Hidden Opportunities In Hong Kong With These 3 Promising Small Caps

In recent weeks, the Hong Kong market has experienced a downturn, with the Hang Seng Index falling by 6.53% amid waning optimism about Beijing's stimulus measures. This environment of cautious sentiment and economic adjustments presents an intriguing backdrop for identifying promising small-cap stocks that may offer hidden opportunities in this dynamic region. In such conditions, a good stock is often characterized by strong fundamentals and resilience to broader market volatility, which can position it well for potential growth despite current challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Sprocomm Intelligence (SEHK:1401)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sprocomm Intelligence Limited is an investment holding company involved in the research and development, design, manufacture, and sale of mobile phones across various international markets including China, India, Algeria, and Bangladesh with a market capitalization of HK$5.31 billion.

Operations: Sprocomm Intelligence generates revenue primarily from its wireless communications equipment segment, amounting to CN¥3.27 billion. The company's financial performance is characterized by its focus on this key revenue stream across multiple international markets.

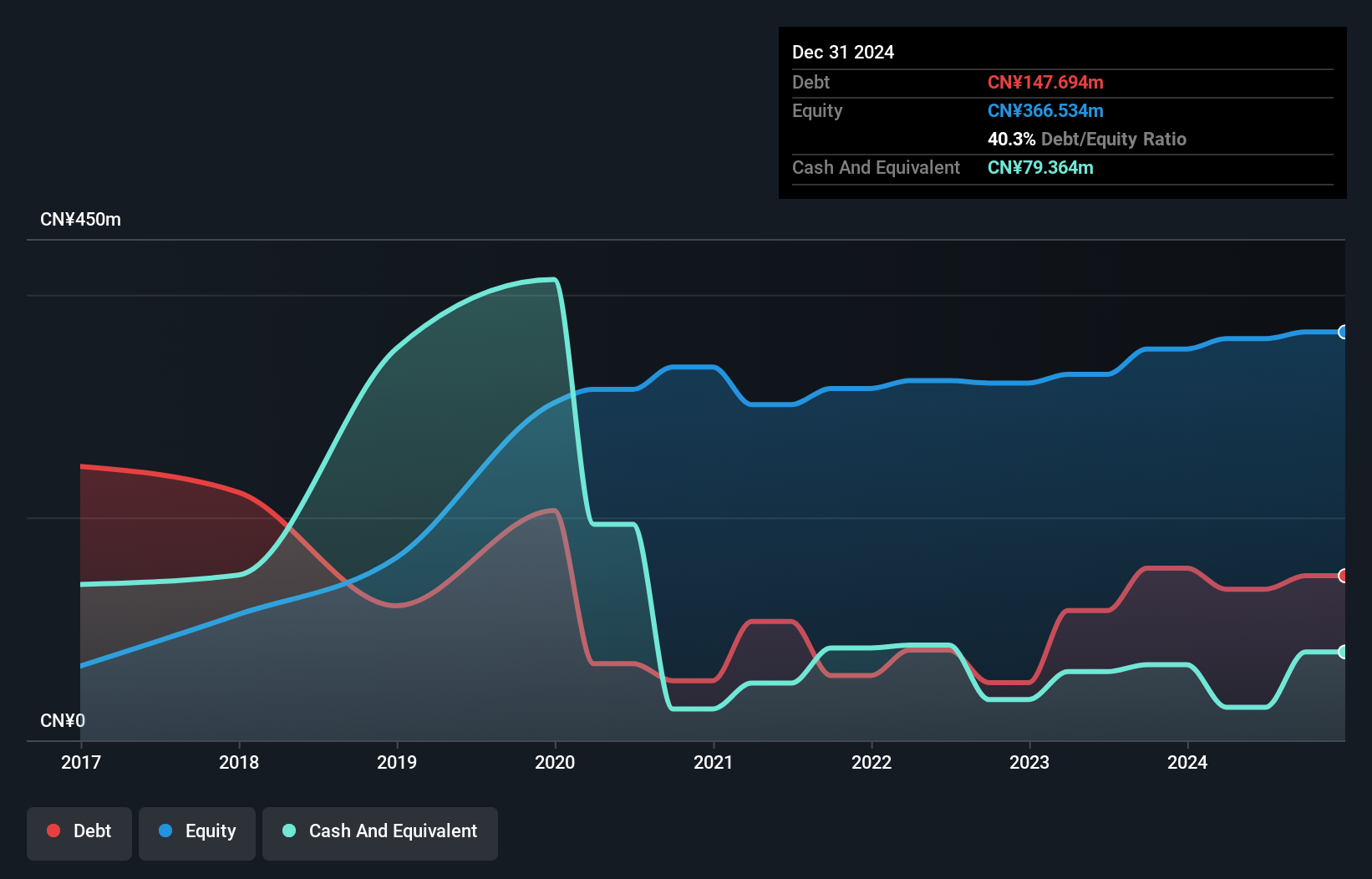

Sprocomm Intelligence, a tech player in Hong Kong, recently saw its earnings soar by 301% over the past year, outpacing the industry average of -0.6%. Despite this impressive growth, it faces challenges with interest payments only covered 1.8 times by EBIT. The company's debt to equity ratio has improved significantly from 73.8% to 37.6% over five years and trades at a significant discount of 93.6% below its estimated fair value.

- Take a closer look at Sprocomm Intelligence's potential here in our health report.

Explore historical data to track Sprocomm Intelligence's performance over time in our Past section.

Plover Bay Technologies (SEHK:1523)

Simply Wall St Value Rating: ★★★★★☆

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers, with a market capitalization of HK$5.40 billion.

Operations: The company's revenue is primarily derived from the sale of SD-WAN routers, with mobile first connectivity contributing $59.87 million and fixed first connectivity adding $15.19 million. Additionally, software licenses and warranty and support services generate $31.86 million in revenue.

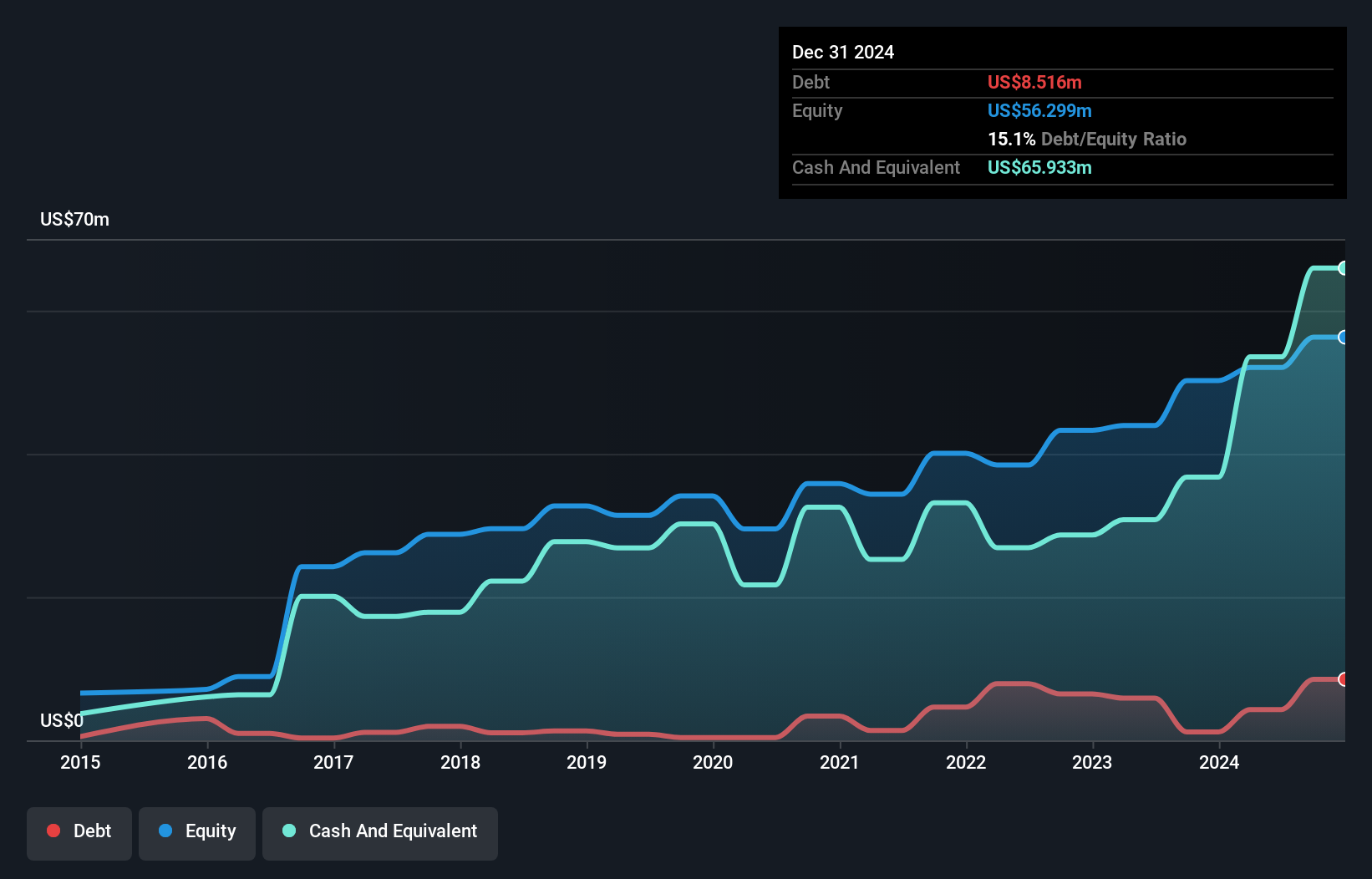

Plover Bay Technologies, a smaller player in the tech space, shows promising growth with earnings up 41.4% over the past year, outpacing its industry peers. The company is trading at 51.5% below its estimated fair value, suggesting potential undervaluation. Recent financials highlight sales of US$57 million and net income of US$19 million for H1 2024. A dividend increase to HKD 0.1083 per share signals confidence in ongoing performance and shareholder returns.

Wanguo Gold Group (SEHK:3939)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wanguo Gold Group Limited is an investment holding company involved in mining, ore processing, and the sale of concentrate products in China and the Solomon Islands, with a market capitalization of approximately HK$8.52 billion.

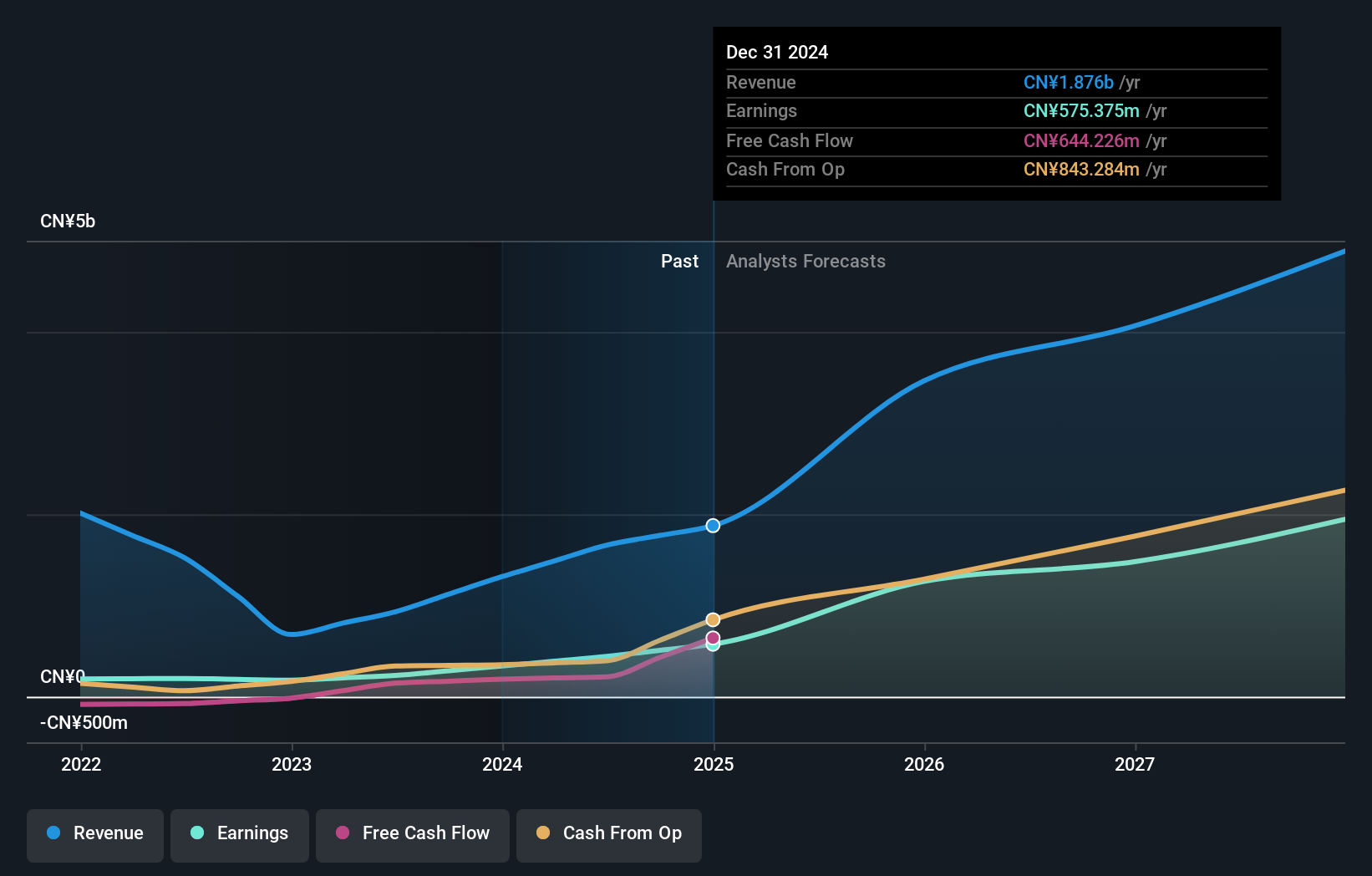

Operations: The company generates revenue primarily from its Yifeng Project and Solomon Project, contributing CN¥749.25 million and CN¥912.63 million, respectively.

Wanguo Gold Group, a smaller player in the mining sector, recently reported impressive earnings growth of 89.9%, outpacing the industry average of 22.5%. The company's debt is comfortably managed with interest coverage at 91.7 times EBIT, and it holds more cash than its total debt. Despite some shareholder dilution over the past year, Wanguo's high-quality earnings and positive free cash flow position it well for future opportunities following its addition to the S&P Global BMI Index.

Where To Now?

- Get an in-depth perspective on all 168 SEHK Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal