Swedish Dividend Stocks Spotlight Featuring Knowit And Two More

As European markets show signs of optimism with hopes for quicker interest rate cuts by the ECB, Swedish investors are keenly observing dividend stocks as a potential source of steady income amidst fluctuating economic conditions. In this context, identifying strong dividend stocks like Knowit and others becomes crucial, as these investments can offer stability and regular returns in an ever-evolving market landscape.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.72% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 3.87% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.25% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.03% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.58% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.84% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 5.02% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 3.93% | ★★★★☆☆ |

| Afry (OM:AFRY) | 3.07% | ★★★★☆☆ |

| Bahnhof (OM:BAHN B) | 3.87% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our Top Swedish Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

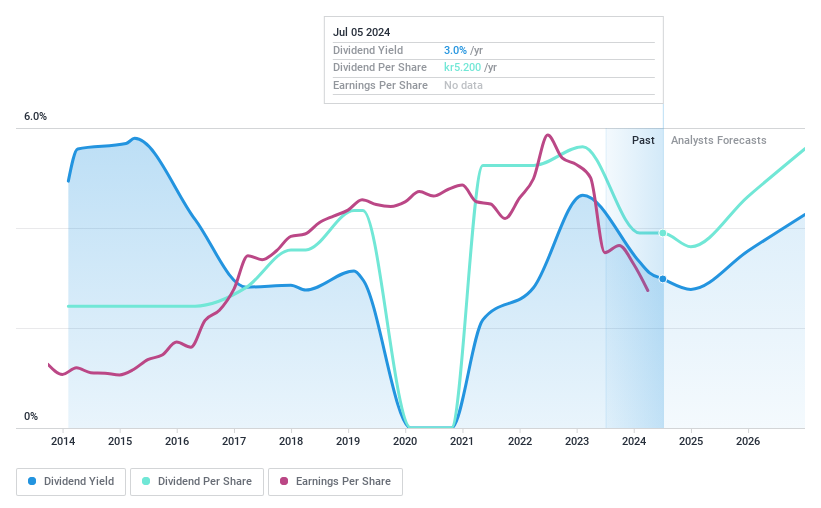

Knowit (OM:KNOW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Knowit AB (publ) is a consultancy company focused on developing digital solutions, with a market cap of SEK4.18 billion.

Operations: Knowit AB (publ) generates revenue through its key segments: Insight (SEK898.95 million), Solutions (SEK3.90 billion), Experience (SEK1.44 billion), and Connectivity (SEK1.02 billion).

Dividend Yield: 3.4%

Knowit's dividend payments have increased over the past decade, yet they remain volatile and unreliable, with significant annual drops. Despite a low cash payout ratio of 41.6%, indicating strong coverage by cash flows, its overall payout ratio is 77.3%, suggesting dividends are covered by earnings as well. Recent financial results show declining sales and net income, which may impact future payouts. The stock trades at a significant discount to estimated fair value but offers a lower-than-top-tier yield in Sweden's market.

- Click to explore a detailed breakdown of our findings in Knowit's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Knowit shares in the market.

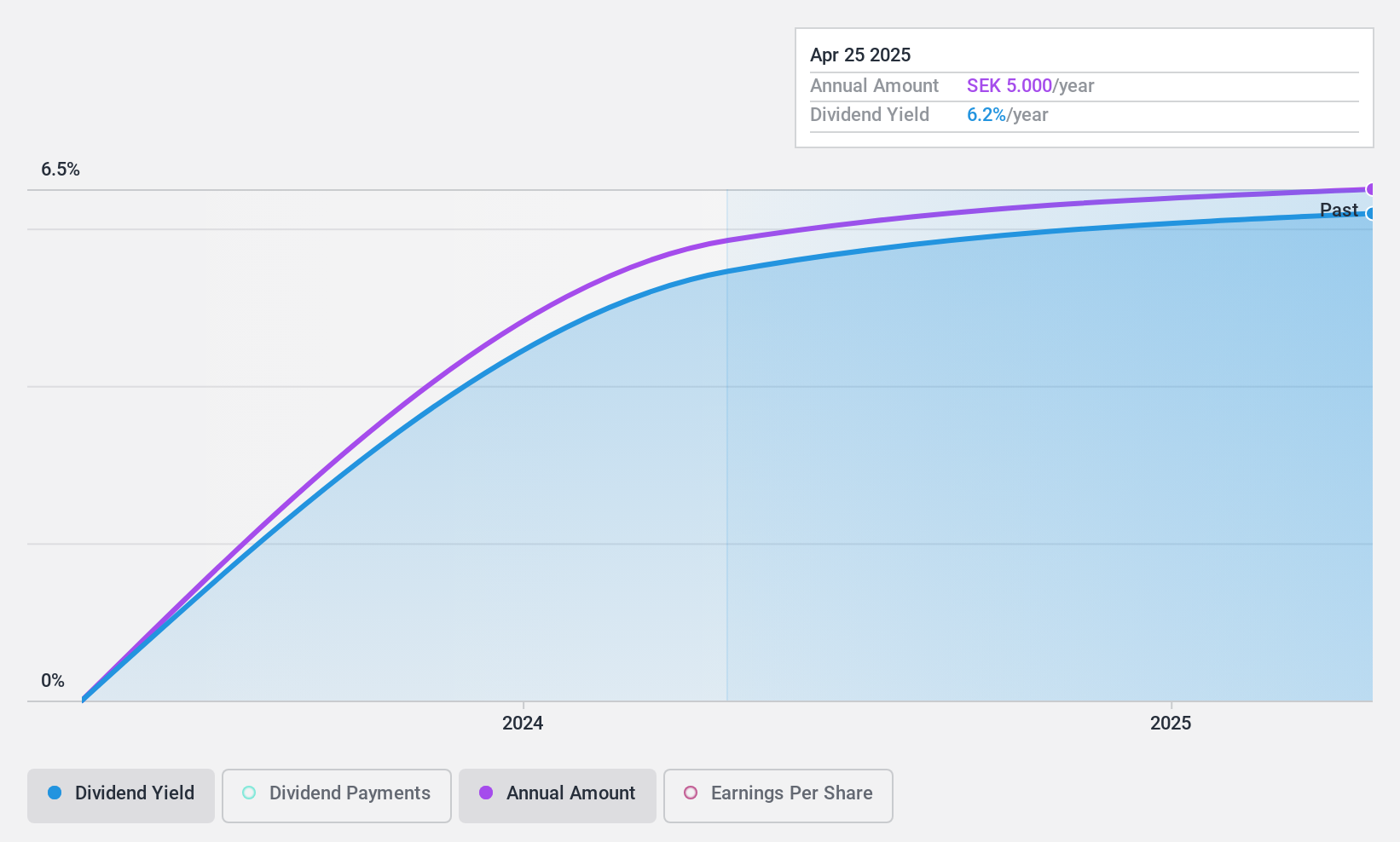

Solid Försäkringsaktiebolag (OM:SFAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Solid Försäkringsaktiebolag (publ) offers non-life insurance services to private and business customers across Sweden, Denmark, Norway, Finland, Germany, Switzerland, and other international markets with a market cap of SEK1.51 billion.

Operations: Solid Försäkringsaktiebolag's revenue segments include Product at SEK320.51 million, Assistance at SEK351.63 million, and Personal Safety at SEK435.09 million.

Dividend Yield: 5.5%

Solid Försäkringsaktiebolag's dividend yield of 5.45% ranks in the top 25% of Swedish dividend payers, with a sustainable payout ratio of 49.1%, indicating coverage by earnings and cash flows. Despite being new to dividends, its financial health is supported by consistent earnings growth at 28.4% annually over five years. Recent share buybacks aim to enhance shareholder value and optimize capital structure, while trading significantly below estimated fair value suggests potential investment appeal.

- Dive into the specifics of Solid Försäkringsaktiebolag here with our thorough dividend report.

- Our valuation report unveils the possibility Solid Försäkringsaktiebolag's shares may be trading at a discount.

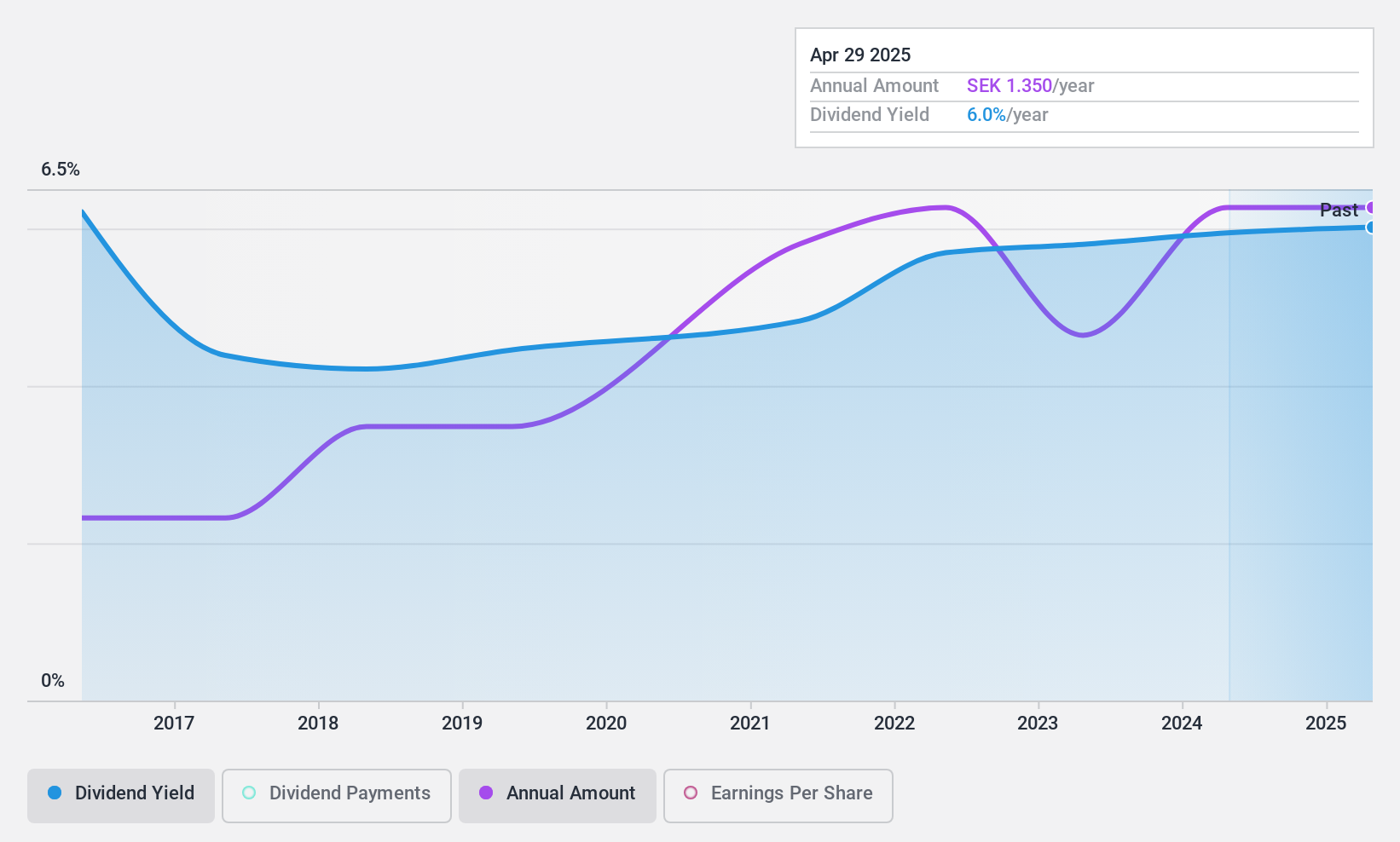

Softronic (OM:SOF B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Softronic AB (publ) is a company that offers IT and management services mainly in Sweden, with a market cap of SEK1.18 billion.

Operations: Softronic AB generates revenue primarily from its Computer Services segment, which amounts to SEK838.92 million.

Dividend Yield: 6%

Softronic's dividend yield of 6% places it among the top 25% of Swedish dividend payers, yet its sustainability is questionable due to a high cash payout ratio of 94.5%. While earnings have grown by 34% over the past year, dividends remain volatile and not fully covered by free cash flows. The payout ratio stands at 85.5%, indicating coverage by earnings but highlighting potential risks in maintaining consistent payments. Its price-to-earnings ratio of 14.2x suggests good value relative to the market average.

- Click here to discover the nuances of Softronic with our detailed analytical dividend report.

- The analysis detailed in our Softronic valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Investigate our full lineup of 23 Top Swedish Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal