Uncovering India's Undiscovered Gems In October 2024

The Indian market has experienced a flat performance over the past week, yet it has surged by 40% over the last year, with earnings projected to grow by 17% annually in the coming years. In this dynamic environment, identifying stocks that offer unique value and growth potential can be crucial for investors seeking opportunities beyond well-trodden paths.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bengal & Assam | 4.48% | 1.53% | 51.11% | ★★★★★★ |

| Shree Digvijay Cement | 0.01% | 13.97% | 16.37% | ★★★★★★ |

| Suraj | 27.47% | 17.95% | 67.29% | ★★★★★★ |

| NGL Fine-Chem | 12.95% | 15.22% | 8.68% | ★★★★★★ |

| ELANTAS Beck India | NA | 14.89% | 24.83% | ★★★★★★ |

| TCPL Packaging | 95.84% | 15.51% | 31.89% | ★★★★★☆ |

| Ingersoll-Rand (India) | 1.05% | 14.88% | 27.54% | ★★★★★☆ |

| Network People Services Technologies | 0.24% | 81.82% | 86.35% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.44% | 61.28% | ★★★★★☆ |

| Rir Power Electronics | 54.23% | 16.42% | 34.78% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

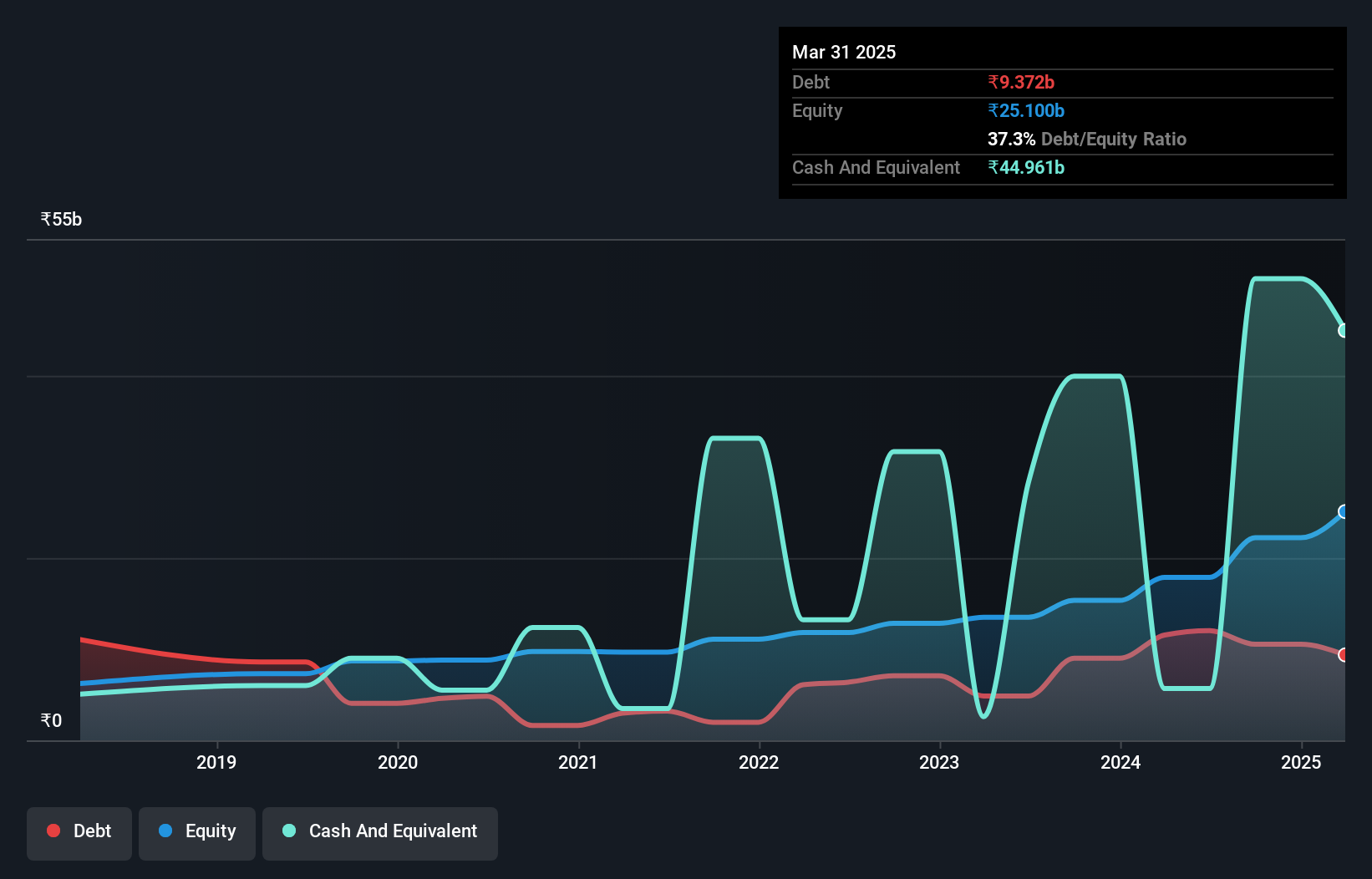

Overview: IIFL Securities Limited operates as a provider of capital market services in India's primary and secondary markets, with a market capitalization of ₹130.92 billion.

Operations: IIFL Securities generates revenue primarily from capital market activities, amounting to ₹20.25 billion, and insurance broking and ancillary services, contributing ₹2.77 billion. The company also earns from facilities and ancillary services with a revenue of ₹375.25 million.

IIFL Securities, a smaller player in India's financial scene, has shown impressive earnings growth of 120% over the past year, outpacing the industry average of 64%. With a net debt to equity ratio at 35.5%, it seems financially stable. However, its share price has been highly volatile recently. Despite this volatility and insufficient data on interest coverage by EBIT, its price-to-earnings ratio of 21x remains attractive compared to the market's 34x.

- Navigate through the intricacies of IIFL Securities with our comprehensive health report here.

Gain insights into IIFL Securities' past trends and performance with our Past report.

Ingersoll-Rand (India) (NSEI:INGERRAND)

Simply Wall St Value Rating: ★★★★★☆

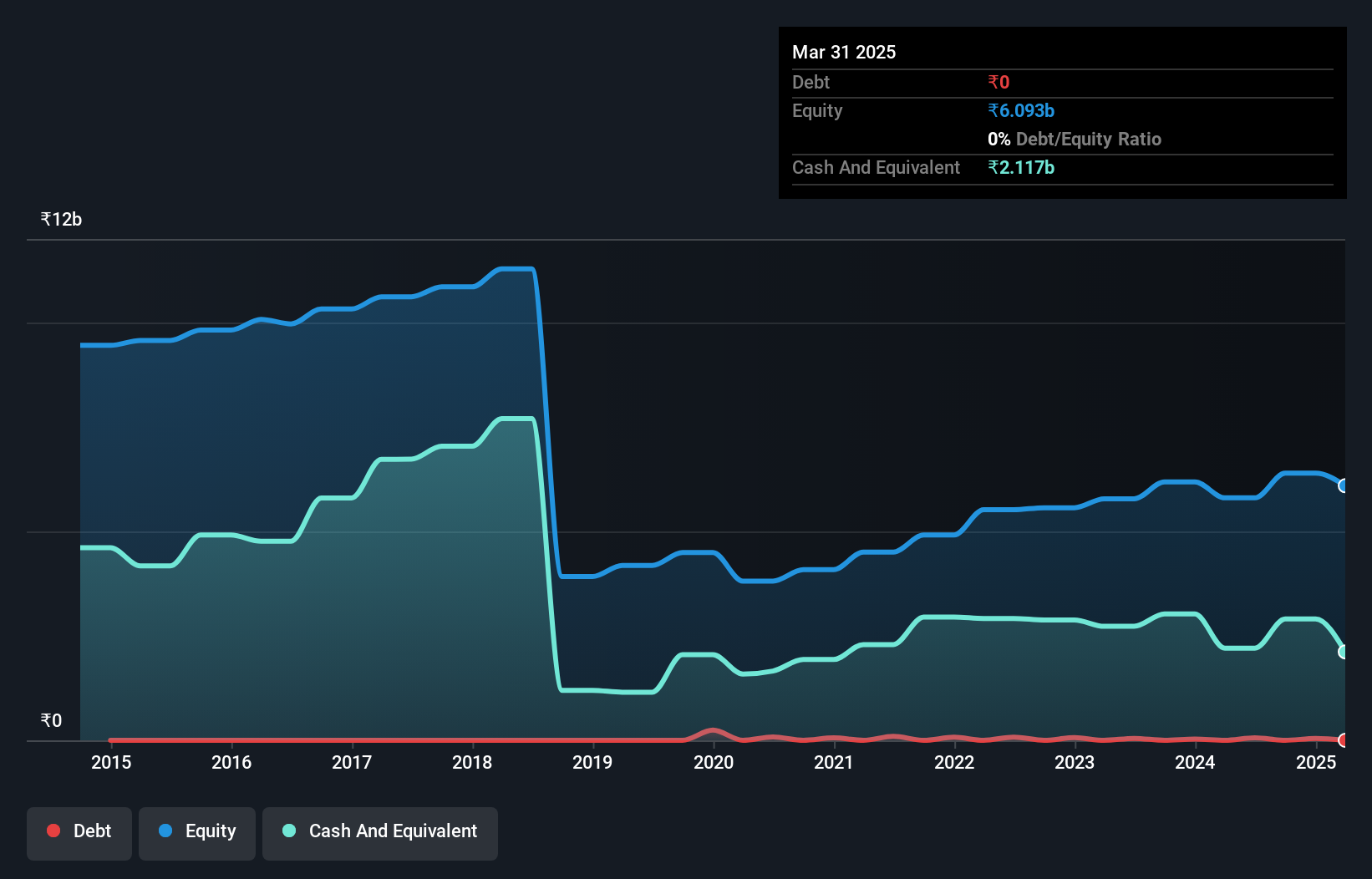

Overview: Ingersoll-Rand (India) Limited focuses on the manufacturing and sale of industrial air compressors in India, with a market capitalization of ₹144.29 billion.

Operations: The primary revenue stream for Ingersoll-Rand (India) Limited is its Air Solutions segment, generating ₹12.27 billion.

Ingersoll-Rand (India), a small yet noteworthy player in the machinery sector, has exhibited robust financial performance with earnings growing at 27.5% annually over the past five years. Their net income for Q1 2024 stood at INR 618.6 million, up from INR 537.3 million a year prior, while basic earnings per share rose to INR 19.6 from INR 17.02. Despite not outpacing industry growth, the company retains high-quality earnings and maintains more cash than total debt, ensuring strong interest coverage and financial stability moving forward.

Time Technoplast (NSEI:TIMETECHNO)

Simply Wall St Value Rating: ★★★★★★

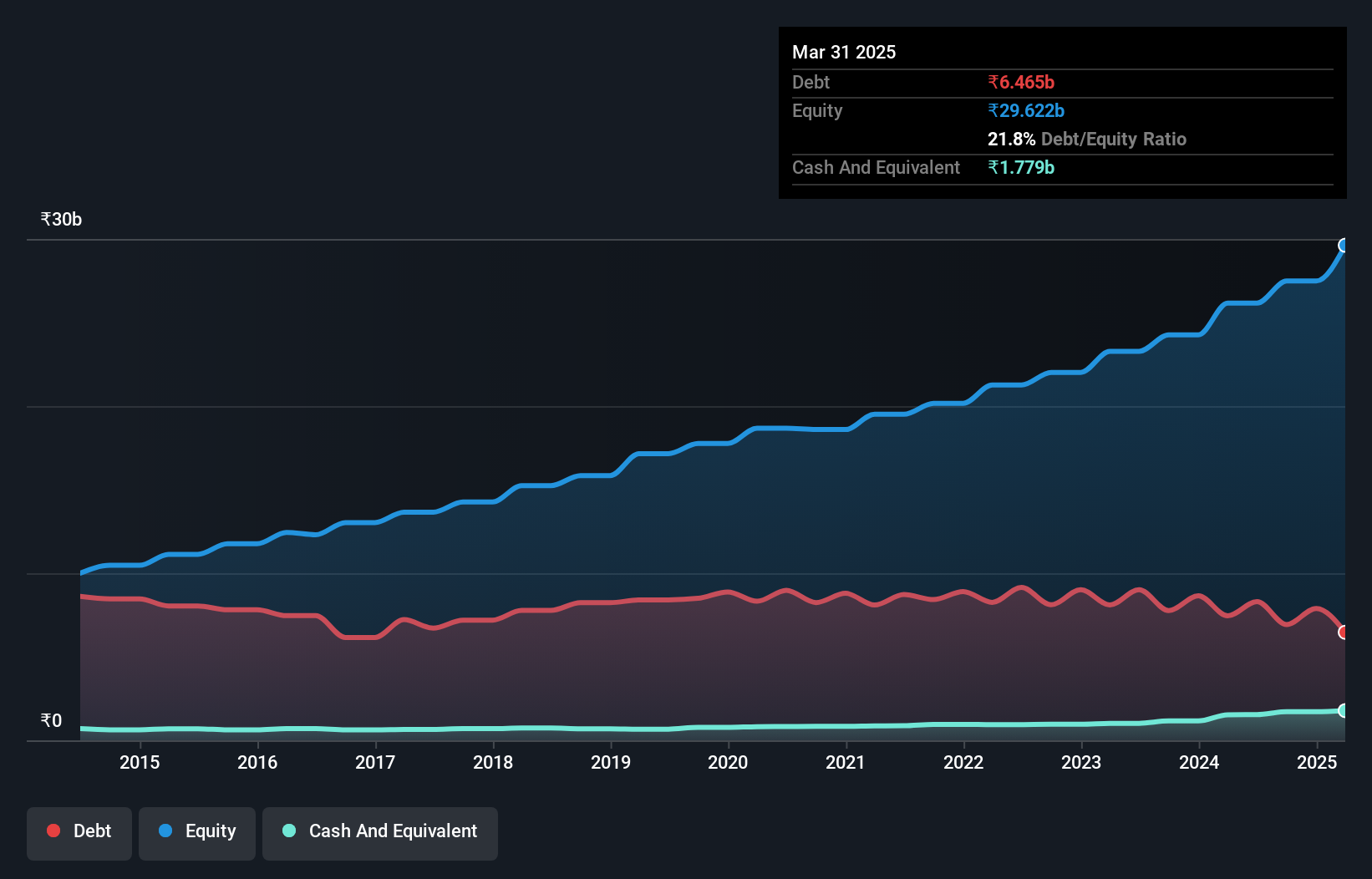

Overview: Time Technoplast Limited is involved in the manufacture and sale of polymer and composite products across India and international markets, with a market cap of ₹99.47 billion.

Operations: The company's primary revenue streams are derived from the sale of polymer products, contributing ₹33.43 billion, and composite products, generating ₹18 billion.

Time Technoplast, a dynamic player in the packaging sector, showcases impressive growth with earnings up 44.6% over the past year, outpacing industry norms. The company’s debt to equity ratio has improved significantly from 49% to 31.7% over five years, reflecting prudent financial management. With a Price-To-Earnings ratio of 29.8x below the market average and high-quality earnings, Time Technoplast seems well-positioned for future opportunities despite recent auditor changes and dividend increases at INR 2 per share (200%).

- Get an in-depth perspective on Time Technoplast's performance by reading our health report here.

Assess Time Technoplast's past performance with our detailed historical performance reports.

Seize The Opportunity

- Embark on your investment journey to our 473 Indian Undiscovered Gems With Strong Fundamentals selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal