High Growth German Tech Stocks To Watch In October 2024

As the German economy faces a forecasted contraction and a significant drop in factory orders, the DAX index has still managed to post gains, reflecting cautious optimism amid potential ECB rate cuts. In this challenging environment, investors might find opportunities in high-growth tech stocks that demonstrate resilience and innovation, qualities that are particularly crucial given the current economic climate.

Top 10 High Growth Tech Companies In Germany

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Formycon | 32.50% | 30.70% | ★★★★★☆ |

| Ströer SE KGaA | 7.50% | 29.71% | ★★★★★☆ |

| Stemmer Imaging | 13.34% | 23.20% | ★★★★★☆ |

| Exasol | 14.66% | 117.10% | ★★★★★☆ |

| ParTec | 41.16% | 63.31% | ★★★★★★ |

| cyan | 28.13% | 71.37% | ★★★★★☆ |

| medondo holding | 35.61% | 82.66% | ★★★★★☆ |

| Northern Data | 32.53% | 68.17% | ★★★★★☆ |

| Rubean | 55.25% | 67.67% | ★★★★★☆ |

| Pantaflix | 20.93% | 113.65% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

ParTec (DB:JY0)

Simply Wall St Growth Rating: ★★★★★★

Overview: ParTec AG specializes in the development, manufacturing, and supply of supercomputer and quantum computer solutions with a market capitalization of €572 million.

Operations: ParTec AG focuses on creating advanced computing solutions, including supercomputers and quantum computers. The company leverages its expertise in high-performance technology to cater to a niche market, contributing to its valuation of €572 million.

ParTec AG, amid its recent presentations at high-profile tech conferences, illustrates a robust trajectory in the tech sector. With revenue growth forecasted at 41.2% annually, it notably outpaces the German market's average of 5.5%. This surge is mirrored in its earnings projections, expected to increase by 63.3% per year. Despite current unprofitability, ParTec's aggressive R&D spending aligns with these growth figures, underscoring a commitment to innovation and market expansion that could redefine its future profitability and industry standing.

- Dive into the specifics of ParTec here with our thorough health report.

Gain insights into ParTec's historical performance by reviewing our past performance report.

adesso (XTRA:ADN1)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: adesso SE, along with its subsidiaries, offers IT services across Germany, Austria, Switzerland, and internationally, with a market capitalization of approximately €504.67 million.

Operations: The company generates revenue primarily from IT services (€1.39 billion) and IT solutions (€128.12 million). The business model focuses on providing comprehensive IT solutions across various regions, with a significant portion of revenue derived from its core service offerings.

Adesso SE, navigating through a challenging phase with a net loss of EUR 9.86 million in the first half of 2024, still shows potential with a significant sales increase to EUR 633.47 million from EUR 548.19 million year-over-year. This growth trajectory, at an annual rate of 11.7%, surpasses the broader German market's average of 5.5%. Despite current setbacks, Adesso's commitment to R&D is evident as it aligns its strategy to harness emerging tech trends, which could pivot its future towards profitability and solidify its standing in the high-growth tech sector in Germany.

- Delve into the full analysis health report here for a deeper understanding of adesso.

Understand adesso's track record by examining our Past report.

SAP (XTRA:SAP)

Simply Wall St Growth Rating: ★★★★☆☆

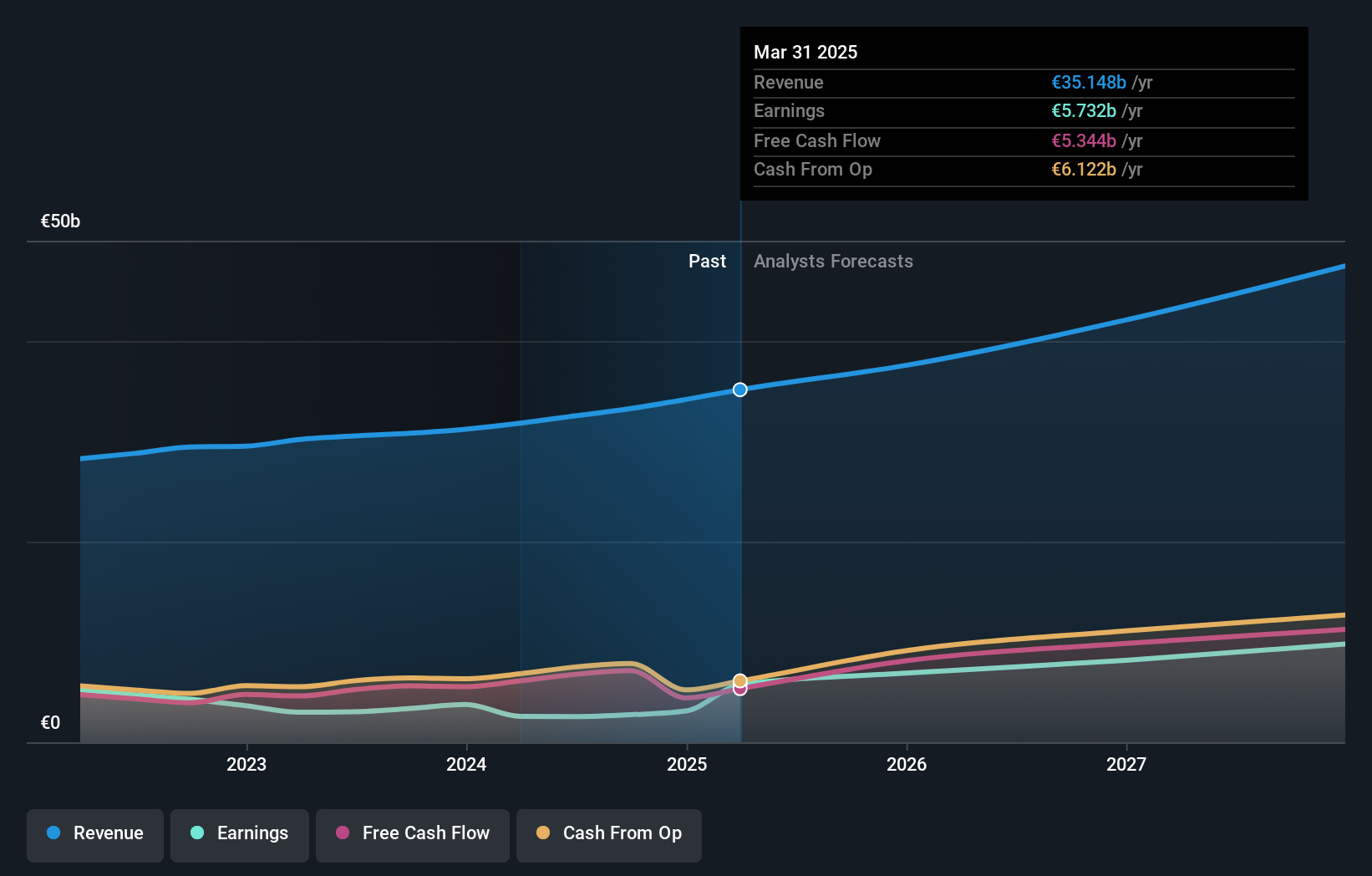

Overview: SAP SE, along with its subsidiaries, offers a range of applications, technology, and services globally and has a market capitalization of €244.07 billion.

Operations: The primary revenue stream for SAP comes from its Applications, Technology & Services segment, generating €32.54 billion.

SAP SE, amid a transformative phase, is leveraging its substantial R&D investment to pioneer in AI-driven business solutions. With a robust 9.5% annual revenue growth forecast, outpacing the German market's 5.5%, and an impressive expected earnings surge of 37.9% per year, SAP is strategically positioned for significant expansion. Recent product launches like the AI copilot Joule illustrate SAP's commitment to integrating advanced technologies across its operations, enhancing efficiency and data utilization which are critical in maintaining competitive advantage in the rapidly evolving tech landscape. These strategic moves are poised to solidify SAP’s role as a leader in enterprise software solutions while addressing the complexities of global commerce through innovation.

Make It Happen

- Click this link to deep-dive into the 41 companies within our German High Growth Tech and AI Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal