3 Euronext Paris Stocks Estimated To Be Undervalued By Up To 42.7%

As the European markets show signs of optimism, with the CAC 40 Index experiencing modest gains amid expectations of potential interest rate cuts by the European Central Bank, investors are increasingly on the lookout for opportunities within France's equity landscape. In this context, identifying undervalued stocks can be particularly appealing as they may offer potential value in a market environment where economic stimuli and monetary policy adjustments are anticipated.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SPIE (ENXTPA:SPIE) | €35.18 | €53.99 | 34.8% |

| NSE (ENXTPA:ALNSE) | €29.80 | €57.40 | 48.1% |

| Vivendi (ENXTPA:VIV) | €10.27 | €17.93 | 42.7% |

| Lectra (ENXTPA:LSS) | €27.80 | €53.01 | 47.6% |

| Groupe Berkem Société anonyme (ENXTPA:ALKEM) | €3.08 | €5.09 | 39.5% |

| EKINOPS (ENXTPA:EKI) | €3.84 | €6.65 | 42.2% |

| Solutions 30 (ENXTPA:S30) | €1.191 | €2.34 | 49% |

| Vogo (ENXTPA:ALVGO) | €3.25 | €6.27 | 48.2% |

| Exail Technologies (ENXTPA:EXA) | €17.32 | €29.45 | 41.2% |

| OVH Groupe (ENXTPA:OVH) | €6.75 | €11.96 | 43.6% |

Let's review some notable picks from our screened stocks.

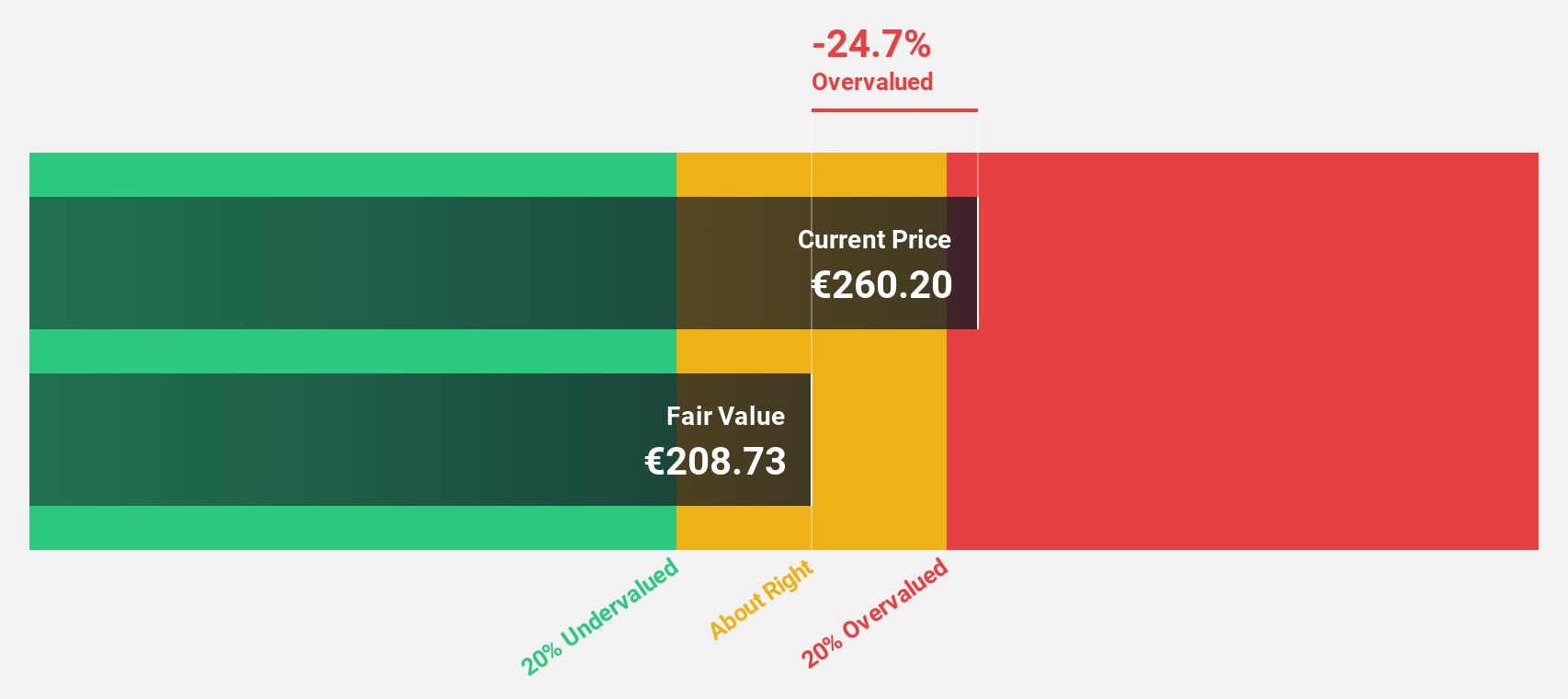

Safran (ENXTPA:SAF)

Overview: Safran SA, along with its subsidiaries, operates in the aerospace and defense sectors globally, with a market capitalization of approximately €87.61 billion.

Operations: The company's revenue is primarily derived from Aerospace Propulsion (€12.66 billion), Aeronautical Equipment, Defense and Aerosystems (€9.91 billion), and Aircraft Interiors (€2.73 billion).

Estimated Discount To Fair Value: 27.6%

Safran is trading at €208.4, significantly below its estimated fair value of €287.9, suggesting undervaluation based on cash flows. Despite a challenging year with net income dropping to €57 million from €1.86 billion, revenue grew to €13.41 billion from €11.36 billion year-over-year for H1 2024. With forecasted earnings growth of 19.5% annually and expected revenue growth outpacing the French market, Safran presents potential long-term value despite recent profit margin declines.

- Upon reviewing our latest growth report, Safran's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Safran stock in this financial health report.

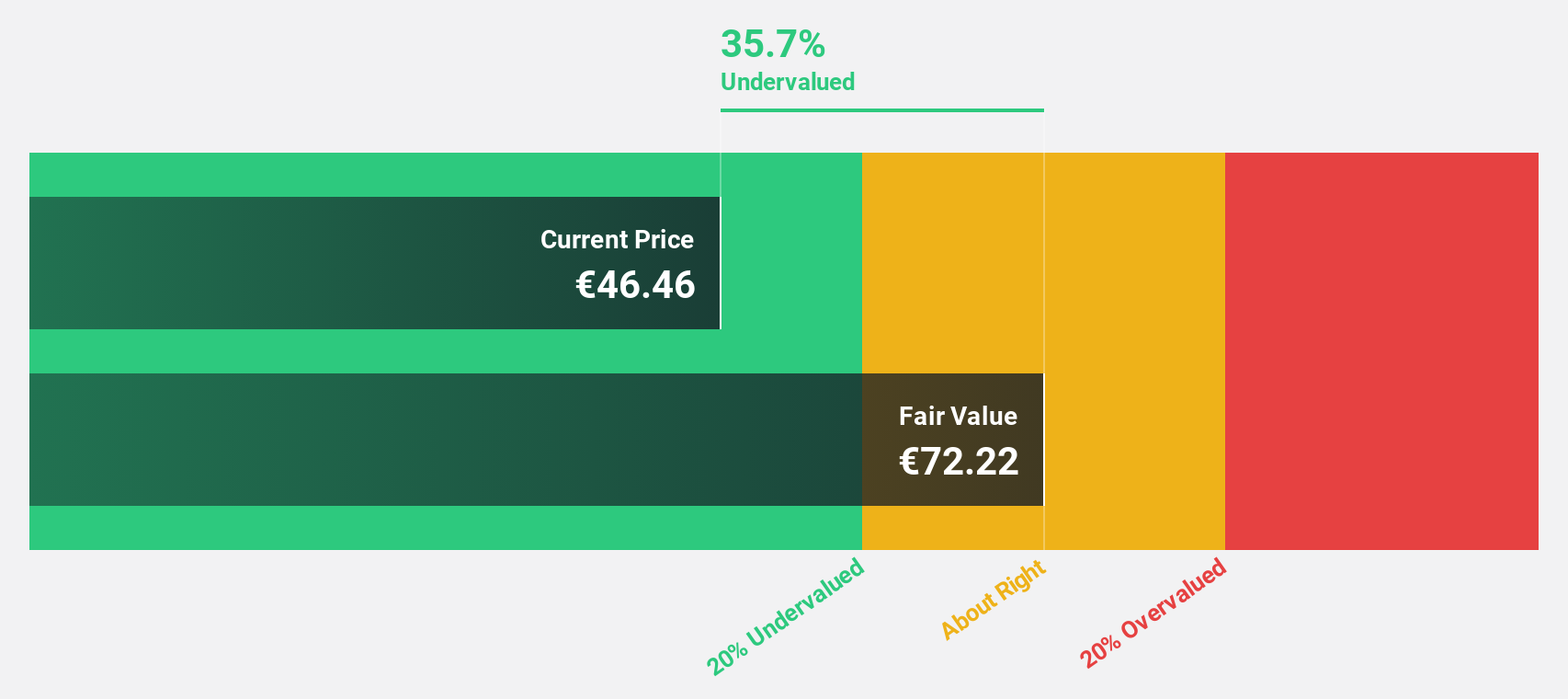

SPIE (ENXTPA:SPIE)

Overview: SPIE SA offers multi-technical services in energy and communications across France, Germany, the Netherlands, and internationally, with a market cap of €5.87 billion.

Operations: The company's revenue segments include North-Western Europe, generating €1.89 billion, and Global Services Energy, contributing €684.90 million.

Estimated Discount To Fair Value: 34.8%

SPIE is trading at €35.18, below its estimated fair value of €53.99, highlighting potential undervaluation based on cash flows. Despite a high debt level and unstable dividend history, earnings are expected to grow 20% annually over the next three years, outpacing the French market's 12.1%. Recent H1 2024 results showed sales increased to €4.66 billion from €4.13 billion year-over-year, although net income decreased to €56.75 million from €73.17 million due to large one-off items impacting results.

- The analysis detailed in our SPIE growth report hints at robust future financial performance.

- Take a closer look at SPIE's balance sheet health here in our report.

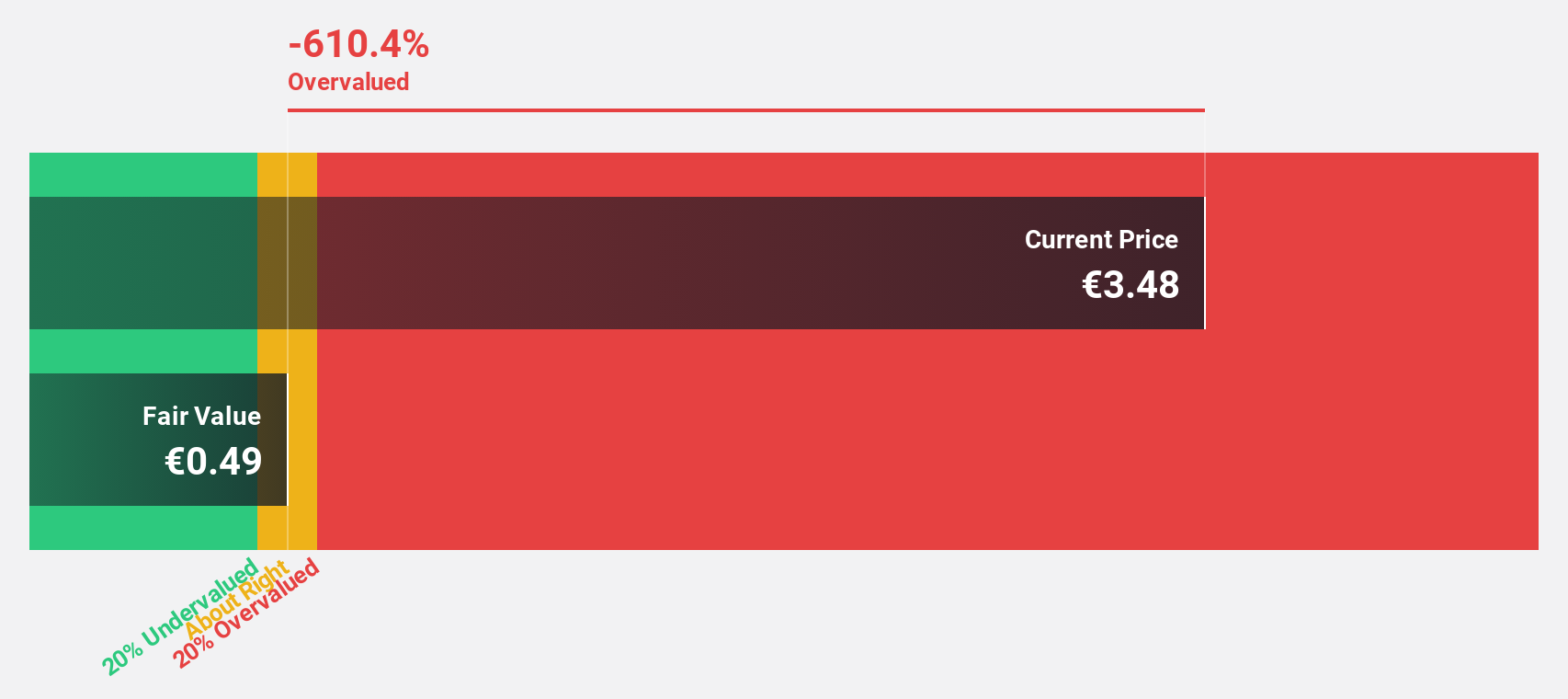

Vivendi (ENXTPA:VIV)

Overview: Vivendi SE is a global entertainment, media, and communication company operating across France, Europe, the Americas, Asia/Oceania, and Africa with a market cap of approximately €10.35 billion.

Operations: The company's revenue is primarily generated from Canal + Group (€6.20 billion), Havas Group (€2.92 billion), Gameloft (€304 million), Prisma Media (€303 million), Vivendi Village (€151 million), and New Initiatives (€176 million).

Estimated Discount To Fair Value: 42.7%

Vivendi is trading at €10.27, significantly below its estimated fair value of €17.93, indicating potential undervaluation based on cash flows. Despite an unstable dividend history, earnings are forecast to grow 30.6% annually over the next three years, surpassing the French market's 12.1% growth rate. Recent H1 2024 results showed sales increased to €9 billion from €4.7 billion year-over-year, though net income slightly declined to €159 million from €174 million due to operational challenges.

- According our earnings growth report, there's an indication that Vivendi might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Vivendi.

Seize The Opportunity

- Delve into our full catalog of 20 Undervalued Euronext Paris Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal