Ocado Group (LON:OCDO shareholders incur further losses as stock declines 6.4% this week, taking three-year losses to 79%

Ocado Group plc (LON:OCDO) shareholders should be happy to see the share price up 12% in the last month. But that is meagre solace in the face of the shocking decline over three years. Indeed, the share price is down a whopping 79% in the last three years. Arguably, the recent bounce is to be expected after such a bad drop. The thing to think about is whether the business has really turned around.

After losing 6.4% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Ocado Group

Ocado Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

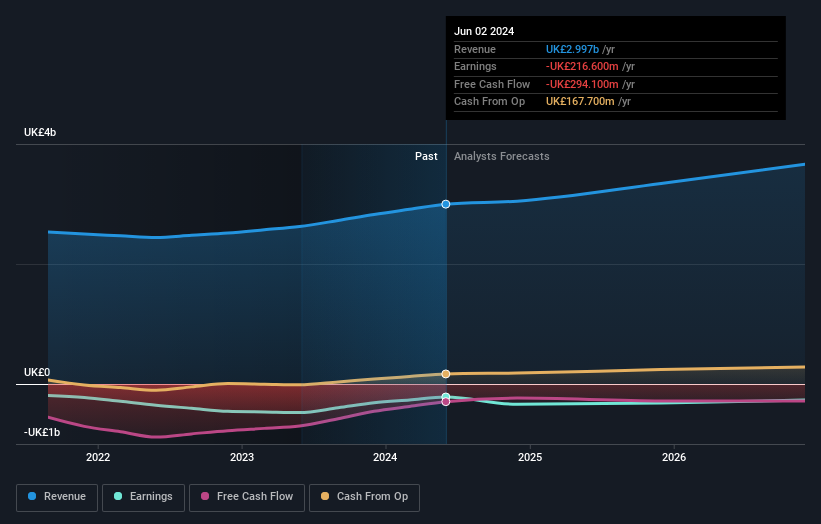

Over three years, Ocado Group grew revenue at 5.9% per year. That's not a very high growth rate considering it doesn't make profits. Nonetheless, it's fair to say the rapidly declining share price (down 22%, compound, over three years) suggests the market is very disappointed with this level of growth. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. Before considering a purchase, take a look at the losses the company is racking up.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Ocado Group will earn in the future (free profit forecasts).

A Different Perspective

Ocado Group shareholders are down 27% for the year, but the market itself is up 11%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Ocado Group better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Ocado Group you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal