Exploring Switzerland's Undiscovered Gems for October 2024

The Switzerland market recently experienced a modest decline, with the SMI index ending down 0.33% as investors processed regional economic data and awaited the European Central Bank's monetary policy announcement. In this environment of fluctuating indices and cautious sentiment, identifying stocks that demonstrate resilience and potential for growth can be particularly valuable, making it an opportune time to explore some of Switzerland's lesser-known yet promising companies.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| IVF Hartmann Holding | NA | 0.24% | 0.63% | ★★★★★★ |

| TX Group | 0.93% | -1.67% | 7.21% | ★★★★★★ |

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 47.15% | 1.91% | 11.44% | ★★★★★☆ |

| Vaudoise Assurances Holding | NA | 1.52% | 1.85% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Burkhalter Holding (SWX:BRKN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Burkhalter Holding AG, with a market cap of CHF972.32 million, operates through its subsidiaries to deliver electrical engineering services to the construction sector in Switzerland.

Operations: With revenue of CHF1.18 billion from electrical engineering services, Burkhalter Holding AG focuses on the construction sector in Switzerland.

Burkhalter Holding, a notable player in Switzerland's construction sector, has displayed solid financial performance with earnings growth of 10.3% over the past year, outpacing the industry average of 8.7%. The company reported a revenue increase to CHF 570.3 million for the first half of 2024 and net income rose to CHF 23.3 million. Despite being dropped from the S&P Global BMI Index recently, Burkhalter's earnings per share improved to CHF 2.19 from CHF 2.04 last year, indicating resilience amidst challenges like its high net debt-to-equity ratio of 52.9%.

- Navigate through the intricacies of Burkhalter Holding with our comprehensive health report here.

Assess Burkhalter Holding's past performance with our detailed historical performance reports.

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA operates as an interdealer broker of financial and non-financial products worldwide, with a market cap of CHF 1.25 billion.

Operations: The company generates revenue primarily from three regions: Europe, Middle East and Africa (CHF 452.85 million), Americas (CHF 352.67 million), and Asia-Pacific (CHF 273.16 million). The net profit margin reflects the company's profitability after accounting for all expenses, taxes, and costs associated with its operations.

Compagnie Financière Tradition, a Swiss financial entity, showcases robust performance with earnings growth of 16.1% over the past year, outpacing the Capital Markets industry by a significant margin. The debt-to-equity ratio has impressively decreased from 75.7% to 47.1% in five years, indicating improved financial health. Recent half-year results revealed revenue of CHF 538 million and net income climbing to CHF 60 million from CHF 51 million last year, reflecting strong operational momentum despite shareholder dilution concerns.

V-ZUG Holding (SWX:VZUG)

Simply Wall St Value Rating: ★★★★★★

Overview: V-ZUG Holding AG specializes in the development, manufacture, marketing, sale, and servicing of kitchen and laundry appliances for private households both in Switzerland and internationally, with a market capitalization of CHF366.43 million.

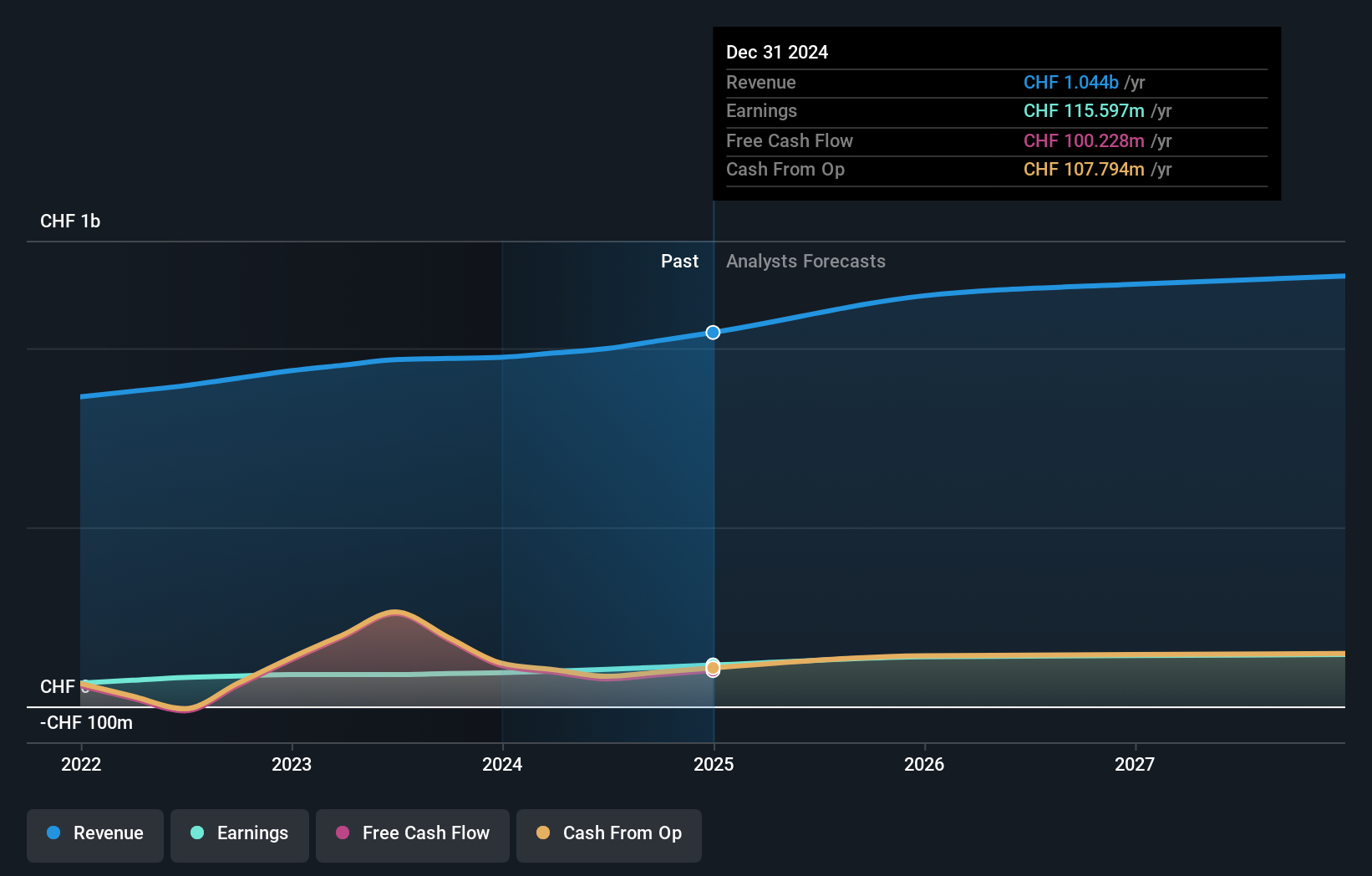

Operations: V-ZUG Holding AG generates revenue primarily from its Household Appliances segment, which contributed CHF571.35 million.

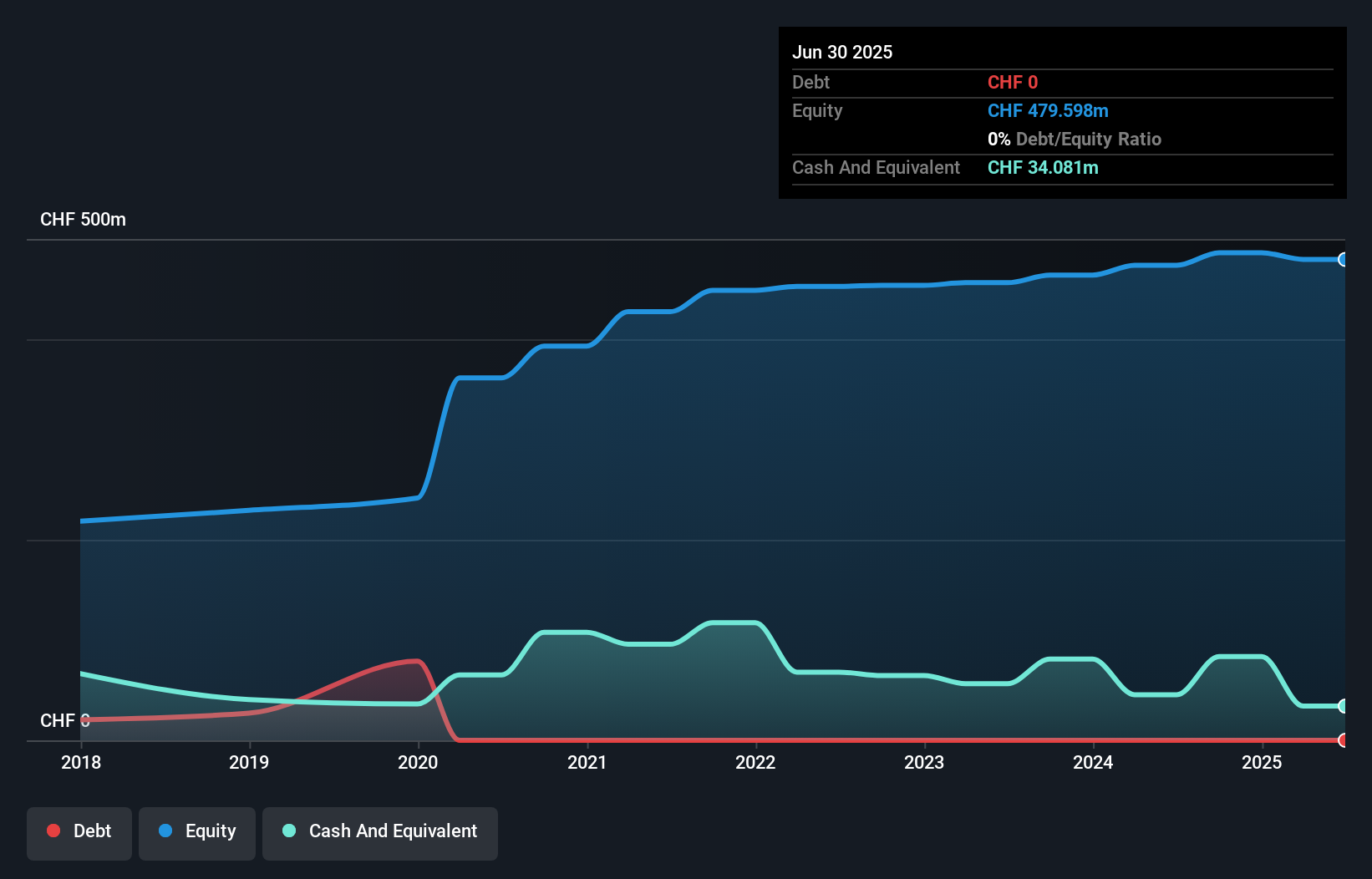

V-ZUG stands out with its robust financial health, being entirely debt-free compared to five years ago when its debt-to-equity ratio was 22.4%. Despite a dip in sales from CHF 298.15 million to CHF 284.08 million for the half year ending June 2024, net income impressively rose from CHF 4.33 million to CHF 8.73 million, doubling basic earnings per share from CHF 0.67 to CHF 1.36. Trading at a significant discount of about 81% below estimated fair value, V-ZUG's earnings growth of over 89% last year notably surpasses industry averages and forecasts suggest continued strong growth at around nearly four times the industry rate annually going forward.

- Click here to discover the nuances of V-ZUG Holding with our detailed analytical health report.

Evaluate V-ZUG Holding's historical performance by accessing our past performance report.

Summing It All Up

- Investigate our full lineup of 18 SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal