Discover These 3 High Growth Insider-Owned Stocks On The Swedish Exchange

As the pan-European STOXX Europe 600 Index shows positive momentum with hopes of quicker interest rate cuts by the European Central Bank, Sweden's stock market continues to attract attention for its potential growth opportunities. In this environment, stocks with high insider ownership often draw interest as they can indicate a strong alignment between company management and shareholder interests, particularly in growth-oriented companies.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.7% | 21.7% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Biovica International (OM:BIOVIC B) | 18.3% | 78.5% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| LumenRadio (OM:LUMEN) | 33.7% | 31.8% |

| Yubico (OM:YUBICO) | 37.5% | 42.2% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| InCoax Networks (OM:INCOAX) | 20.1% | 115.5% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

Let's explore several standout options from the results in the screener.

Logistea (OM:LOGI A)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Logistea AB (publ) operates in the real estate sector in Sweden with a market capitalization of approximately SEK8.03 billion.

Operations: Logistea AB (publ) generates revenue through its operations in the Swedish real estate sector.

Insider Ownership: 14.0%

Return On Equity Forecast: N/A (2027 estimate)

Logistea's earnings are forecast to grow significantly at 24.67% annually, outpacing the Swedish market's 15.6%. Despite being valued below its fair estimate, recent large one-off items have impacted financial results. Revenue is expected to rise by 20.7% yearly, surpassing market growth rates. M2 Capital Management's acquisition of a significant stake has increased insider ownership to nearly 25%, enhancing strategic influence but also reflecting past shareholder dilution and challenges in covering interest payments with earnings.

- Click here to discover the nuances of Logistea with our detailed analytical future growth report.

- Our valuation report here indicates Logistea may be overvalued.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) offers solutions in medical IT and cybersecurity across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market cap of SEK55.72 billion.

Operations: The company's revenue is primarily derived from Imaging IT Solutions at SEK2.67 billion and Secure Communications at SEK388.55 million.

Insider Ownership: 30.3%

Return On Equity Forecast: N/A (2027 estimate)

Sectra's earnings are forecast to grow 21.2% annually, outpacing the Swedish market's 15.6%. Recent results show revenue rising to SEK 739.48 million, with net income at SEK 80.4 million for Q1 2024, reflecting strong growth from the previous year. The company's recent agreement with MaineGeneral Health highlights its scalable cloud solutions in healthcare IT, enhancing operational efficiency and security. Insider activity shows more shares bought than sold recently, though not in substantial volumes.

- Unlock comprehensive insights into our analysis of Sectra stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Sectra shares in the market.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★★

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of approximately SEK15.60 billion.

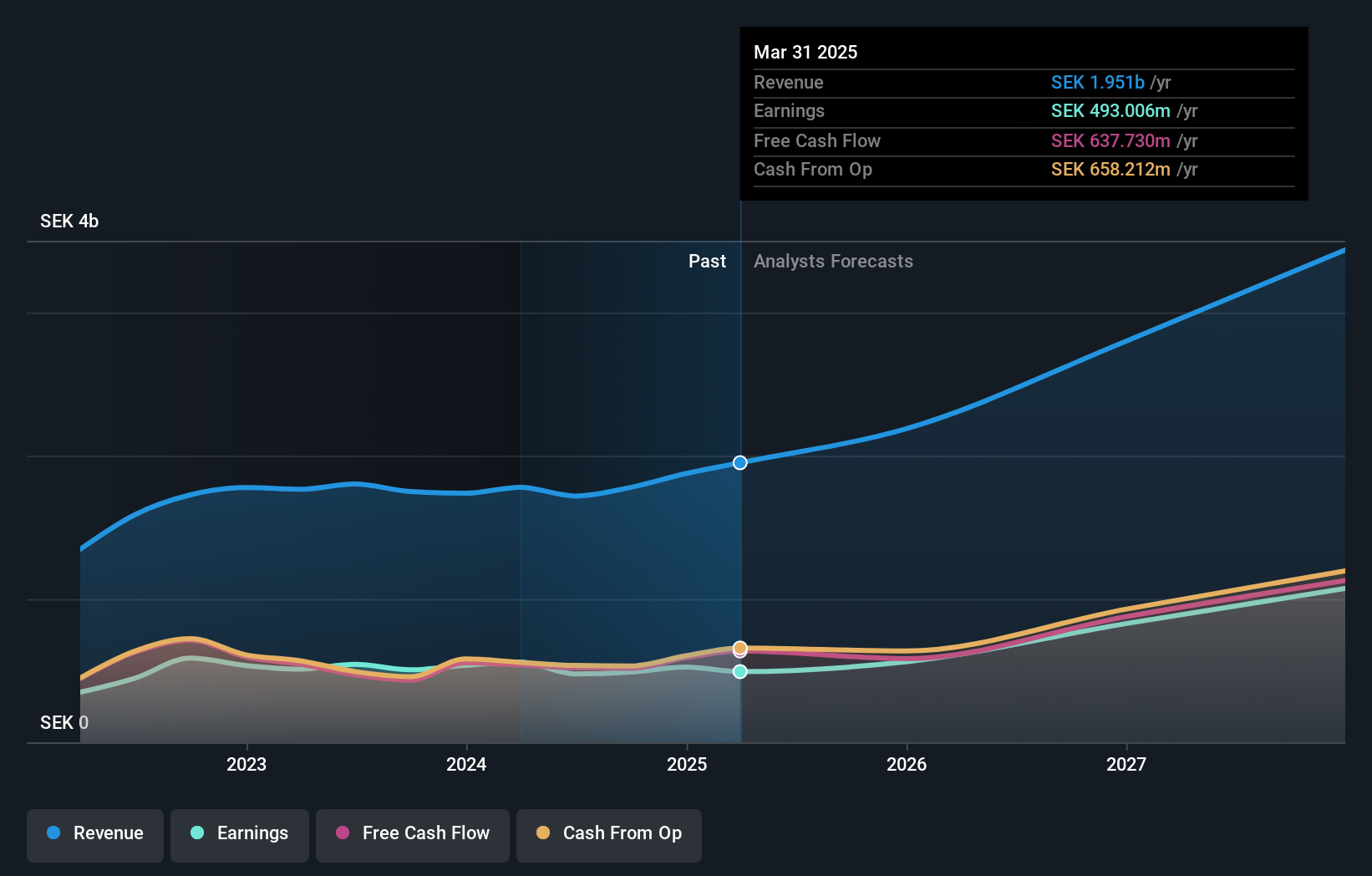

Operations: The company's revenue primarily comes from its Communications Software segment, which generated SEK1.72 billion.

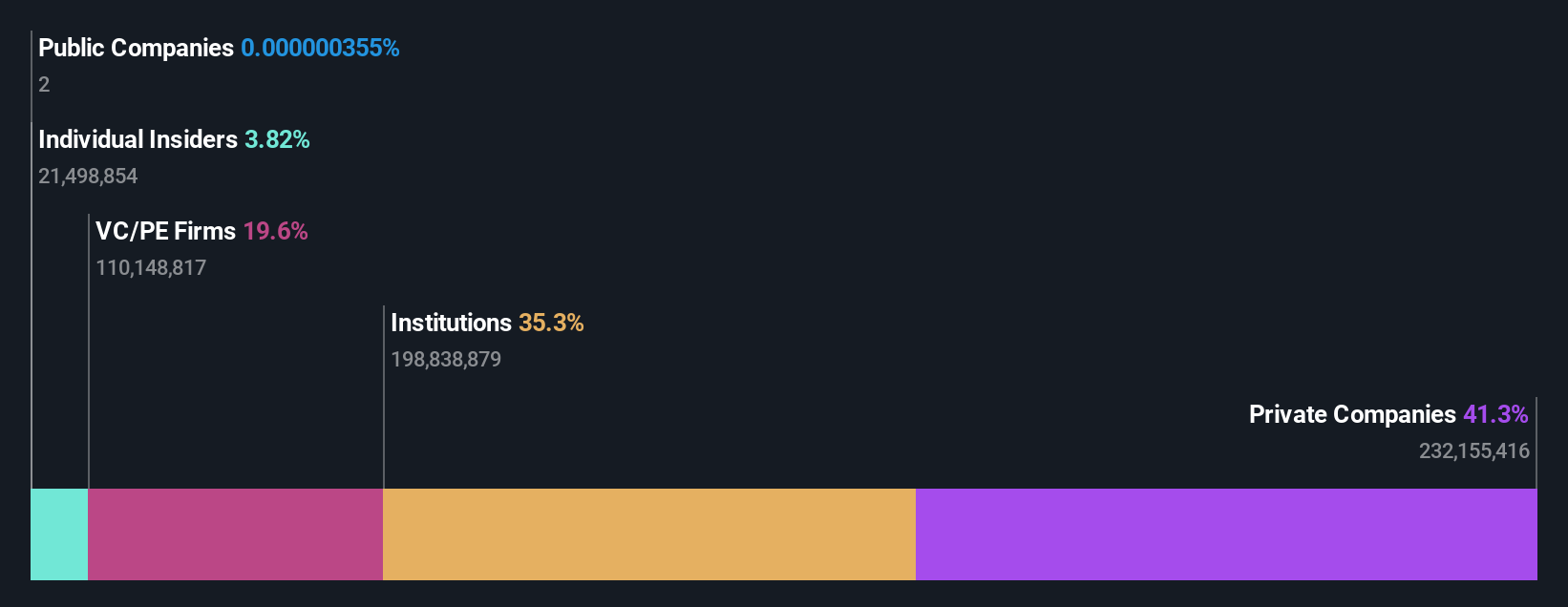

Insider Ownership: 29.7%

Return On Equity Forecast: 42% (2027 estimate)

Truecaller is positioned for significant growth, with earnings expected to rise by 21.73% annually, outpacing the Swedish market. The company's revenue is also forecasted to grow over 20% per year. Recent strategic moves include a partnership with Halan to enhance communication security and an appointment of a seasoned executive in India, both supporting its expansion efforts. Insider activity shows more shares bought than sold recently, albeit not in substantial volumes.

- Navigate through the intricacies of Truecaller with our comprehensive analyst estimates report here.

- Our valuation report here indicates Truecaller may be undervalued.

Summing It All Up

- Unlock our comprehensive list of 80 Fast Growing Swedish Companies With High Insider Ownership by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal