With Visual China Group Co.,Ltd. (SZSE:000681) It Looks Like You'll Get What You Pay For

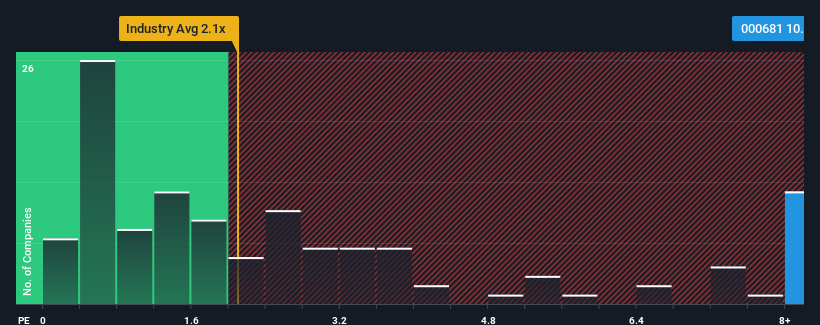

When you see that almost half of the companies in the Interactive Media and Services industry in China have price-to-sales ratios (or "P/S") below 5.5x, Visual China Group Co.,Ltd. (SZSE:000681) looks to be giving off strong sell signals with its 10.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Visual China GroupLtd

What Does Visual China GroupLtd's P/S Mean For Shareholders?

Recent times have been pleasing for Visual China GroupLtd as its revenue has risen in spite of the industry's average revenue going into reverse. The P/S ratio is probably high because investors think the company will continue to navigate the broader industry headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Visual China GroupLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Visual China GroupLtd's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. The latest three year period has also seen a 27% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 14% during the coming year according to the three analysts following the company. That's shaping up to be materially higher than the 9.6% growth forecast for the broader industry.

With this information, we can see why Visual China GroupLtd is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Visual China GroupLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Interactive Media and Services industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It is also worth noting that we have found 1 warning sign for Visual China GroupLtd that you need to take into consideration.

If these risks are making you reconsider your opinion on Visual China GroupLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal