Exploring High Growth Tech Stocks In The UK October 2024

Over the last 7 days, the United Kingdom market has remained flat, but it is up 6.5% over the past year with earnings forecasted to grow by 14% annually. In this context of steady growth, identifying high growth tech stocks involves looking for companies with strong innovation potential and robust financial health that align with these positive market trends.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| Oxford Biomedica | 21.00% | 98.44% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

YouGov (AIM:YOU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: YouGov plc is a company that offers online market research services across regions including the United Kingdom, the United States, the Middle East, Mainland Europe, and the Asia Pacific with a market cap of £485.74 million.

Operations: The company generates revenue primarily from Data Products, contributing £85.10 million. Segment Adjustment accounts for an additional £181.70 million in revenue.

YouGov, navigating the competitive landscape of high-growth tech in the UK, has demonstrated a robust trajectory with an expected revenue growth of 14.3% per year, outpacing the broader UK market's average of 3.5%. Despite a challenging past with earnings declining by 15.3% over the last year, future prospects appear brighter with earnings forecasted to surge by 29.8% annually. The appointment of Marc Ryan as Chief Product Officer signals strategic enhancements to their product suite, potentially bolstering YouGov's position in audience intelligence and brand tracking sectors. This move coincides with an upward revision in annual revenue projections to £327-330 million, reflecting confidence in their operational adjustments and market strategy adaptations amidst volatile conditions.

- Unlock comprehensive insights into our analysis of YouGov stock in this health report.

Explore historical data to track YouGov's performance over time in our Past section.

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc is an international company that specializes in events, digital services, and academic research across various regions including the United Kingdom, Continental Europe, the United States, and China; it has a market capitalization of approximately £10.90 billion.

Operations: Informa generates revenue through its diverse segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million).

Despite facing a challenging year with earnings down by 11.3%, Informa's strategic moves indicate a potential rebound, underscored by its forecasted annual earnings growth of 22.5%. The company has also been active in enhancing its event and digital business segments, as evidenced by the recent acquisition aimed at expanding its luxury and lifestyle event portfolio. Additionally, Informa's commitment to innovation is reflected in its R&D spending, crucial for staying competitive in the high-growth tech landscape of the UK. With revenue growth anticipated at 6.9% annually—outpacing the broader market—Informa seems poised to leverage its enhanced offerings and strategic partnerships for future growth.

- Take a closer look at Informa's potential here in our health report.

Examine Informa's past performance report to understand how it has performed in the past.

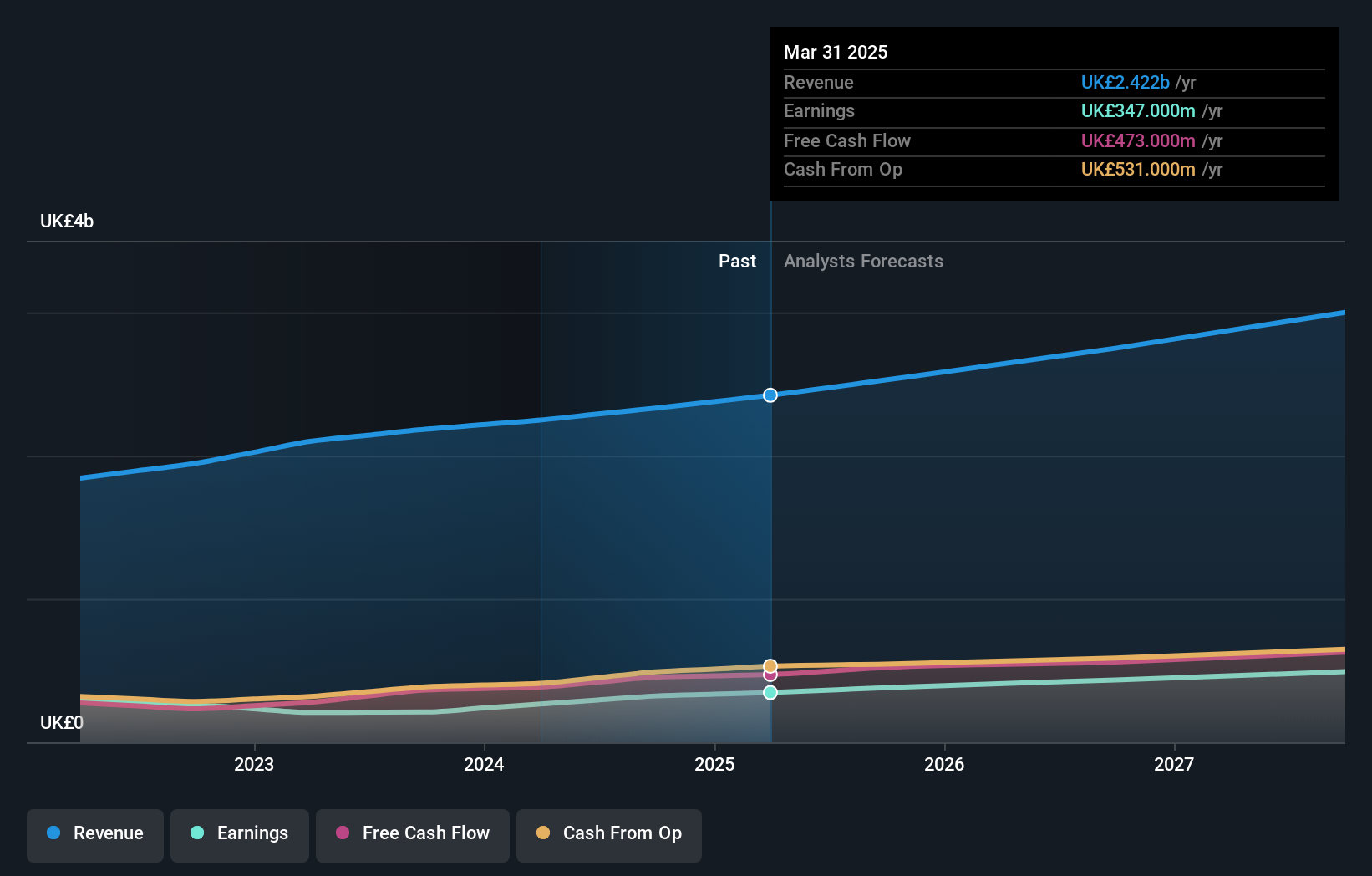

Sage Group (LSE:SGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Sage Group plc, along with its subsidiaries, offers technology solutions and services tailored for small and medium businesses across the United States, the United Kingdom, France, and other international markets, with a market cap of £10.09 billion.

Operations: Sage Group generates revenue primarily from its operations in North America (£1.01 billion), Europe (£595 million), and the United Kingdom & Ireland (£488 million). The company focuses on providing technology solutions and services to small and medium-sized businesses across these regions.

Sage Group, amid executive shifts and strategic partnerships, is navigating a dynamic landscape with a 9% revenue uptick in Q3 2024 to £585 million, signaling robust engagement with its Sage Business Cloud. This performance dovetails with a reiteration of full-year guidance projecting consistent organic growth. Notably, the integration of VoPay's payment technology enhances Sage's payroll solutions, addressing efficiency bottlenecks for SMBs—a move that not only streamlines operations but also fortifies client reliance on Sage’s platforms. With R&D expenses aligning closely with these innovations and an earnings forecast promising an annual increase of 15.1%, Sage is reinforcing its market position by capitalizing on technological advancements and customer-centric solutions.

Make It Happen

- Explore the 47 names from our UK High Growth Tech and AI Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal