ASX Growth Stocks With High Insider Confidence For October 2024

As the Australian market faces a potential dip with ASX200 futures indicating a reversal of recent gains, investors are closely watching global influences such as tempered expectations for AI demand and fluctuating commodity prices. In this environment, growth companies with high insider ownership can signal strong internal confidence and may offer appealing prospects for those looking to navigate these uncertain times.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| Catalyst Metals (ASX:CYL) | 17% | 45.8% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Liontown Resources (ASX:LTR) | 14.7% | 61% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.2% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Pointerra (ASX:3DP) | 20.1% | 126.4% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Here we highlight a subset of our preferred stocks from the screener.

Emerald Resources (ASX:EMR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.73 billion.

Operations: The company generates revenue primarily from its mine operations, amounting to A$366.04 million.

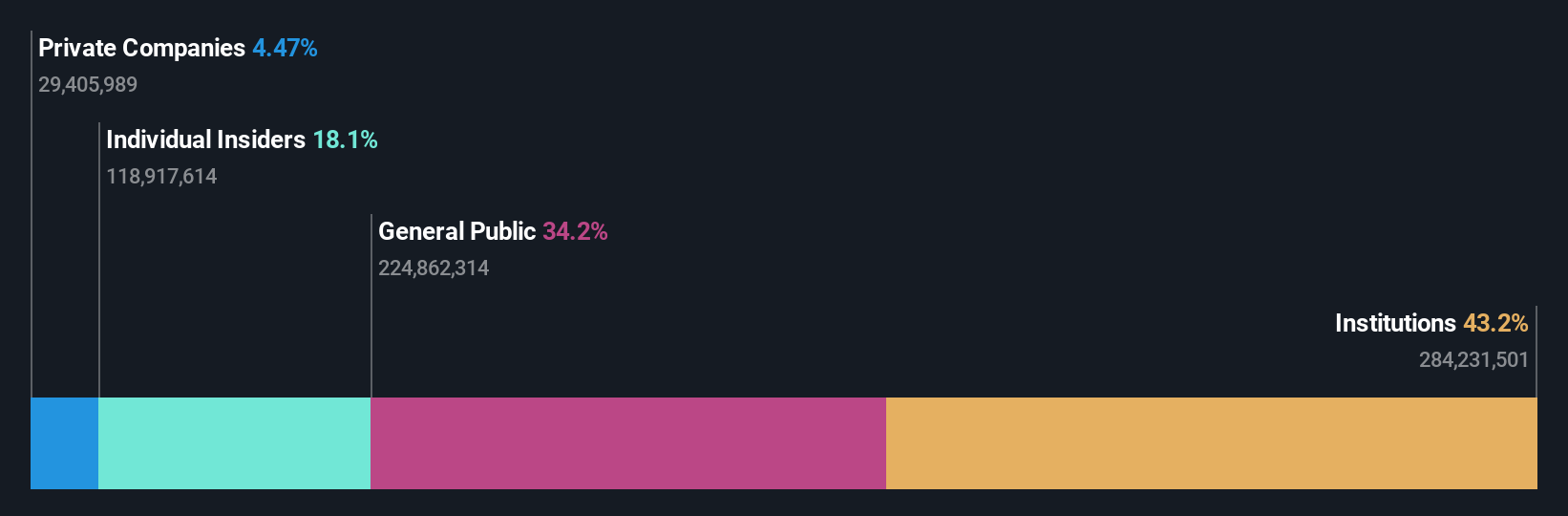

Insider Ownership: 18%

Emerald Resources has demonstrated robust financial growth, with recent earnings increasing to A$84.27 million from A$59.36 million year-on-year, and revenue reaching A$371.07 million. Despite past shareholder dilution, its forecasted revenue growth of 35.2% annually surpasses the Australian market average significantly. However, insider ownership dynamics may shift following the retirement of influential board member Simon Lee AO in November 2024, who has been pivotal in the company's strategic direction and development into a gold producer.

- Delve into the full analysis future growth report here for a deeper understanding of Emerald Resources.

- In light of our recent valuation report, it seems possible that Emerald Resources is trading beyond its estimated value.

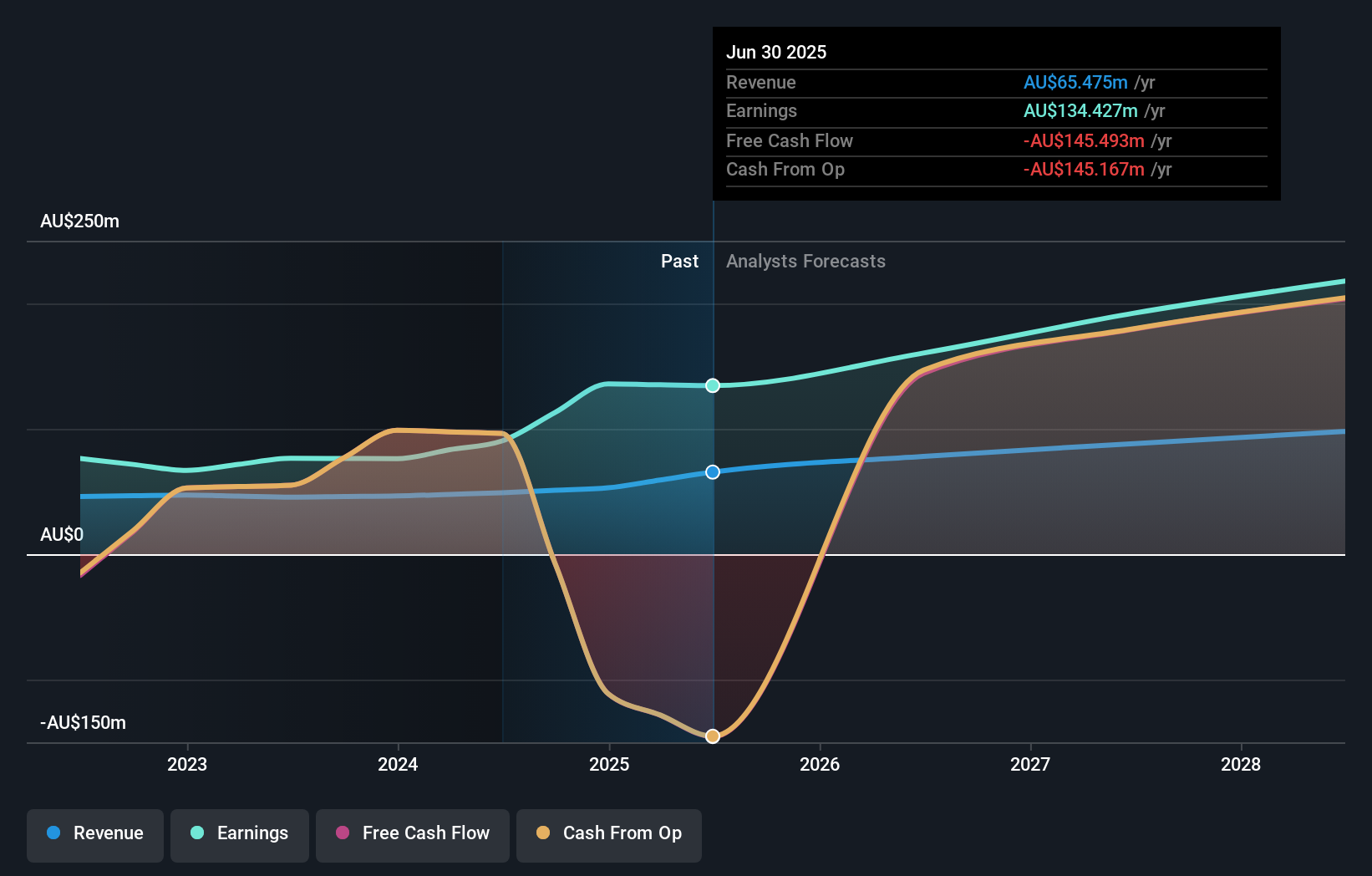

Pinnacle Investment Management Group (ASX:PNI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pinnacle Investment Management Group Limited is an investment management company based in Australia with a market capitalization of A$3.88 billion.

Operations: The company generates revenue primarily from its Funds Management Operations, amounting to A$48.99 million.

Insider Ownership: 31.5%

Pinnacle Investment Management Group has shown solid financial performance, with earnings rising to A$90.35 million from A$76.47 million year-on-year and revenue increasing to A$48.99 million. The company forecasts a 13.6% annual revenue growth, outpacing the Australian market average of 5.5%. While insider ownership remains stable, recent board changes include the appointment of Christina Lenard as Director, potentially influencing strategic direction amid consistent dividend announcements and earnings growth forecasts at 14.4% annually.

- Navigate through the intricacies of Pinnacle Investment Management Group with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Pinnacle Investment Management Group implies its share price may be too high.

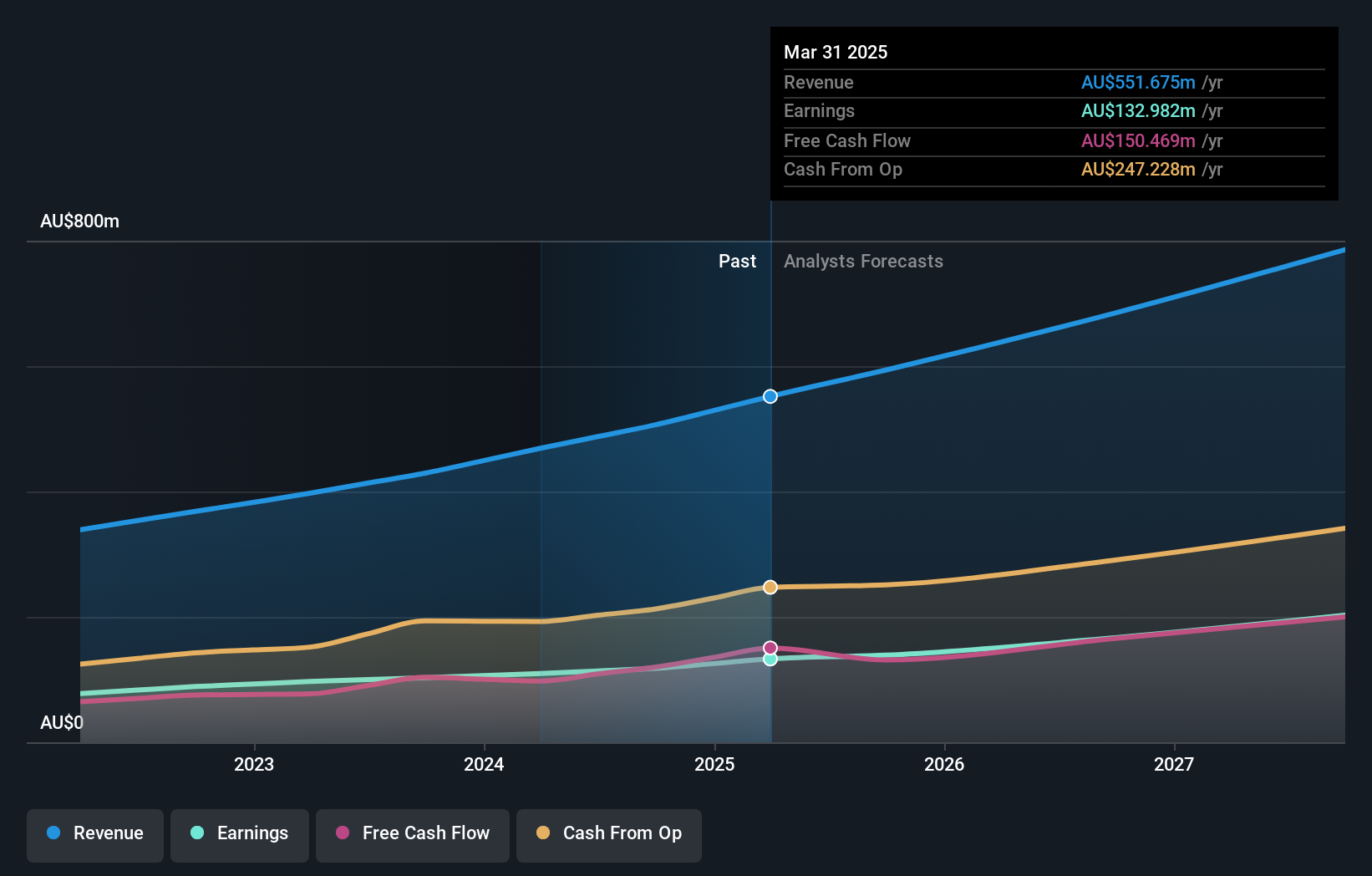

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is an enterprise software company that develops, markets, sells, implements, and supports integrated business solutions in Australia and internationally with a market cap of A$8.03 billion.

Operations: The company's revenue segments are comprised of Software at A$317.24 million, Corporate at A$83.83 million, and Consulting at A$68.13 million.

Insider Ownership: 12.3%

Technology One's earnings are projected to grow at 13.6% annually, surpassing the Australian market average of 12.2%, while revenue is expected to increase by 10.8% per year, also outpacing the market. The company's Return on Equity is anticipated to reach a high of 32.7% in three years, supporting its growth narrative despite no significant insider trading activity recently reported. Currently trading slightly below fair value estimates, Technology One maintains strong growth potential within its sector.

- Unlock comprehensive insights into our analysis of Technology One stock in this growth report.

- Our comprehensive valuation report raises the possibility that Technology One is priced higher than what may be justified by its financials.

Key Takeaways

- Unlock more gems! Our Fast Growing ASX Companies With High Insider Ownership screener has unearthed 95 more companies for you to explore.Click here to unveil our expertly curated list of 98 Fast Growing ASX Companies With High Insider Ownership.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal