Top German Dividend Stocks For October 2024

As the German economy faces a contraction for the second consecutive year, with factory orders experiencing a significant decline, investors are increasingly turning their attention to dividend stocks as a potential source of stability and income. In this challenging economic environment, selecting dividend stocks with strong fundamentals can offer resilience and consistent returns amidst market fluctuations.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Edel SE KGaA (XTRA:EDL) | 6.61% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.87% | ★★★★★★ |

| SAF-Holland (XTRA:SFQ) | 5.95% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.69% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.58% | ★★★★★☆ |

| Allianz (XTRA:ALV) | 4.58% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.29% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 9.25% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.39% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.76% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top German Dividend Stocks screener.

We'll examine a selection from our screener results.

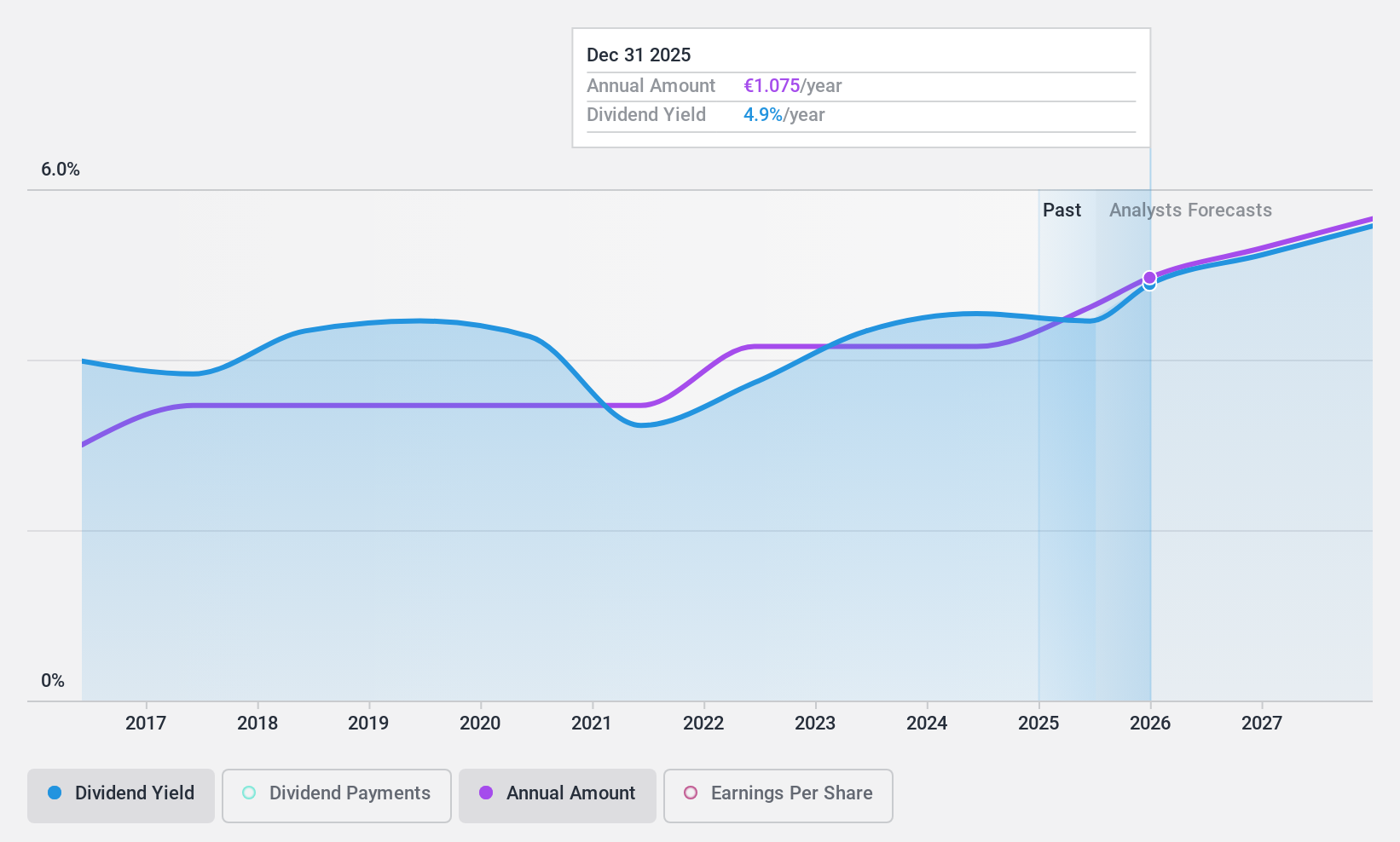

OVB Holding (XTRA:O4B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: OVB Holding AG, with a market cap of €273.63 million, operates through its subsidiaries to offer advisory and brokerage services to private households across Europe.

Operations: OVB Holding AG generates revenue primarily from its Insurance Brokers segment, which amounts to €382.93 million.

Dividend Yield: 4.7%

OVB Holding AG, trading at 32.4% below its estimated fair value, offers a stable and reliable dividend history over the past decade. Recent earnings growth of 32.6% supports its dividend sustainability, with a payout ratio of 70.3% and cash flow coverage at 56.6%. Despite a slightly lower yield of 4.69% compared to top German dividend payers, OVB's consistent financial performance underpins its attractiveness for income-focused investors seeking stability in their portfolio returns.

- Click here to discover the nuances of OVB Holding with our detailed analytical dividend report.

- Our expertly prepared valuation report OVB Holding implies its share price may be lower than expected.

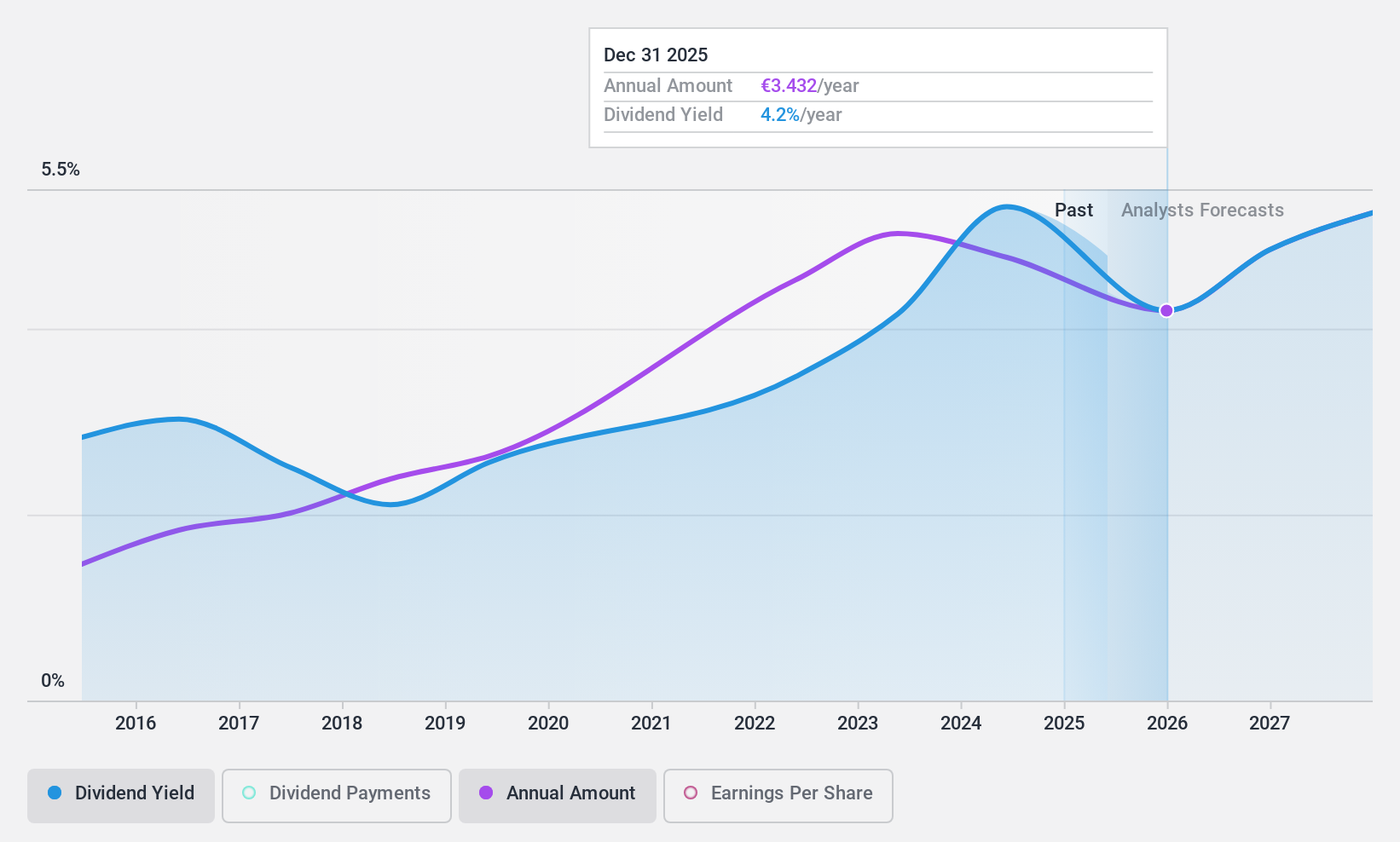

Sixt (XTRA:SIX2)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sixt SE operates a global network offering mobility services to private and business customers through both corporate and franchise stations, with a market cap of €3.09 billion.

Operations: Sixt SE generates its revenue primarily from Europe (€1.49 billion), Germany (€1.22 billion), and North America (€1.21 billion).

Dividend Yield: 5.5%

Sixt SE's dividend yield ranks in the top 25% of German payers, but its sustainability is questionable due to insufficient free cash flow coverage. Despite a favorable price-to-earnings ratio compared to the market, profit margins have declined from last year. The company's dividends have been volatile over the past decade, indicating unreliability for consistent income. Recent U.S. expansion efforts highlight growth potential; however, dropping from the FTSE All-World Index may affect investor sentiment.

- Get an in-depth perspective on Sixt's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Sixt's share price might be too pessimistic.

WashTec (XTRA:WSU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WashTec AG offers car wash solutions across Germany, Europe, North America, and the Asia Pacific with a market cap of €519.23 million.

Operations: WashTec AG's revenue segments include €91.10 million from North America, with additional adjustments amounting to €393.04 million.

Dividend Yield: 5.7%

WashTec's dividend yield of 5.67% is among the top 25% in Germany, yet its sustainability is challenged by a high payout ratio of 101.5%, indicating dividends are not well covered by earnings, though cash flow coverage at a 47.9% cash payout ratio is more favorable. Earnings grew modestly by €1.38 million year-over-year for Q2 2024 despite a decline in sales, reflecting some financial resilience amidst fluctuating dividend payments over the past decade.

- Navigate through the intricacies of WashTec with our comprehensive dividend report here.

- According our valuation report, there's an indication that WashTec's share price might be on the cheaper side.

Seize The Opportunity

- Dive into all 33 of the Top German Dividend Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal