Sunzen Biotech Berhad's (KLSE:SUNZEN) Shareholders Might Be Looking For Exit

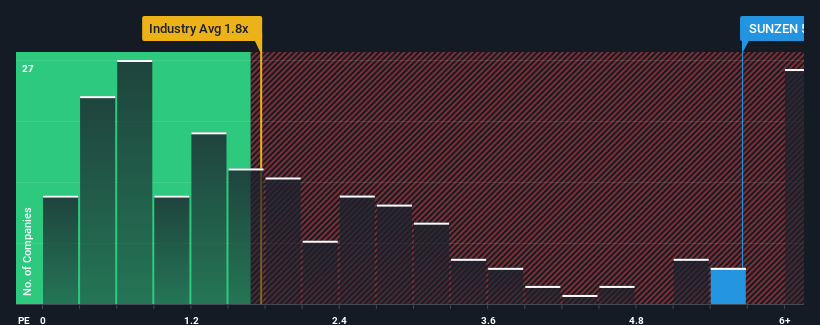

When close to half the companies in the Personal Products industry in Malaysia have price-to-sales ratios (or "P/S") below 1.7x, you may consider Sunzen Biotech Berhad (KLSE:SUNZEN) as a stock to avoid entirely with its 5.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Sunzen Biotech Berhad

How Sunzen Biotech Berhad Has Been Performing

Sunzen Biotech Berhad has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sunzen Biotech Berhad's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Sunzen Biotech Berhad?

The only time you'd be truly comfortable seeing a P/S as steep as Sunzen Biotech Berhad's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 9.7% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Sunzen Biotech Berhad's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Sunzen Biotech Berhad currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Sunzen Biotech Berhad that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal