Is Guangzhou Automobile Group (HKG:2238) Using Too Much Debt?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Guangzhou Automobile Group Co., Ltd. (HKG:2238) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Guangzhou Automobile Group

What Is Guangzhou Automobile Group's Net Debt?

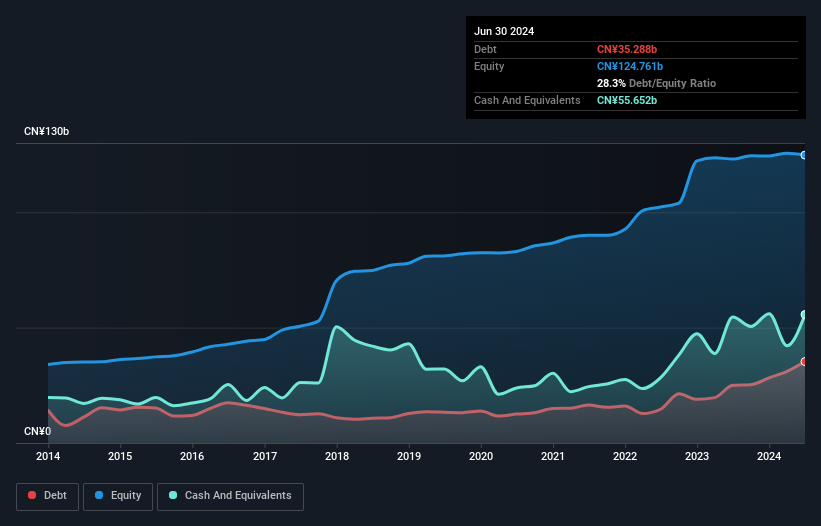

The image below, which you can click on for greater detail, shows that at June 2024 Guangzhou Automobile Group had debt of CN¥35.3b, up from CN¥25.0b in one year. But on the other hand it also has CN¥55.7b in cash, leading to a CN¥20.4b net cash position.

A Look At Guangzhou Automobile Group's Liabilities

Zooming in on the latest balance sheet data, we can see that Guangzhou Automobile Group had liabilities of CN¥73.4b due within 12 months and liabilities of CN¥18.1b due beyond that. Offsetting this, it had CN¥55.7b in cash and CN¥21.8b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥14.1b.

Guangzhou Automobile Group has a market capitalization of CN¥66.5b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. While it does have liabilities worth noting, Guangzhou Automobile Group also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Guangzhou Automobile Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Guangzhou Automobile Group made a loss at the EBIT level, and saw its revenue drop to CN¥114b, which is a fall of 7.6%. We would much prefer see growth.

So How Risky Is Guangzhou Automobile Group?

Although Guangzhou Automobile Group had an earnings before interest and tax (EBIT) loss over the last twelve months, it made a statutory profit of CN¥3.0b. So when you consider it has net cash, along with the statutory profit, the stock probably isn't as risky as it might seem, at least in the short term. Until we see some positive EBIT, we're a bit cautious of the stock, not least because of the rather modest revenue growth. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for Guangzhou Automobile Group you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal