Beijing Yuanliu Hongyuan Electronic Technology (SHSE:603267) sheds CN¥851m, company earnings and investor returns have been trending downwards for past three years

Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd. (SHSE:603267) shareholders should be happy to see the share price up 29% in the last month. But the last three years have seen a terrible decline. Indeed, the share price is down a whopping 75% in the last three years. Arguably, the recent bounce is to be expected after such a bad drop. Only time will tell if the company can sustain the turnaround.

If the past week is anything to go by, investor sentiment for Beijing Yuanliu Hongyuan Electronic Technology isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Beijing Yuanliu Hongyuan Electronic Technology

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

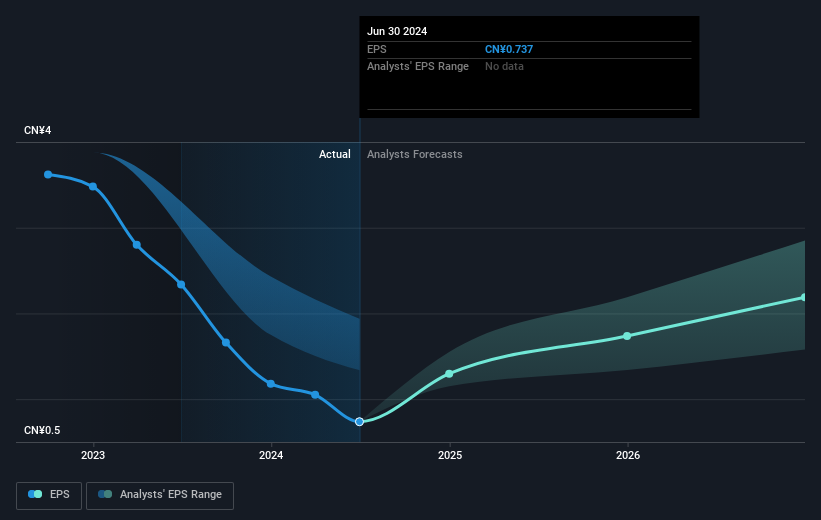

During the three years that the share price fell, Beijing Yuanliu Hongyuan Electronic Technology's earnings per share (EPS) dropped by 39% each year. So do you think it's a coincidence that the share price has dropped 37% per year, a very similar rate to the EPS? We don't. So it seems that investor expectations of the company are staying pretty steady, despite the disappointment. In this case, it seems that the EPS is guiding the share price.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Beijing Yuanliu Hongyuan Electronic Technology's key metrics by checking this interactive graph of Beijing Yuanliu Hongyuan Electronic Technology's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 0.6% in the twelve months, Beijing Yuanliu Hongyuan Electronic Technology shareholders did even worse, losing 30% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 1.5%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with Beijing Yuanliu Hongyuan Electronic Technology .

But note: Beijing Yuanliu Hongyuan Electronic Technology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal