High Growth Tech Stocks in Sweden to Watch October 2024

As European markets experience modest gains amid optimism for potential interest rate cuts by the European Central Bank, Sweden's tech sector continues to capture attention with its innovative and high-growth potential. In this dynamic environment, investors often look for stocks that demonstrate strong fundamentals and adaptability to leverage emerging opportunities in technology-driven industries.

Top 10 High Growth Tech Companies In Sweden

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Truecaller | 20.40% | 21.73% | ★★★★★★ |

| Xbrane Biopharma | 53.90% | 118.02% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Hemnet Group | 20.10% | 25.39% | ★★★★★★ |

| Skolon | 32.63% | 122.14% | ★★★★★★ |

| BioArctic | 42.38% | 98.40% | ★★★★★★ |

| Yubico | 20.52% | 42.18% | ★★★★★★ |

| LumenRadio | 23.11% | 31.75% | ★★★★★★ |

| Bonesupport Holding | 33.76% | 31.20% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Embracer Group (OM:EMBRAC B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Embracer Group AB (publ) is a global developer and publisher of PC, console, mobile, VR, and board games with a market capitalization of SEK41.61 billion.

Operations: Embracer Group generates revenue primarily from PC/console games, tabletop games, mobile games, and entertainment & services. The largest revenue contributor is the tabletop games segment at SEK14.65 billion, followed by PC/console games at SEK13.10 billion.

Embracer Group, amid a challenging fiscal quarter with a net loss of SEK 2.18 billion, contrasts starkly against its previous year's net income of SEK 2.25 billion. Despite these setbacks, the company is positioned for recovery with an anticipated earnings growth of 104.4% annually, underpinned by strategic directorial changes and robust R&D investments aimed at innovation and market adaptation. This focus on development is crucial as it aligns with industry shifts towards digital and interactive entertainment—a sector where continuous innovation forms the cornerstone of success.

- Click to explore a detailed breakdown of our findings in Embracer Group's health report.

Examine Embracer Group's past performance report to understand how it has performed in the past.

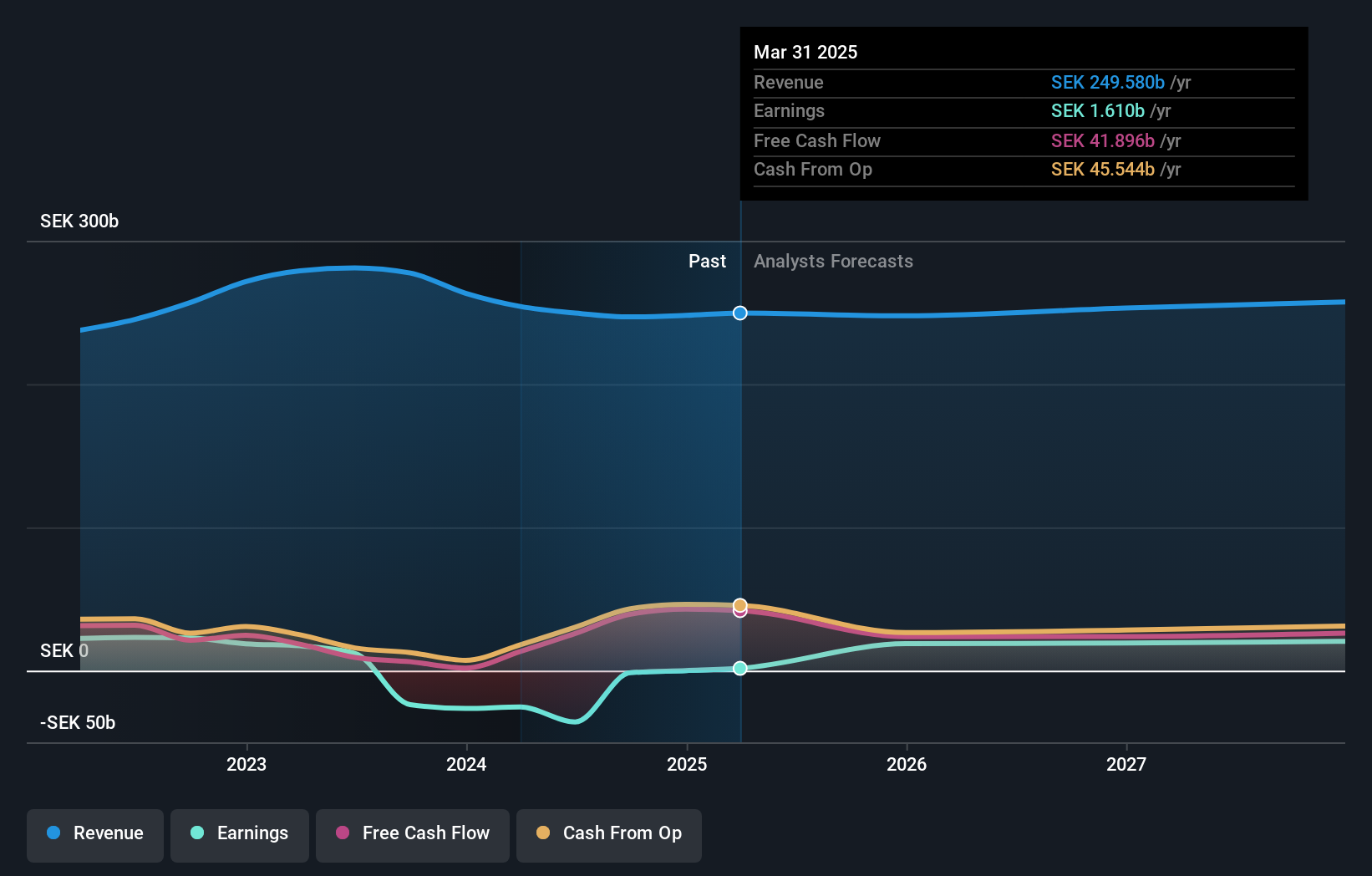

Telefonaktiebolaget LM Ericsson (OM:ERIC B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Telefonaktiebolaget LM Ericsson (publ) offers mobile connectivity solutions for telecom operators and enterprise customers across multiple regions including North America, Europe, Latin America, the Middle East, Africa, North East Asia, South East Asia, Oceania, and India with a market cap of approximately SEK289.21 billion.

Operations: Ericsson generates revenue by providing mobile connectivity solutions to telecom operators and enterprise customers across diverse global markets. The company focuses on delivering advanced network infrastructure and services, contributing to its substantial market presence.

Ericsson's recent pivot towards enhancing its technological capabilities is evident with a robust 83.65% projected annual earnings growth, signaling a strong recovery and potential profitability within three years. This financial resurgence is underscored by strategic alliances, like the collaboration under the U.S. CHIPS Act, which not only fortifies Ericsson’s position in advanced microelectronics for 5G/6G but also aligns with industry trends towards higher frequency bands for future network deployments. Moreover, R&D remains a cornerstone of Ericsson's strategy, with significant investments amounting to billions annually—constituting a substantial percentage of their revenue—ensuring continuous innovation and leadership in communications technology.

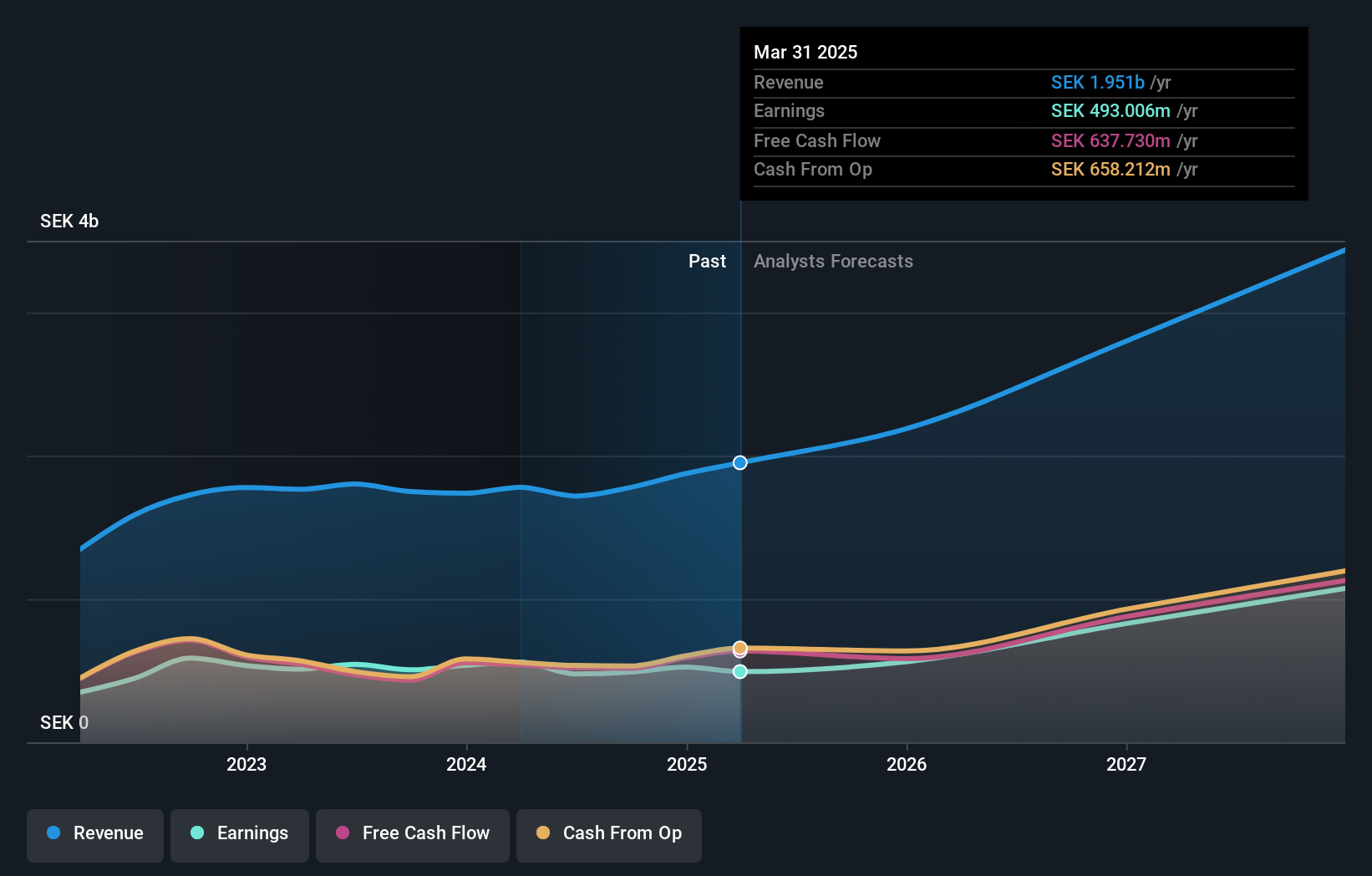

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★★

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market capitalization of approximately SEK15.60 billion.

Operations: Truecaller generates revenue primarily through its communications software, totaling SEK1.72 billion. The company operates in various international markets, focusing on mobile caller ID applications for both individuals and businesses.

Truecaller, a leader in communication safety and efficiency, is poised for significant growth with projected revenue increases of 20.4% annually. This outpaces the general Swedish market's growth rate of 1.1% per year, highlighting its strong position in the tech sector. The company's commitment to innovation is underscored by substantial R&D investments which have consistently represented a significant portion of their revenue, ensuring continuous improvement and expansion of their service offerings. Recent strategic partnerships, like that with Halan to enhance verified business communications, further solidify Truecaller’s role in transforming how businesses interact securely with clients. Additionally, Truecaller has initiated a share repurchase program as part of its capital allocation strategy to fulfill obligations under its Share Program 2024 effectively. These moves not only strengthen Truecaller's market presence but also demonstrate robust financial management aimed at fostering long-term shareholder value amidst dynamic market conditions.

- Navigate through the intricacies of Truecaller with our comprehensive health report here.

Assess Truecaller's past performance with our detailed historical performance reports.

Taking Advantage

- Delve into our full catalog of 81 Swedish High Growth Tech and AI Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal