Does E Factor Experiences (NSE:EFACTOR) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in E Factor Experiences (NSE:EFACTOR). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide E Factor Experiences with the means to add long-term value to shareholders.

Check out our latest analysis for E Factor Experiences

E Factor Experiences' Improving Profits

In the last three years E Factor Experiences' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. E Factor Experiences' EPS skyrocketed from ₹7.30 to ₹11.74, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 61%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that E Factor Experiences is growing revenues, and EBIT margins improved by 5.1 percentage points to 14%, over the last year. That's great to see, on both counts.

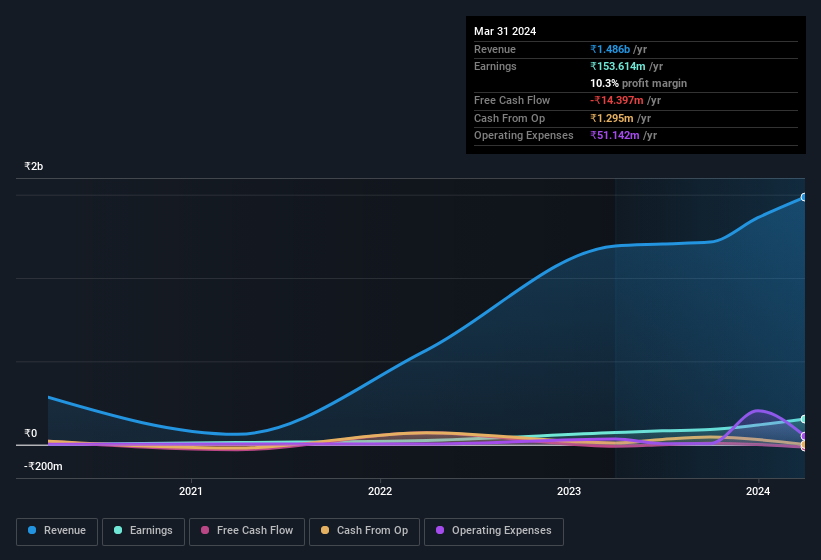

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

E Factor Experiences isn't a huge company, given its market capitalisation of ₹3.4b. That makes it extra important to check on its balance sheet strength.

Are E Factor Experiences Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So we're pleased to report that E Factor Experiences insiders own a meaningful share of the business. In fact, they own 74% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. In terms of absolute value, insiders have ₹2.5b invested in the business, at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Does E Factor Experiences Deserve A Spot On Your Watchlist?

For growth investors, E Factor Experiences' raw rate of earnings growth is a beacon in the night. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in E Factor Experiences' continuing strength. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. Before you take the next step you should know about the 4 warning signs for E Factor Experiences (2 shouldn't be ignored!) that we have uncovered.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Indian companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal