the past year with earnings forecasted to grow by 14% annually. In this environment, identifying stocks with strong fundamentals can be key to uncovering potential opportunities; Warpaint London and two other small-cap companies exemplify such promising prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

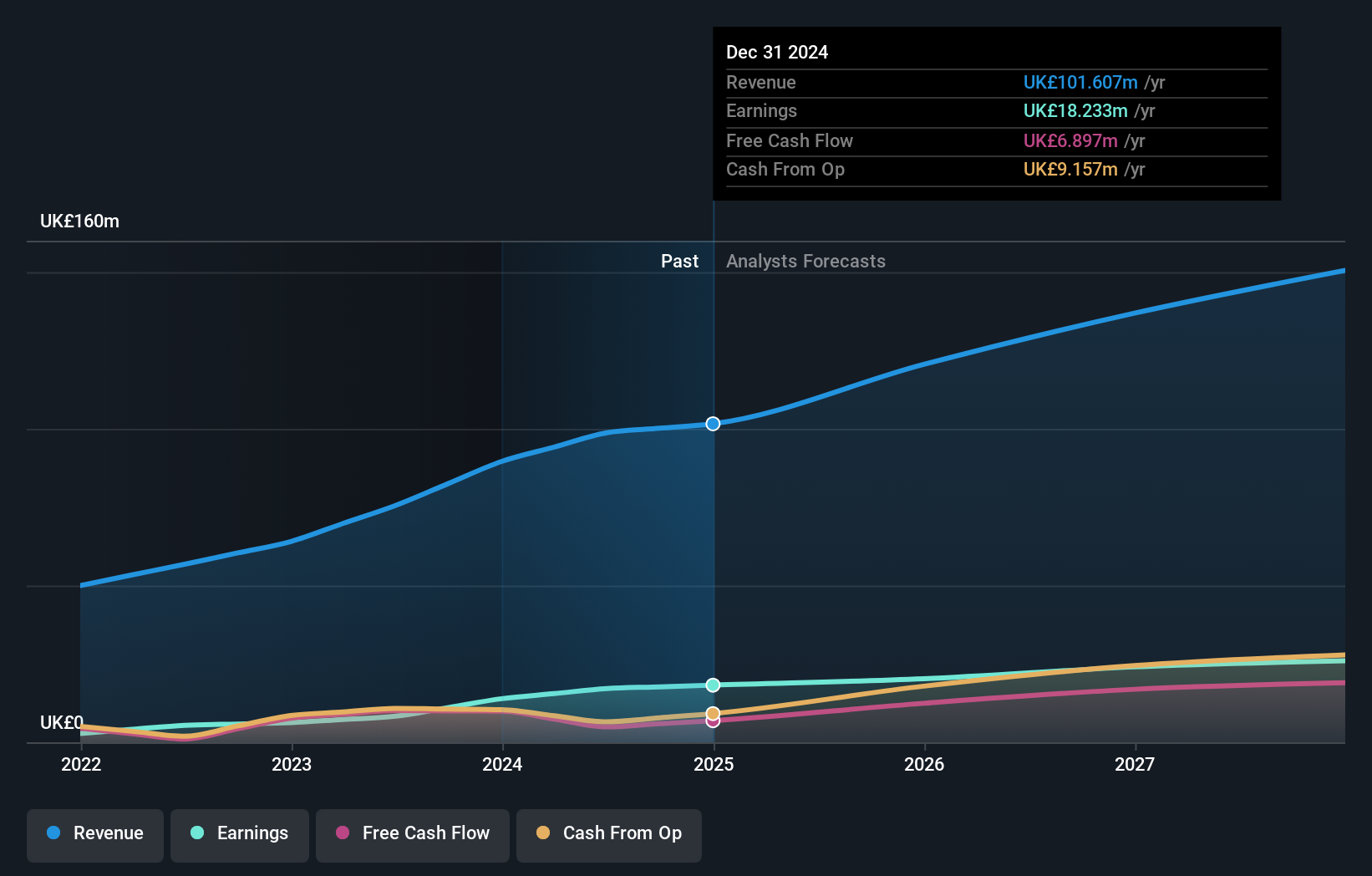

Overview: Warpaint London PLC, along with its subsidiaries, is engaged in the production and sale of cosmetics, with a market capitalization of £435.36 million.

Operations: The company generates revenue primarily from its Own Brand segment, contributing £96.72 million, while the Close-Out segment adds £2.12 million.

Warpaint London, a nimble player in the cosmetics market, has shown impressive growth with earnings up 106% over the past year, outpacing its industry peers. The company reported sales of £45.85 million for H1 2024, significantly higher than last year's £36.69 million. Net income also rose to £8.02 million from £4.78 million a year ago. With no debt on its books and positive free cash flow, Warpaint seems well-positioned for continued expansion despite recent share price volatility.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

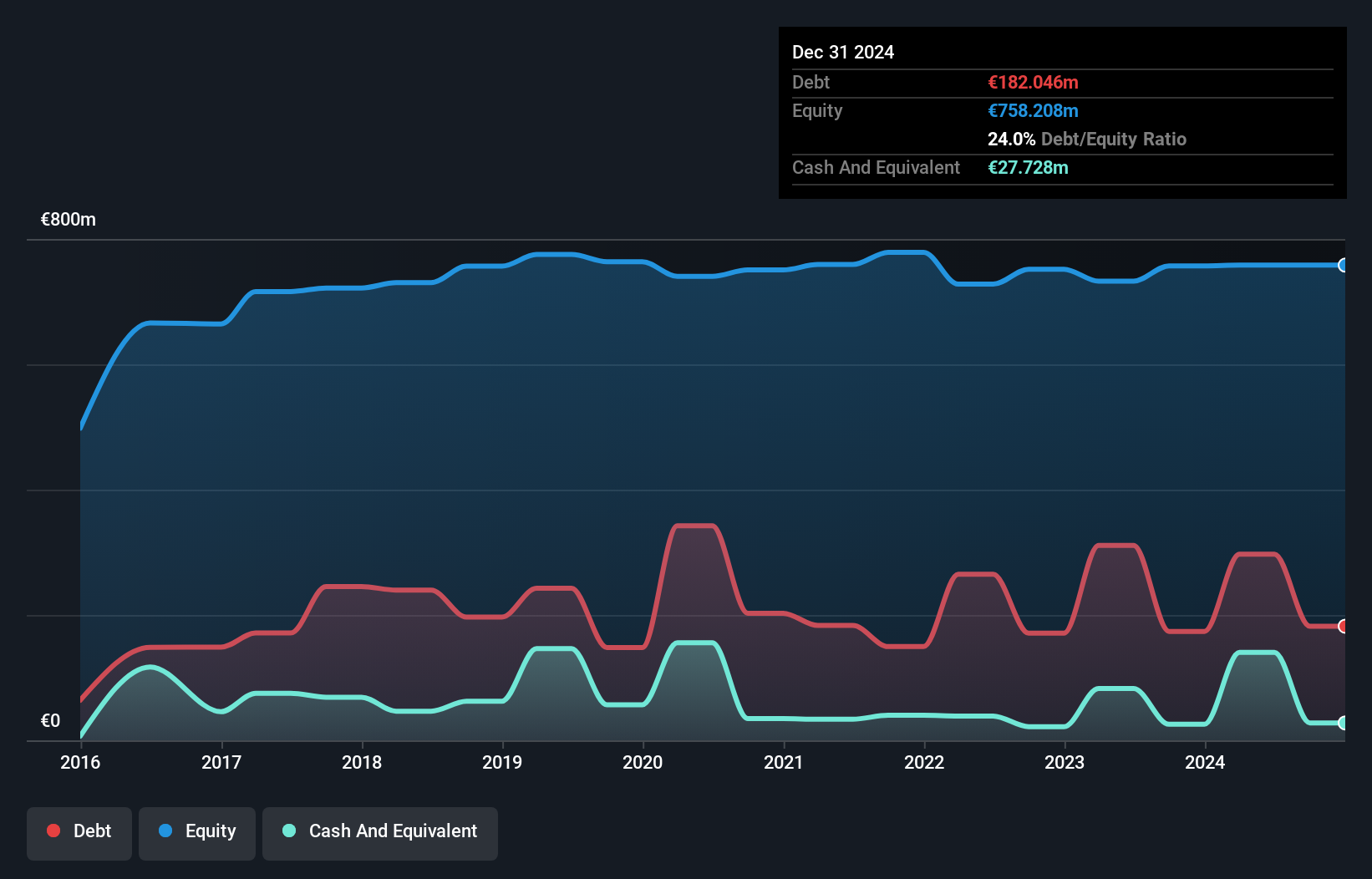

Overview: Cairn Homes plc is a holding company that operates as a home and community builder in Ireland, with a market capitalization of £1.10 billion.

Operations: Cairn Homes generates revenue primarily from building and property development, amounting to €813.40 million.

Cairn Homes, a notable player in the UK market, has shown impressive performance with earnings rising 49.5% over the past year, outpacing its industry. The company trades at a favorable price-to-earnings ratio of 11.8x compared to the broader UK market's 16.3x, suggesting value potential. Its net debt to equity ratio stands at a satisfactory 20.7%, indicating prudent financial management. Recent buybacks totaling €70 million underscore confidence in its future trajectory and value proposition for investors.

- Take a closer look at Cairn Homes' potential here in our health report.

Examine Cairn Homes' past performance report to understand how it has performed in the past.

Senior (LSE:SNR)

Simply Wall St Value Rating: ★★★★★☆

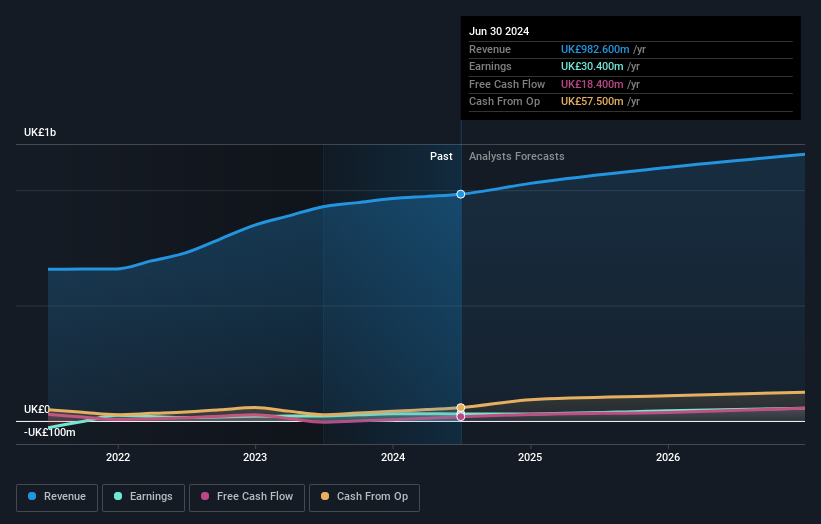

Overview: Senior plc designs, manufactures, and sells high-technology components and systems for major original equipment manufacturers across aerospace, defense, land vehicle, and power and energy markets globally; the company has a market cap of approximately £551.24 million.

Operations: Senior plc generates revenue primarily from its Aerospace segment, contributing £651.10 million, and its Flexonics segment, adding £333 million.

Senior plc, a notable player in the aerospace sector, showcases robust earnings growth of 40.1% over the past year, outpacing industry norms. Trading at 37.3% below its estimated fair value suggests attractive valuation prospects. Despite an increase in debt to equity ratio from 35.5% to 42.4% over five years, its net debt to equity remains satisfactory at 34.4%. Recent contract wins with Deutsche Aircraft and Rolls-Royce highlight strategic partnerships enhancing future growth potential.

- Unlock comprehensive insights into our analysis of Senior stock in this health report.

Gain insights into Senior's past trends and performance with our Past report.

Next Steps

- Dive into all 84 of the UK Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal