3 Chinese Growth Stocks With Up To 33% Insider Ownership

As Chinese equities experienced a decline over a holiday-shortened week, concerns about the effectiveness of Beijing's stimulus measures have come to the forefront. Despite these challenges, insider ownership can be an encouraging sign for investors seeking growth opportunities, as it often indicates that company executives are confident in their business's potential and aligned with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Jiayou International LogisticsLtd (SHSE:603871) | 20.6% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 38.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| UTour Group (SZSE:002707) | 22.8% | 28.7% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Let's uncover some gems from our specialized screener.

Shanghai Lily&Beauty CosmeticsLtd (SHSE:605136)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Lily&Beauty Cosmetics Co., Ltd. operates in China, offering online cosmetics marketing and retailing services with a market cap of CN¥2.86 billion.

Operations: Shanghai Lily&Beauty Cosmetics Co., Ltd. generates revenue through its online marketing and retailing services in the cosmetics sector within China.

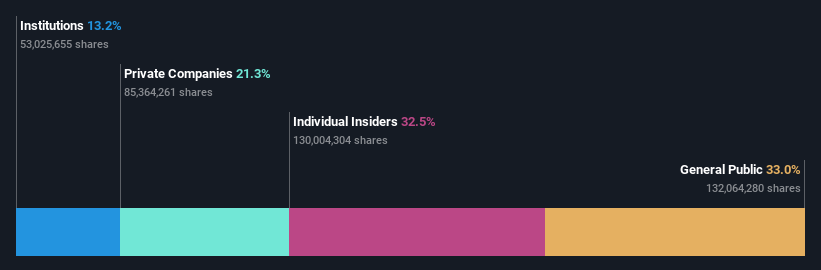

Insider Ownership: 32.5%

Shanghai Lily&Beauty Cosmetics Ltd. has demonstrated significant earnings growth potential, with forecasts indicating a 52.7% annual increase over the next three years, outpacing the Chinese market's average. Despite recent revenue declines to ¥966.13 million from ¥1.44 billion year-on-year, it became profitable this year with net income of ¥2.69 million compared to a loss previously. The stock trades at a substantial discount to its estimated fair value, although insider trading activity remains unreported recently.

- Dive into the specifics of Shanghai Lily&Beauty CosmeticsLtd here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Shanghai Lily&Beauty CosmeticsLtd's current price could be inflated.

BeijingABT NetworksLtd (SHSE:688168)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BeijingABT Networks Co., Ltd. develops and provides visualized network security technology solutions in China, with a market cap of CN¥2.71 billion.

Operations: The company's revenue is primarily derived from its network security segment, totaling CN¥592.45 million.

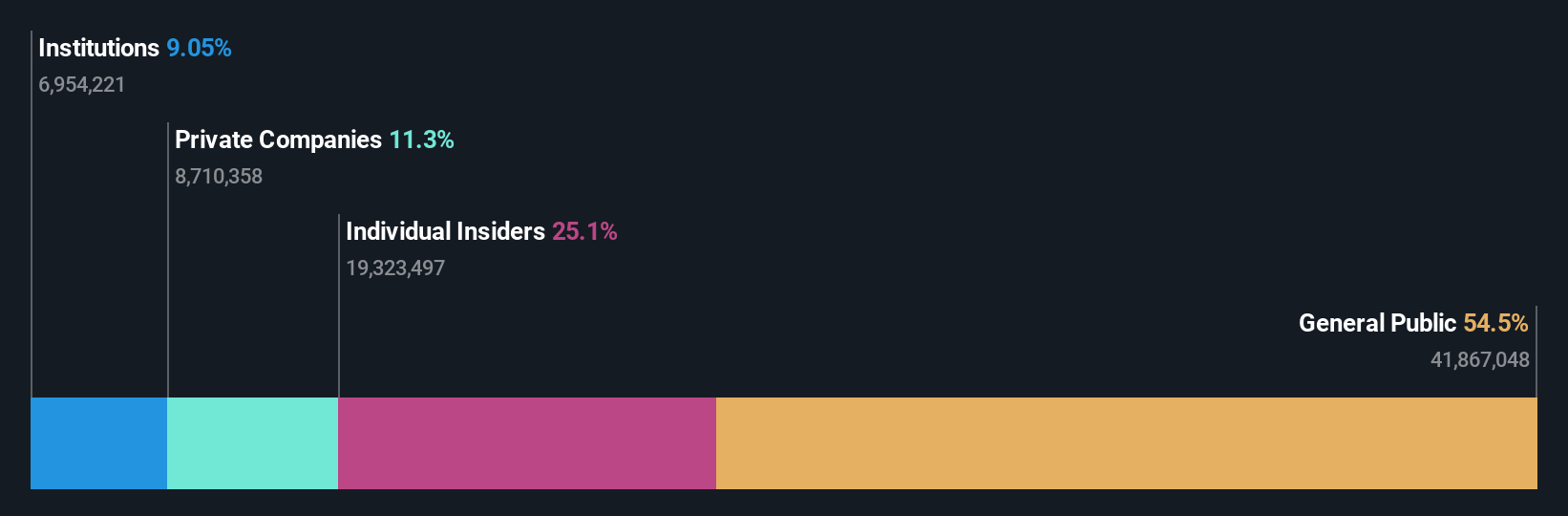

Insider Ownership: 25.6%

BeijingABT Networks Ltd. is poised for significant growth, with earnings expected to increase 44.79% annually over the next three years, surpassing the Chinese market average. The company's revenue is also forecasted to grow by 20.9% per year, outpacing the market's 13.2%. Recent financials show improved performance with sales rising to CNY 191.26 million and a reduced net loss of CNY 61.31 million for H1 2024, though insider trading data remains unavailable recently.

- Get an in-depth perspective on BeijingABT NetworksLtd's performance by reading our analyst estimates report here.

- Our valuation report here indicates BeijingABT NetworksLtd may be overvalued.

Sichuan Chuanhuan TechnologyLtd (SZSE:300547)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Chuanhuan Technology Co., Ltd. focuses on the research, development, production, and sale of automotive rubber hose series products in China and has a market cap of CN¥4.04 billion.

Operations: The company's revenue primarily comes from its Non-Tire Rubber Products segment, which generated CN¥1.29 billion.

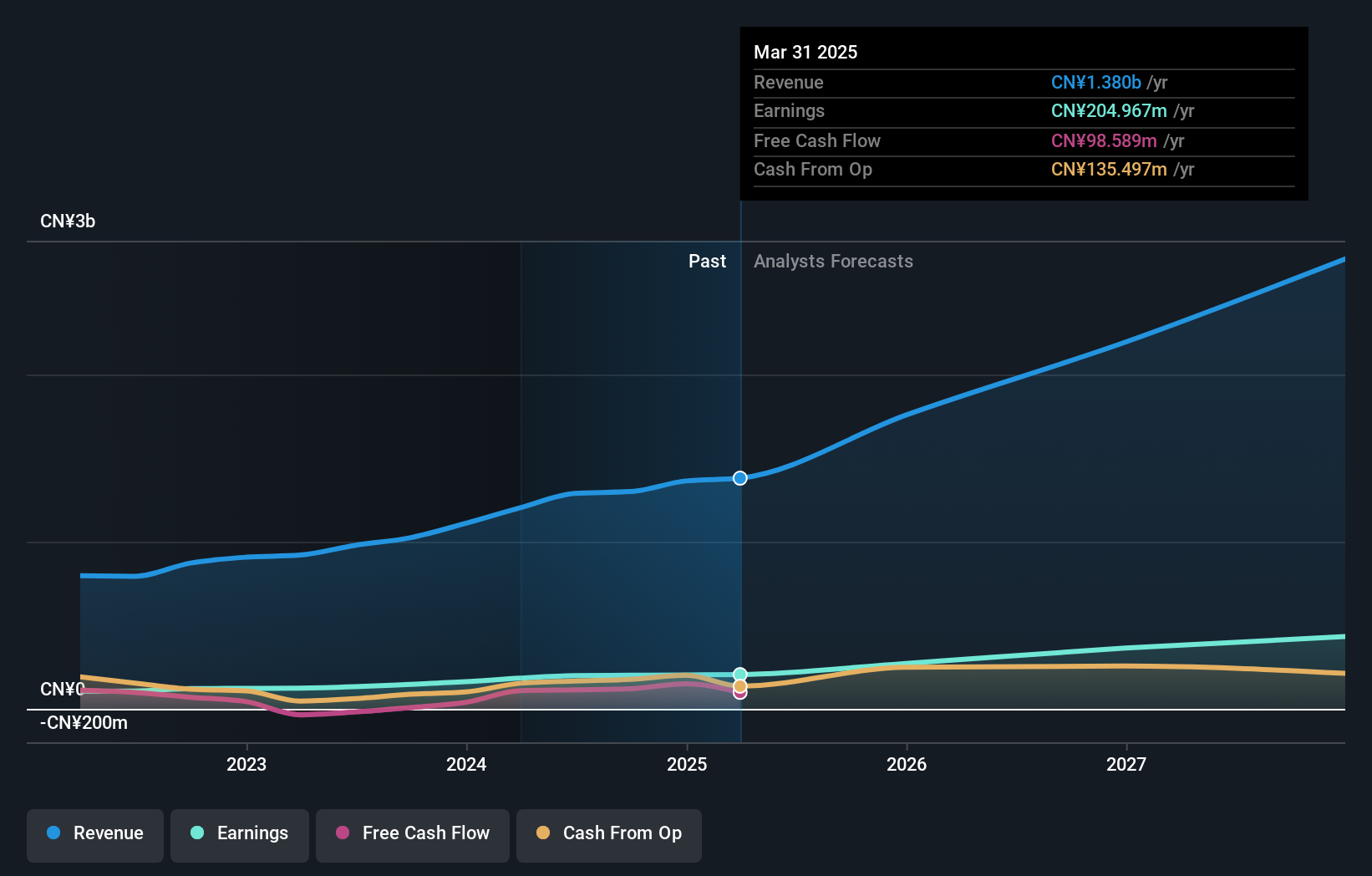

Insider Ownership: 33.9%

Sichuan Chuanhuan Technology Ltd. demonstrates robust growth potential, with earnings rising by 50.6% over the past year and forecasted to grow significantly at 20.7% annually, though slightly below the market average. Revenue is expected to increase at 19.2% per year, surpassing the broader market's growth rate of 13.2%. Recent earnings show substantial improvement with net income reaching CNY 98.36 million for H1 2024, despite a volatile share price and an unstable dividend history.

- Click to explore a detailed breakdown of our findings in Sichuan Chuanhuan TechnologyLtd's earnings growth report.

- Our valuation report unveils the possibility Sichuan Chuanhuan TechnologyLtd's shares may be trading at a premium.

Make It Happen

- Navigate through the entire inventory of 381 Fast Growing Chinese Companies With High Insider Ownership here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal