Investors Continue Waiting On Sidelines For Lu Thai Textile Co., Ltd. (SZSE:000726)

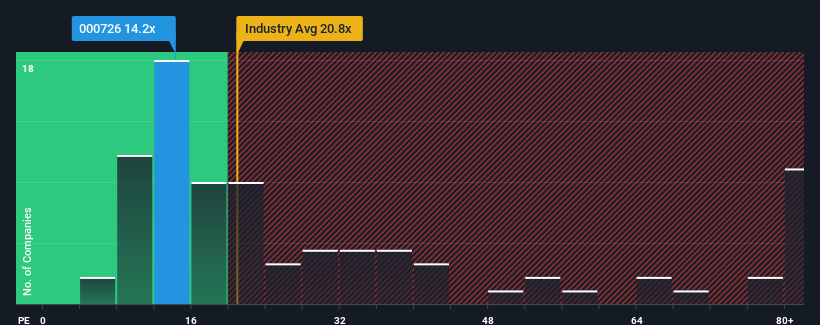

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 32x, you may consider Lu Thai Textile Co., Ltd. (SZSE:000726) as a highly attractive investment with its 14.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings that are retreating more than the market's of late, Lu Thai Textile has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Lu Thai Textile

How Is Lu Thai Textile's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Lu Thai Textile's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 54%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 268% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 23% per annum over the next three years. That's shaping up to be materially higher than the 19% per year growth forecast for the broader market.

With this information, we find it odd that Lu Thai Textile is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Lu Thai Textile's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Lu Thai Textile currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Lu Thai Textile you should know about.

If these risks are making you reconsider your opinion on Lu Thai Textile, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal