Bharat Petroleum And 2 Other Top Indian Dividend Stocks

The Indian market has experienced a flat performance over the last week, yet it has impressively risen by 40% in the past year, with earnings expected to grow by 17% per annum in the coming years. In such dynamic conditions, dividend stocks like Bharat Petroleum offer investors potential stability and income through regular payouts while navigating a rapidly evolving market landscape.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.48% | ★★★★★★ |

| Balmer Lawrie Investments (BSE:532485) | 4.58% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 5.34% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.34% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.65% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.43% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.43% | ★★★★★☆ |

| Canara Bank (NSEI:CANBK) | 3.08% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 4.09% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.12% | ★★★★★☆ |

Click here to see the full list of 20 stocks from our Top Indian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

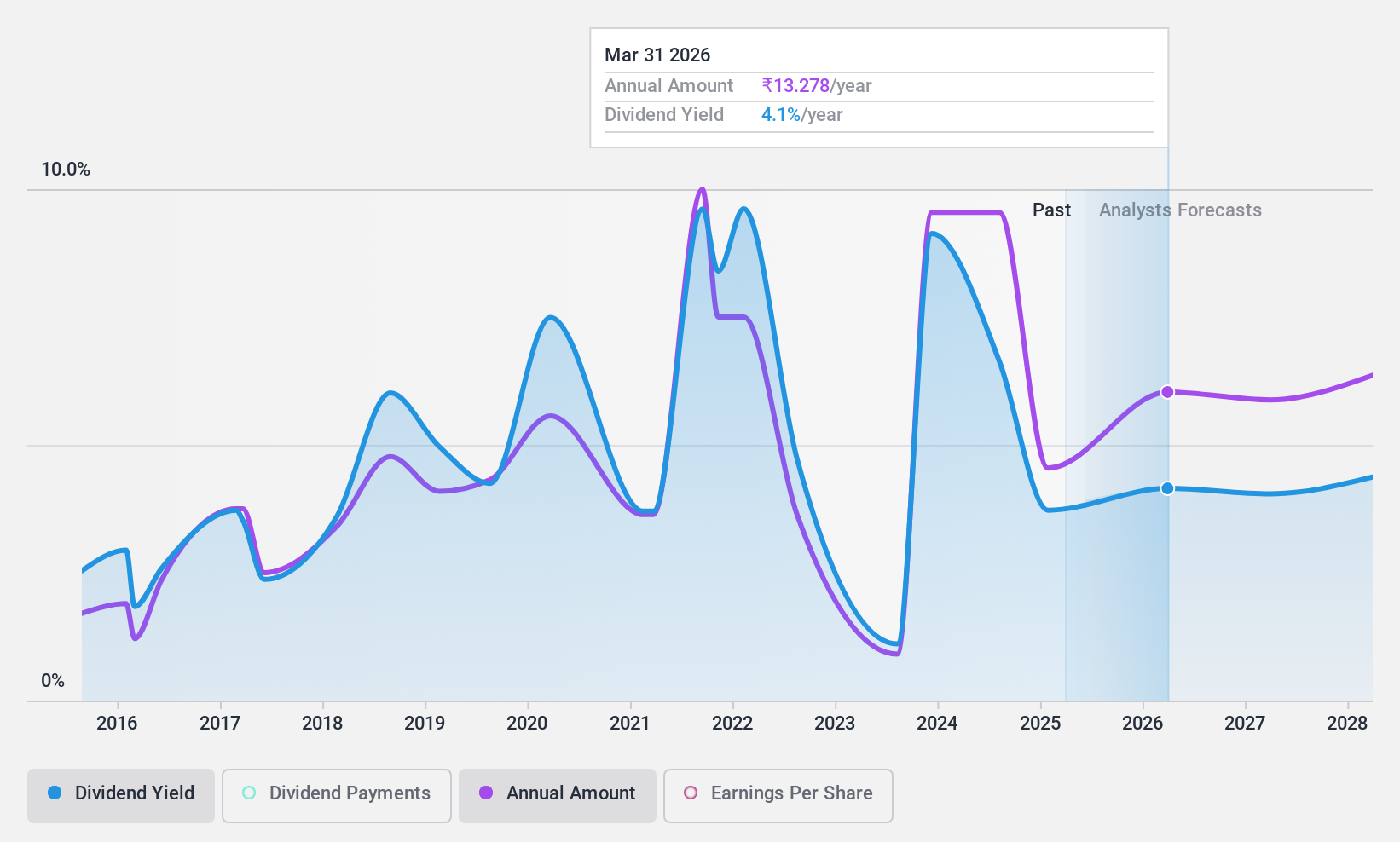

Bharat Petroleum (NSEI:BPCL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bharat Petroleum Corporation Limited focuses on refining crude oil and marketing petroleum products both in India and internationally, with a market cap of ₹1.51 trillion.

Operations: Bharat Petroleum Corporation Limited generates revenue primarily from its Downstream Petroleum segment, amounting to ₹5.07 trillion, and its Exploration & Production of Hydrocarbons segment, which contributes ₹1.92 billion.

Dividend Yield: 6%

Bharat Petroleum offers a compelling dividend yield of 6.02%, placing it among the top 25% of dividend payers in India. The company's dividends are well-covered by earnings and cash flows, with payout ratios around 33%. Despite this, its dividend history has been volatile over the past decade. Recent developments include strategic ventures into renewable energy and green hydrogen, which may impact future financials but currently do not affect its strong coverage for dividends.

- Navigate through the intricacies of Bharat Petroleum with our comprehensive dividend report here.

- According our valuation report, there's an indication that Bharat Petroleum's share price might be on the cheaper side.

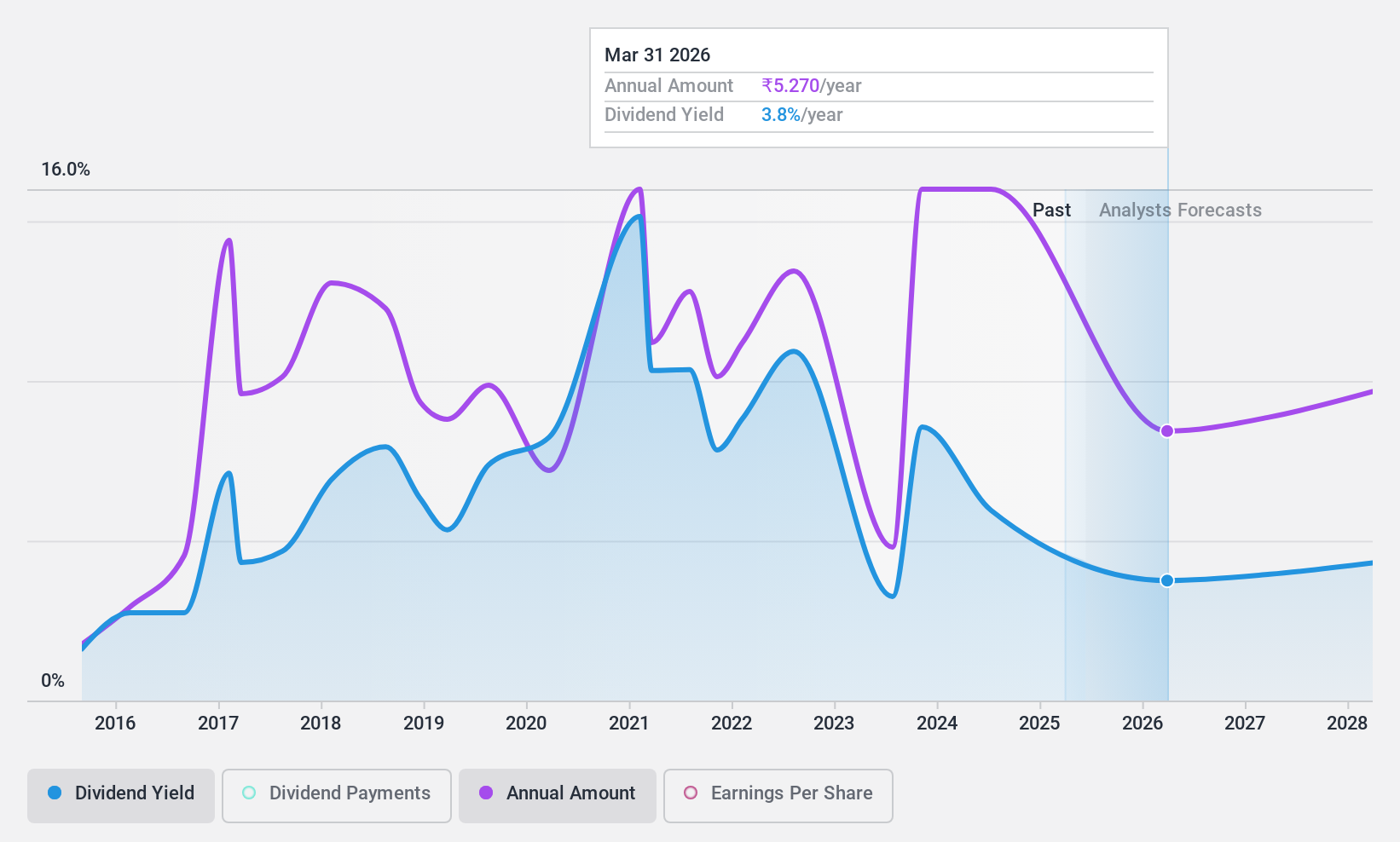

Indian Oil (NSEI:IOC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Indian Oil Corporation Limited, with a market cap of ₹2.31 trillion, refines, transports via pipelines, and markets petroleum products both in India and internationally.

Operations: Indian Oil Corporation Limited generates revenue primarily from its Petroleum Products segment, amounting to ₹8.25 trillion, and its Petrochemicals segment, contributing ₹262.95 billion.

Dividend Yield: 8.3%

Indian Oil Corporation's dividend yield of 8.34% ranks it in the top 25% of Indian dividend payers. While its dividends are well-covered by earnings and cash flows, historical volatility raises concerns about reliability. The company maintains a low payout ratio of 39.6%, supporting sustainability despite high debt levels. Recent strategic moves, such as a joint venture for biofuel development, align with long-term goals but do not immediately impact its dividend stability or financial position.

- Dive into the specifics of Indian Oil here with our thorough dividend report.

- Our valuation report unveils the possibility Indian Oil's shares may be trading at a discount.

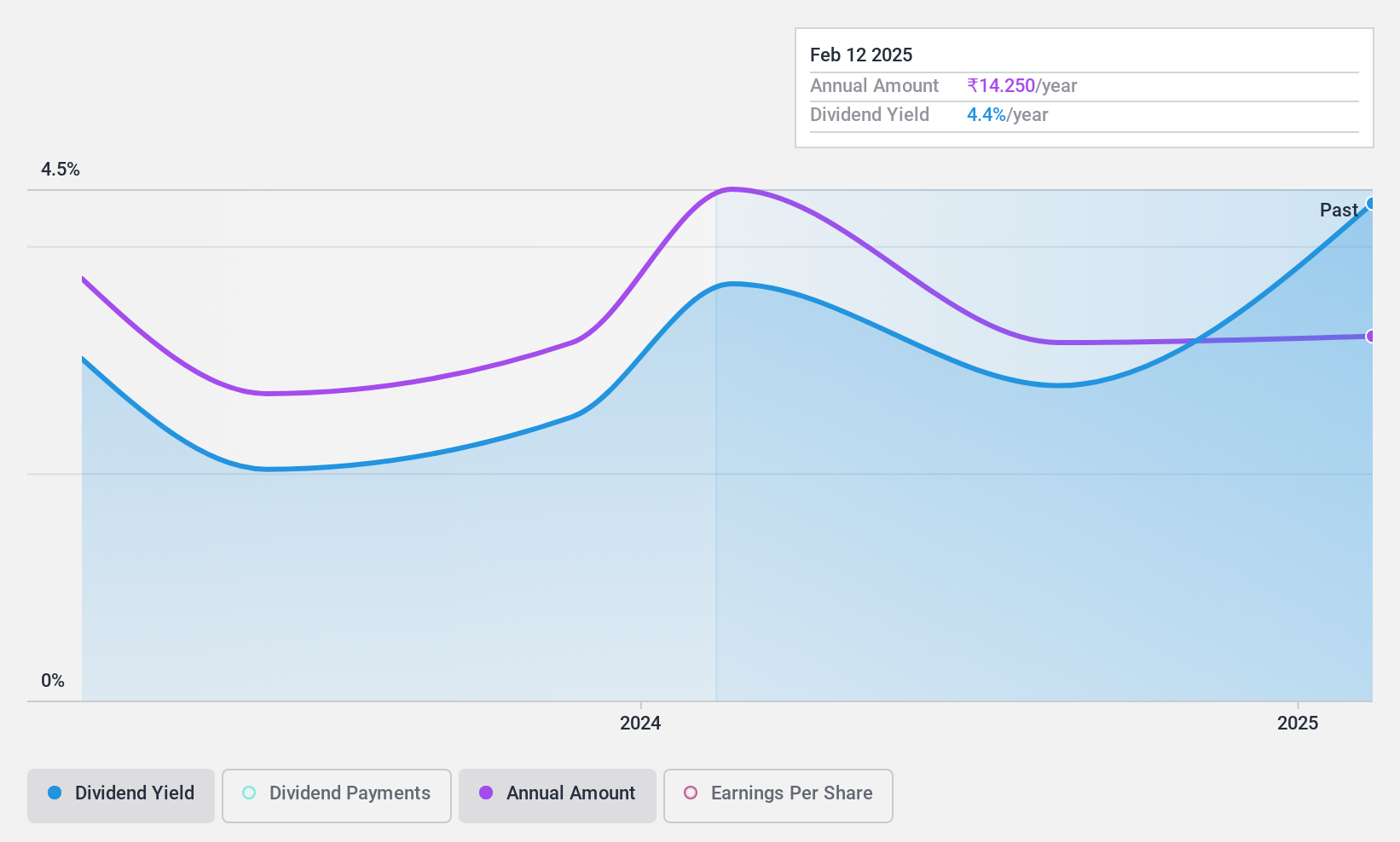

Uniparts India (NSEI:UNIPARTS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Uniparts India Limited, along with its subsidiaries, manufactures and sells engineering systems, solutions, and assemblies for off-highway vehicles across various international markets including India, the United States, Asia Pacific, Europe, and Japan; it has a market cap of ₹20.44 billion.

Operations: Uniparts India Limited generates its revenue primarily from the sale of linkage parts and components for off-highway vehicles, amounting to ₹11.04 billion.

Dividend Yield: 4.5%

Uniparts India offers a competitive dividend yield of 4.54%, placing it among the top 25% of Indian dividend payers. The company's dividends are covered by earnings and cash flows, with payout ratios of 73.8% and 56.7%, respectively, indicating sustainability despite a short two-year history of payments marked by volatility. Recent approvals for interim dividends reflect management's commitment to shareholder returns, though the track record remains unstable due to fluctuating payouts.

- Unlock comprehensive insights into our analysis of Uniparts India stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Uniparts India shares in the market.

Taking Advantage

- Click here to access our complete index of 20 Top Indian Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal