3 Dividend Stocks On SEHK Yielding Up To 7.1 Percent

As global markets experience varied economic shifts, Hong Kong's Hang Seng Index has notably declined by 6.53% amid waning optimism about Beijing’s stimulus measures. In this fluctuating market environment, dividend stocks can offer a measure of stability and income, making them an attractive option for investors seeking to navigate uncertain times with potentially reliable returns.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| China Hongqiao Group (SEHK:1378) | 9.04% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.24% | ★★★★★☆ |

| Chow Tai Fook Jewellery Group (SEHK:1929) | 7.91% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.00% | ★★★★★☆ |

| Playmates Toys (SEHK:869) | 8.82% | ★★★★★☆ |

| Lion Rock Group (SEHK:1127) | 8.09% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.13% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 9.11% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.77% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 7.84% | ★★★★★☆ |

Click here to see the full list of 96 stocks from our Top SEHK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

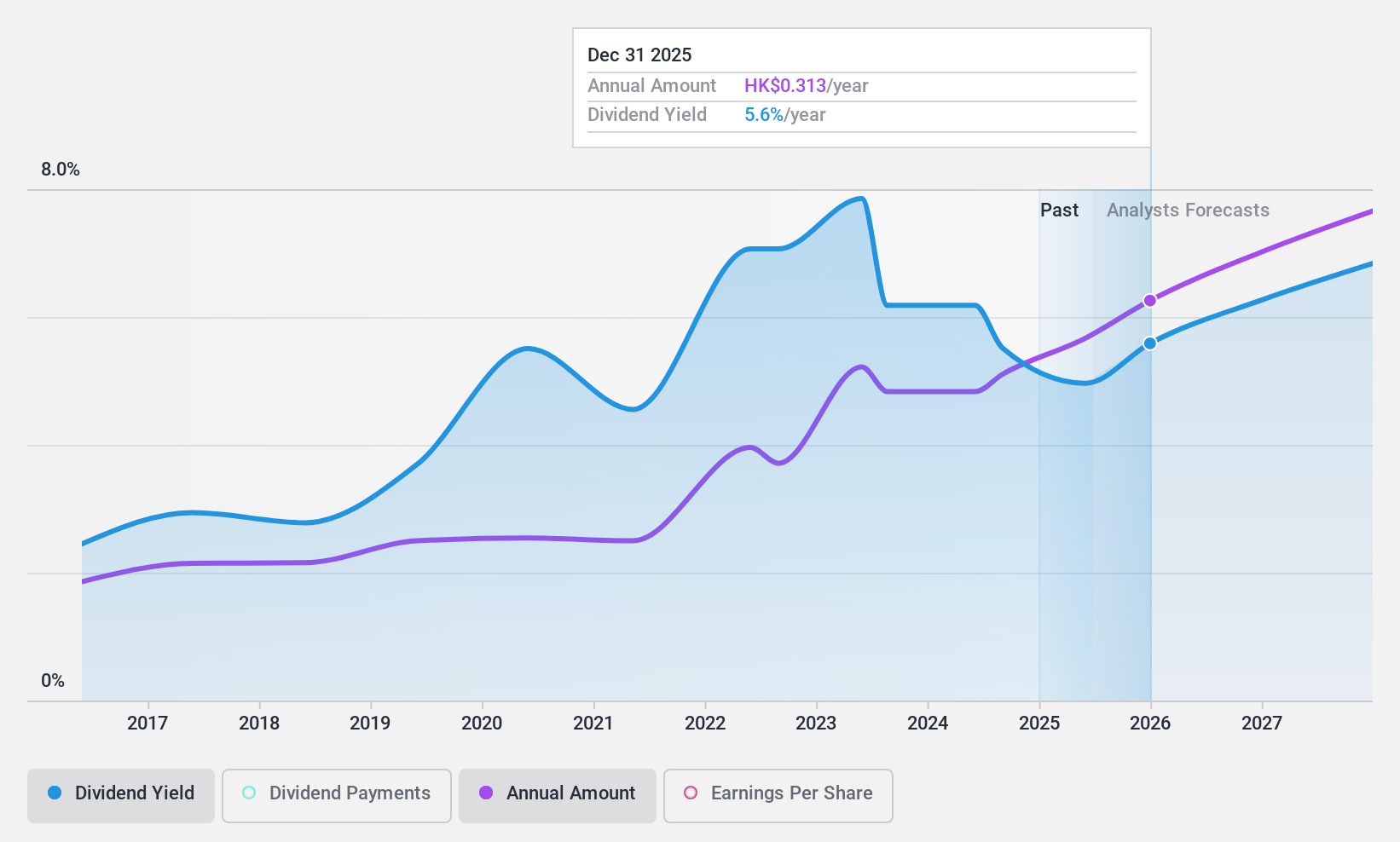

China Telecom (SEHK:728)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Telecom Corporation Limited, along with its subsidiaries, offers wireline and mobile telecommunications services mainly in the People's Republic of China and has a market capitalization of approximately HK$612.42 billion.

Operations: China Telecom Corporation Limited generates revenue primarily from its Integrated Telecommunications Business, amounting to CN¥515.19 billion.

Dividend Yield: 5.9%

China Telecom's dividend payments have been volatile over the past decade, with a payout ratio of 73.3% covered by earnings and a cash payout ratio of 67.3%, suggesting reasonable coverage despite an unstable track record. The recent interim dividend increase to RMB 0.1671 per share reflects its commitment to shareholder returns, though its yield remains below the top tier in Hong Kong's market. Recent leadership changes and auditor appointments may impact future financial strategies.

- Delve into the full analysis dividend report here for a deeper understanding of China Telecom.

- Our valuation report here indicates China Telecom may be undervalued.

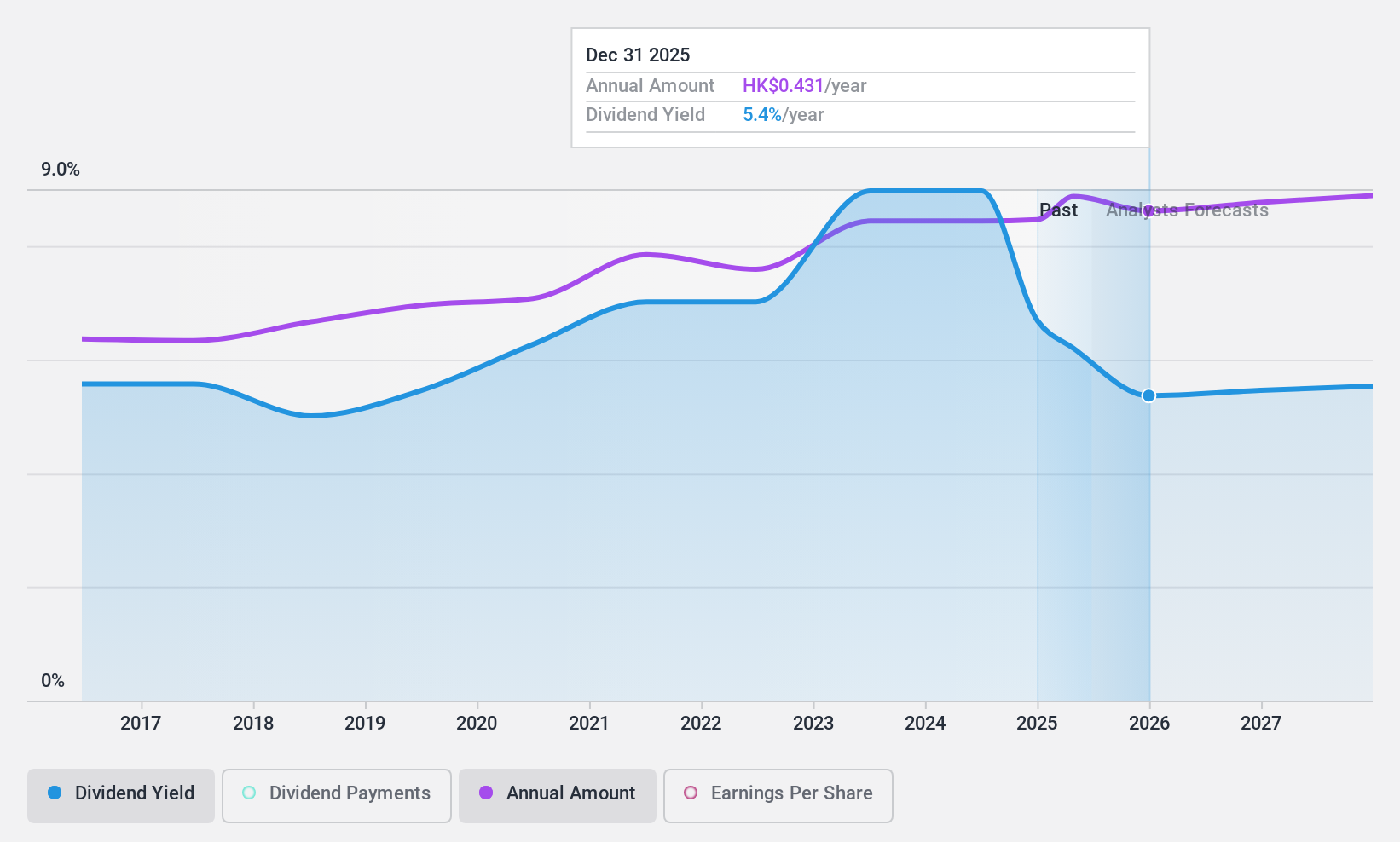

China Construction Bank (SEHK:939)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Construction Bank Corporation provides a range of banking and financial services to individual and corporate clients in China and internationally, with a market cap of HK$1.54 trillion.

Operations: China Construction Bank Corporation's revenue is primarily derived from its Personal Financial Business (CN¥289.81 billion), Corporate Finance Business (CN¥161.48 billion), and Treasury and Asset Management Business (CN¥137.06 billion).

Dividend Yield: 7.1%

China Construction Bank's dividend payments have been stable and growing over the past decade, supported by a low payout ratio of 30.5%, ensuring sustainability. Despite a yield of 7.13% falling short of Hong Kong's top tier, the bank trades at good value compared to peers and below its estimated fair value. Recent earnings showed slight declines, yet dividends remain well-covered by earnings. Leadership changes may influence future strategies but do not currently impact dividend reliability.

- Click to explore a detailed breakdown of our findings in China Construction Bank's dividend report.

- Upon reviewing our latest valuation report, China Construction Bank's share price might be too pessimistic.

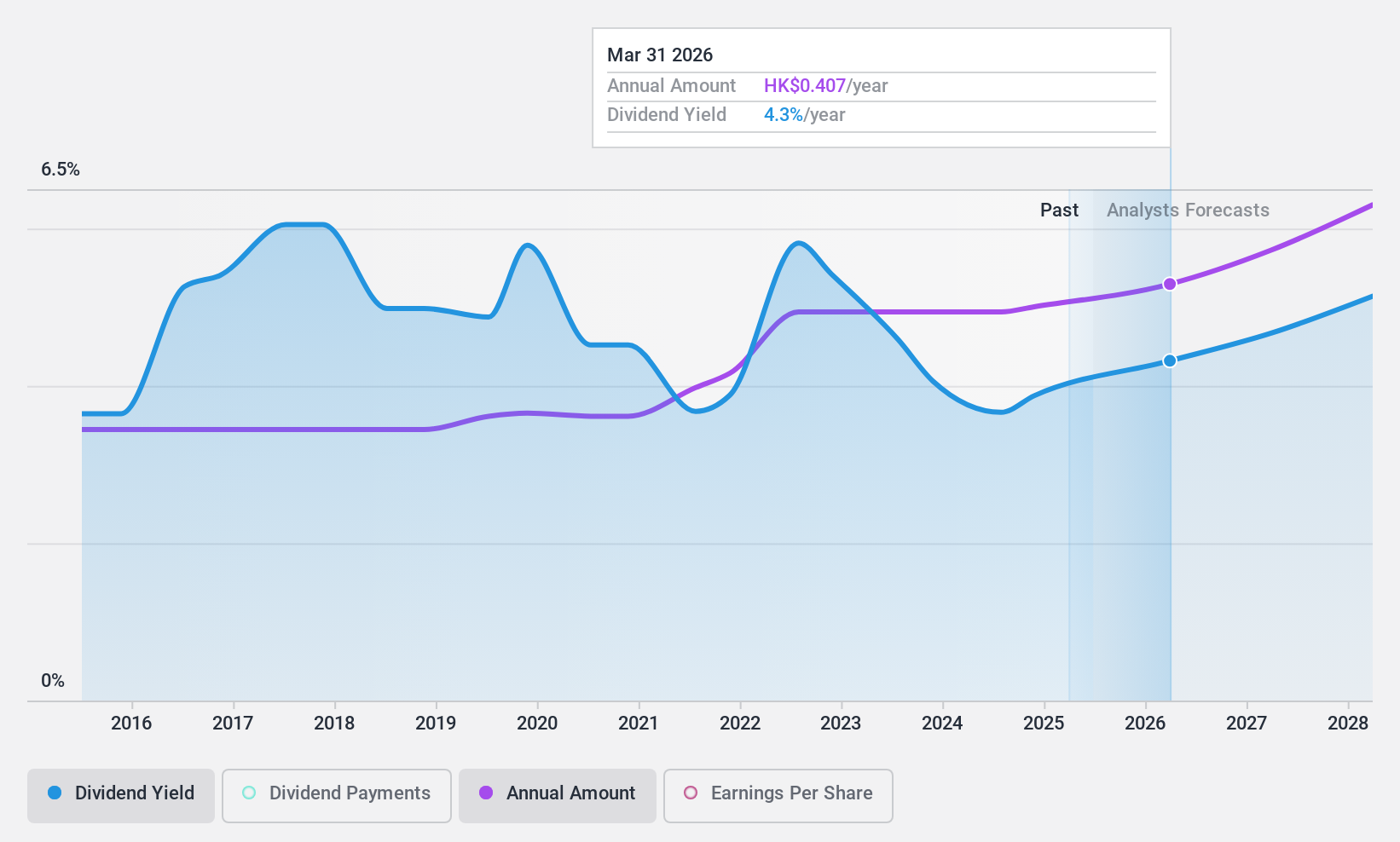

Lenovo Group (SEHK:992)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services, with a market cap of HK$135.46 billion.

Operations: Lenovo Group's revenue is primarily generated from its Intelligent Devices Group (IDG) at $45.76 billion, followed by the Infrastructure Solutions Group (ISG) at $10.17 billion, and the Solutions and Services Group (SSG) at $7.64 billion.

Dividend Yield: 3.5%

Lenovo Group offers a stable dividend yield of 3.46%, supported by a reasonable payout ratio of 57.8% and cash flow coverage at 67.4%. While not among the highest in Hong Kong, its dividends have been reliable and growing over the past decade. Recent earnings growth has bolstered financial stability, with sales reaching US$15.45 billion in Q1 2024, enhancing dividend sustainability despite recent executive changes and product innovations like AI-optimized devices.

- Take a closer look at Lenovo Group's potential here in our dividend report.

- The valuation report we've compiled suggests that Lenovo Group's current price could be quite moderate.

Seize The Opportunity

- Explore the 96 names from our Top SEHK Dividend Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal