Exploring Koshidaka Holdings And 2 Other Undiscovered Gems In Japan

As Japan's stock markets experience a rise, with the Nikkei 225 Index gaining 2.45% and the broader TOPIX Index up 0.45%, investors are keenly observing how yen weakness might boost profits for exporters amid shifting economic conditions. In this dynamic environment, identifying promising small-cap stocks like Koshidaka Holdings can offer unique opportunities, particularly when these companies demonstrate resilience and potential for growth within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Intelligent Wave | NA | 6.92% | 15.18% | ★★★★★★ |

| Nitto Fuji Flour MillingLtd | 0.80% | 6.26% | 4.41% | ★★★★★★ |

| Otec | 9.81% | 2.32% | -1.39% | ★★★★★★ |

| HeadwatersLtd | NA | 19.26% | 23.89% | ★★★★★★ |

| Kondotec | 11.75% | 6.85% | 2.62% | ★★★★★☆ |

| Innotech | 38.96% | 7.08% | 6.36% | ★★★★★☆ |

| Imuraya Group | 26.21% | 2.37% | 32.09% | ★★★★★☆ |

| GENOVA | 0.93% | 33.82% | 30.22% | ★★★★☆☆ |

| Ogaki Kyoritsu Bank | 139.93% | 2.20% | -0.27% | ★★★★☆☆ |

| Nippon Sharyo | 61.34% | -1.68% | -17.07% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

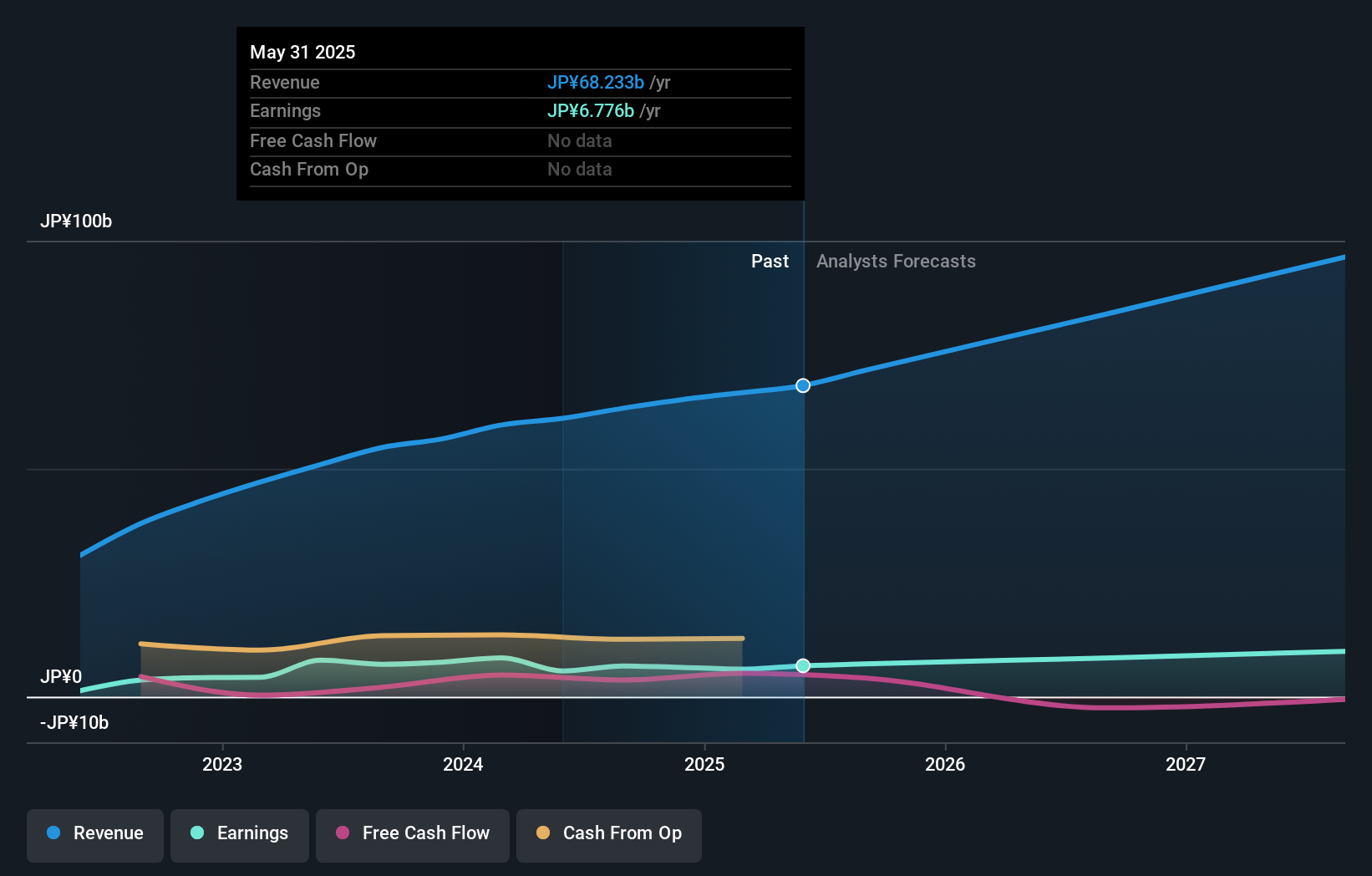

Koshidaka Holdings (TSE:2157)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Koshidaka Holdings Co., Ltd. operates a karaoke and bath house business both in Japan and internationally, with a market capitalization of approximately ¥95.03 billion.

Operations: Koshidaka Holdings generates revenue primarily from its karaoke business, which contributes ¥61.25 billion, and also engages in real estate management with a revenue of ¥1.59 billion.

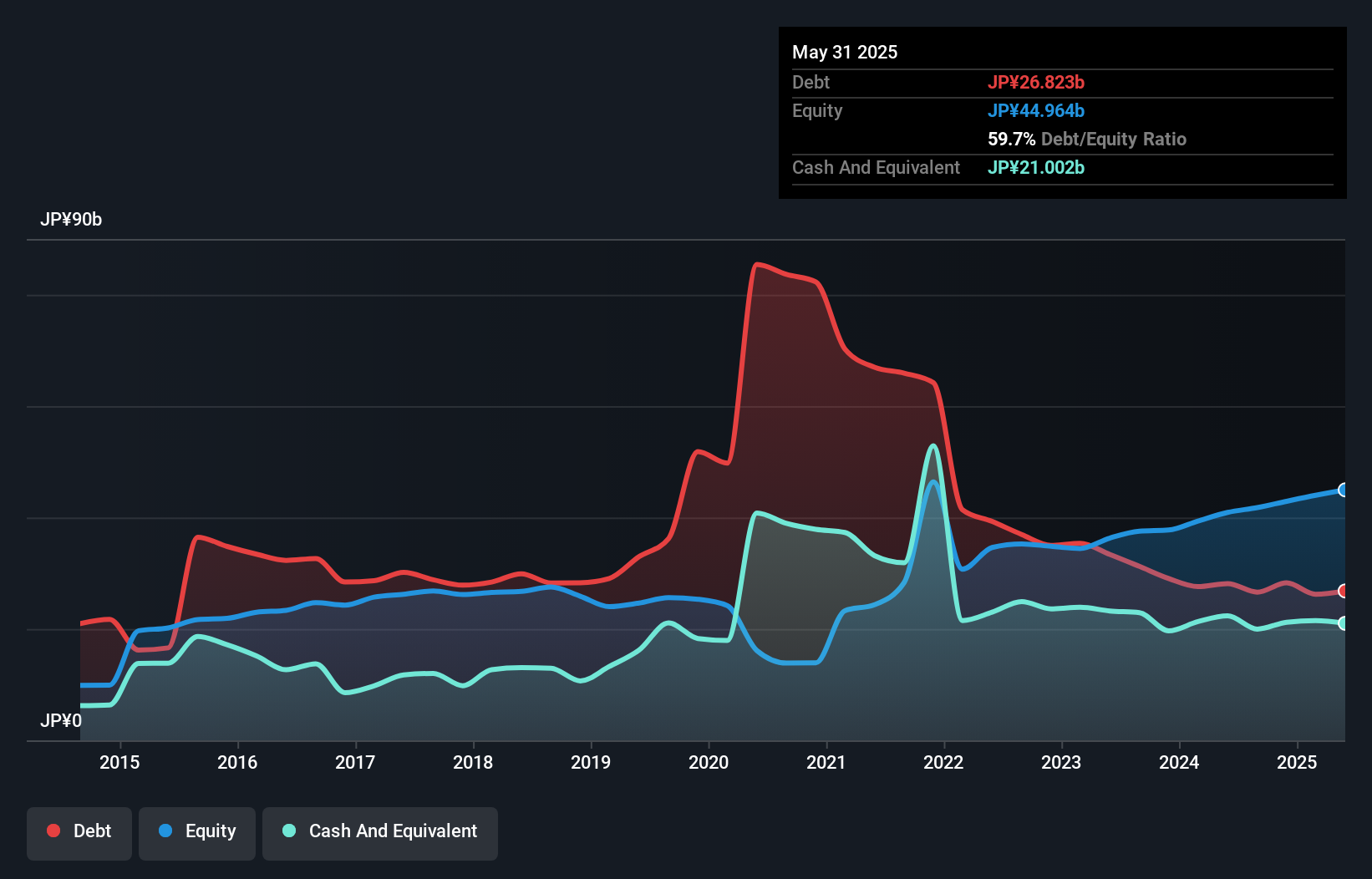

Koshidaka Holdings, a notable player in the karaoke industry, offers an attractive profile with a price-to-earnings ratio of 14.1x, undercutting the hospitality sector's average of 21.9x. Over five years, its debt to equity ratio impressively decreased from 69.9% to 37.7%, while maintaining a satisfactory net debt to equity ratio at 15.4%. Despite recent earnings growth challenges at -5.2%, it projects an optimistic annual growth forecast of 6.5%.

- Unlock comprehensive insights into our analysis of Koshidaka Holdings stock in this health report.

Gain insights into Koshidaka Holdings' past trends and performance with our Past report.

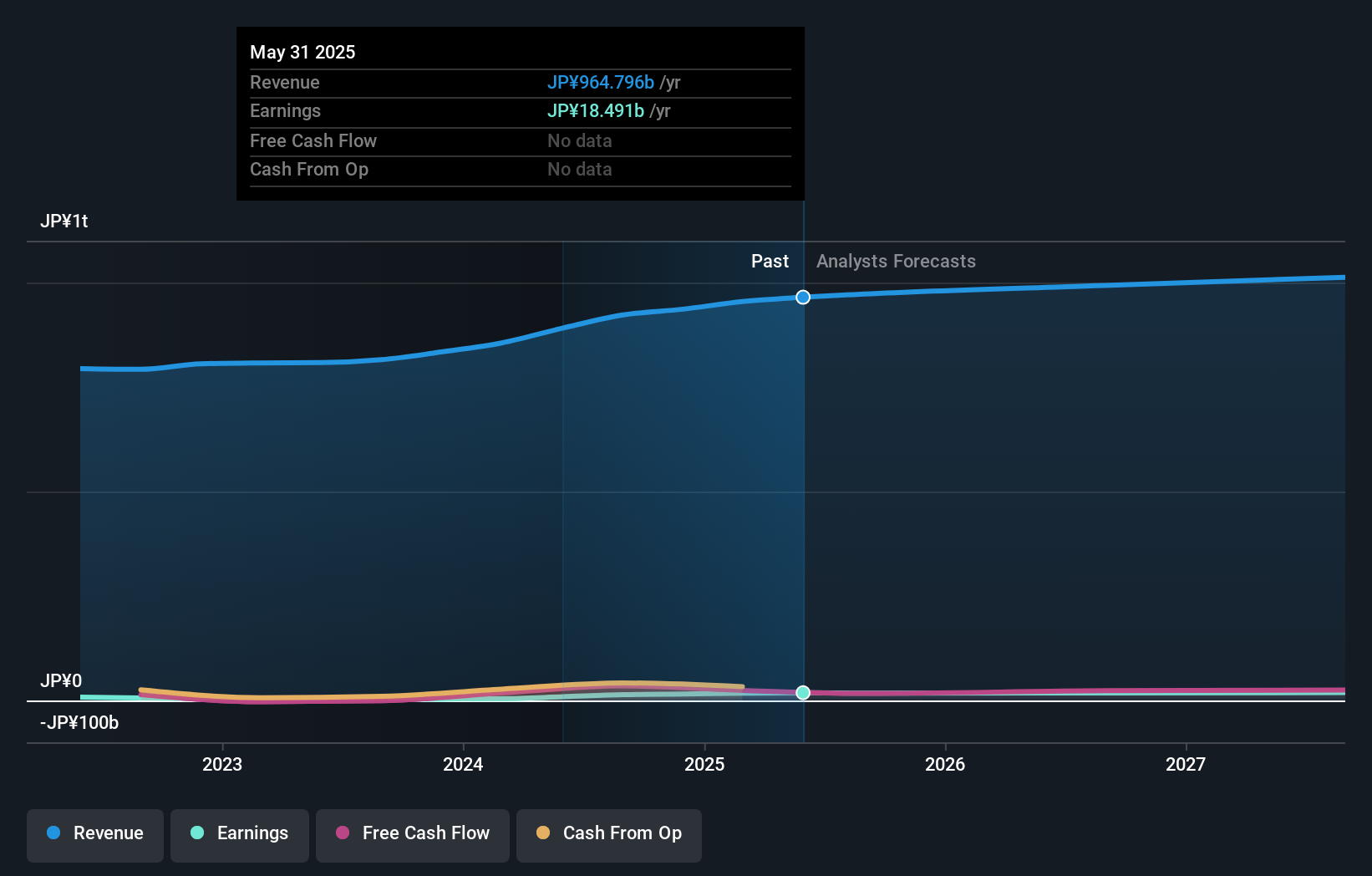

Bic Camera (TSE:3048)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bic Camera Inc., along with its subsidiaries, is involved in the manufacture and sale of audiovisual products in Japan, with a market capitalization of approximately ¥294.78 billion.

Operations: Bic Camera generates revenue primarily from the sale of audiovisual products in Japan. The company's financial performance is highlighted by a market capitalization of approximately ¥294.78 billion.

Bic Camera, a promising player in Japan's retail sector, recently reported a significant ¥5.4 billion one-off loss impacting its financials up to May 2024. Despite this setback, the company has shown impressive earnings growth of 299% over the past year, outpacing the industry average of 5%. Trading slightly below its estimated fair value by 0.7%, Bic Camera maintains a satisfactory net debt to equity ratio of 26.7%, indicating prudent financial management and potential for future growth.

create restaurants holdings (TSE:3387)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Create Restaurants Holdings Inc. is involved in planning, developing, and managing food courts, izakaya bars, dinner-time restaurants, and bakeries in Japan with a market cap of ¥237.31 billion.

Operations: The company generates revenue through its diverse portfolio of food courts, izakaya bars, dinner-time restaurants, and bakeries across Japan. It focuses on optimizing its cost structure to enhance profitability. The financial performance is influenced by the efficient management of operational expenses and strategic expansion initiatives.

Create Restaurants Holdings, a dynamic player in Japan's hospitality sector, has demonstrated impressive growth with earnings surging 78.5% last year, outpacing the industry average of 26.2%. The company is trading at 53.7% below its estimated fair value and maintains a satisfactory net debt to equity ratio of 15.9%. Recently, it announced an interim dividend increase to JPY 4 per share and revised revenue guidance to JPY 156 billion due to strategic acquisitions set for consolidation this fiscal year.

Next Steps

- Navigate through the entire inventory of 730 Japanese Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal