Investors Don't See Light At End Of Geratherm Medical AG's (ETR:GME) Tunnel And Push Stock Down 26%

Geratherm Medical AG (ETR:GME) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 41% share price drop.

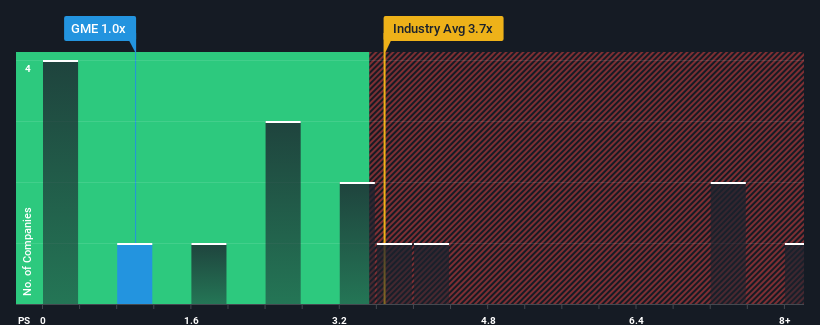

Since its price has dipped substantially, considering around half the companies operating in Germany's Medical Equipment industry have price-to-sales ratios (or "P/S") above 2.4x, you may consider Geratherm Medical as an solid investment opportunity with its 1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Geratherm Medical

What Does Geratherm Medical's Recent Performance Look Like?

Geratherm Medical hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Geratherm Medical will help you uncover what's on the horizon.How Is Geratherm Medical's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Geratherm Medical's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 29%. As a result, revenue from three years ago have also fallen 32% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 2.8% per annum during the coming three years according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 6.5% each year, which is noticeably more attractive.

With this in consideration, its clear as to why Geratherm Medical's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Geratherm Medical's P/S Mean For Investors?

Geratherm Medical's recently weak share price has pulled its P/S back below other Medical Equipment companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Geratherm Medical's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Geratherm Medical (1 is a bit unpleasant!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal