3 Chinese Stocks That Could Be Trading Below Their Estimated Value

Amid recent declines in Chinese equities, with the Shanghai Composite Index and blue-chip CSI 300 both experiencing significant drops, investors are closely monitoring potential opportunities that may arise from these market shifts. In this context, identifying undervalued stocks can be crucial as they might offer a chance to capitalize on discrepancies between current market prices and their estimated intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HangzhouS MedTech (SHSE:688581) | CN¥56.83 | CN¥109.13 | 47.9% |

| Beijing Konruns PharmaceuticalLtd (SHSE:603590) | CN¥23.11 | CN¥46.03 | 49.8% |

| Wuhan Keqian BiologyLtd (SHSE:688526) | CN¥12.95 | CN¥25.45 | 49.1% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥30.96 | CN¥58.53 | 47.1% |

| Crystal Growth & Energy EquipmentLtd (SHSE:688478) | CN¥28.18 | CN¥56.04 | 49.7% |

| Neusoft (SHSE:600718) | CN¥9.74 | CN¥19.30 | 49.5% |

| Seres GroupLtd (SHSE:601127) | CN¥89.89 | CN¥172.12 | 47.8% |

| Brilliance Technology (SZSE:300542) | CN¥20.48 | CN¥40.62 | 49.6% |

| Ningbo Jifeng Auto Parts (SHSE:603997) | CN¥12.95 | CN¥25.82 | 49.8% |

| Yangmei ChemicalLtd (SHSE:600691) | CN¥2.07 | CN¥3.96 | 47.7% |

Let's dive into some prime choices out of the screener.

Ficont Industry (Beijing) (SHSE:605305)

Overview: Ficont Industry (Beijing) Co., Ltd. manufactures and supplies wind turbine tower internals and safety systems for wind turbine manufacturers in China and internationally, with a market cap of CN¥5.90 billion.

Operations: The company generates revenue of CN¥1.23 billion from its Construction Machinery & Equipment segment.

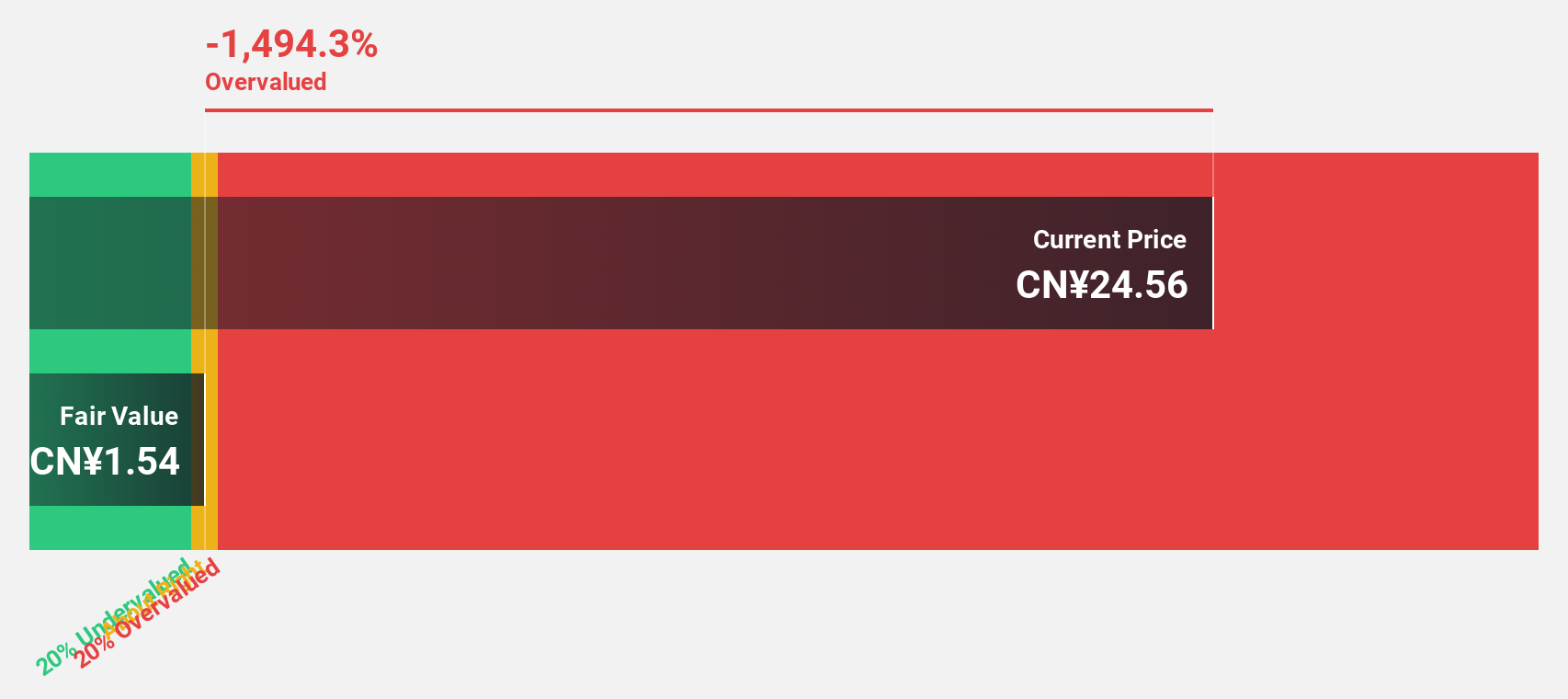

Estimated Discount To Fair Value: 38.8%

Ficont Industry (Beijing) is trading at CN¥27.77, significantly below its estimated fair value of CN¥45.4, indicating a substantial undervaluation based on discounted cash flows. The company reported strong earnings growth with net income rising to CN¥140.43 million for the half year ended June 30, 2024, from CN¥81.76 million the previous year. Revenue is forecast to grow at 25.3% annually, outpacing the Chinese market's average growth rate of 13.2%.

- Our comprehensive growth report raises the possibility that Ficont Industry (Beijing) is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Ficont Industry (Beijing)'s balance sheet health report.

Beijing SDL TechnologyLtd (SZSE:002658)

Overview: Beijing SDL Technology Co., Ltd. develops and sells environmental monitoring products in China, with a market cap of CN¥3.88 billion.

Operations: The company's revenue segments include the development and sale of environmental monitoring products in China.

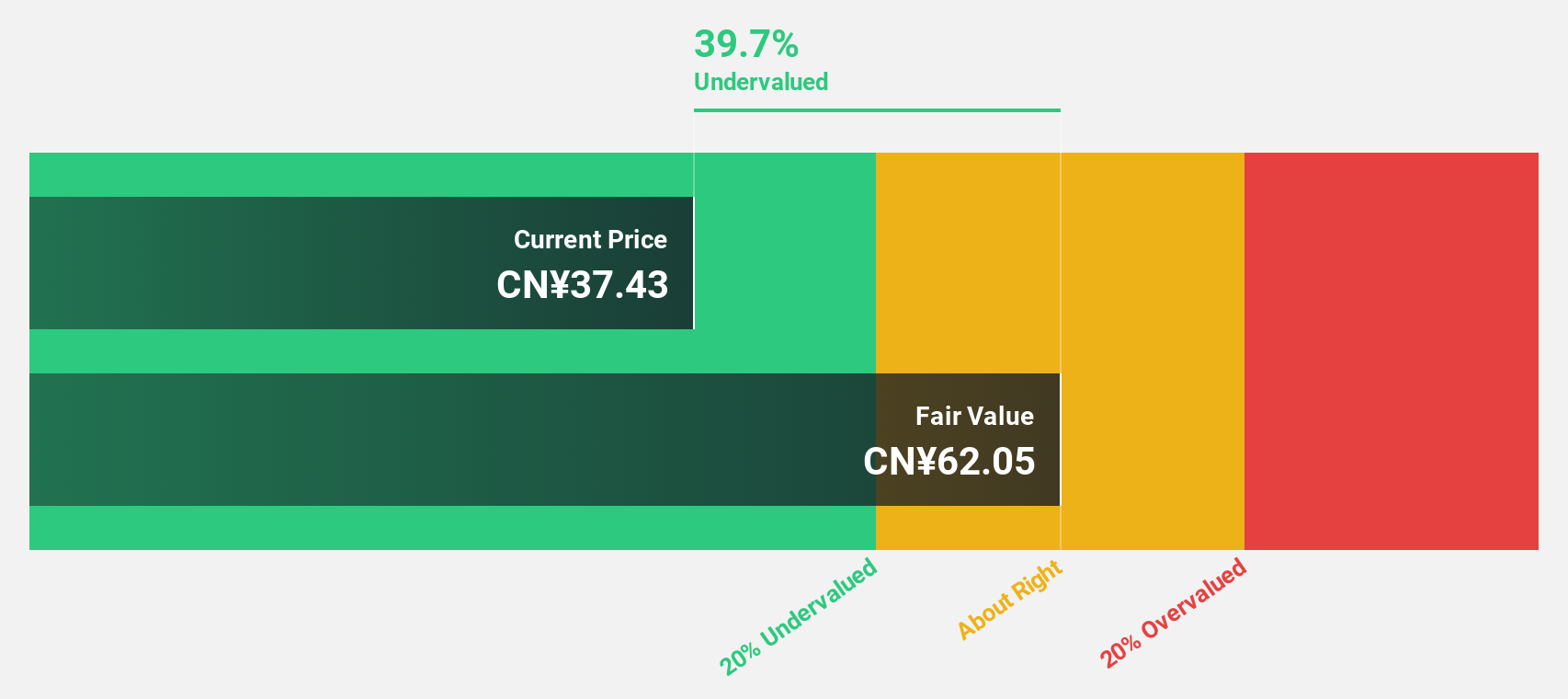

Estimated Discount To Fair Value: 40.8%

Beijing SDL Technology Ltd. is trading at CN¥6.22, significantly below its estimated fair value of CN¥10.5, highlighting a substantial undervaluation based on discounted cash flows. Despite a recent decline in half-year revenue to CN¥574.8 million from CN¥637.16 million and net income to CN¥49.38 million from CN¥82.13 million year-over-year, earnings are forecast to grow 23.7% annually, surpassing the Chinese market's average growth rate of 23.3%.

- According our earnings growth report, there's an indication that Beijing SDL TechnologyLtd might be ready to expand.

- Get an in-depth perspective on Beijing SDL TechnologyLtd's balance sheet by reading our health report here.

Bichamp Cutting Technology (Hunan) (SZSE:002843)

Overview: Bichamp Cutting Technology (Hunan) Co., Ltd. operates in the cutting tools industry and has a market cap of CN¥4.12 billion.

Operations: Bichamp Cutting Technology (Hunan) Co., Ltd. does not provide specific revenue segments in the available data.

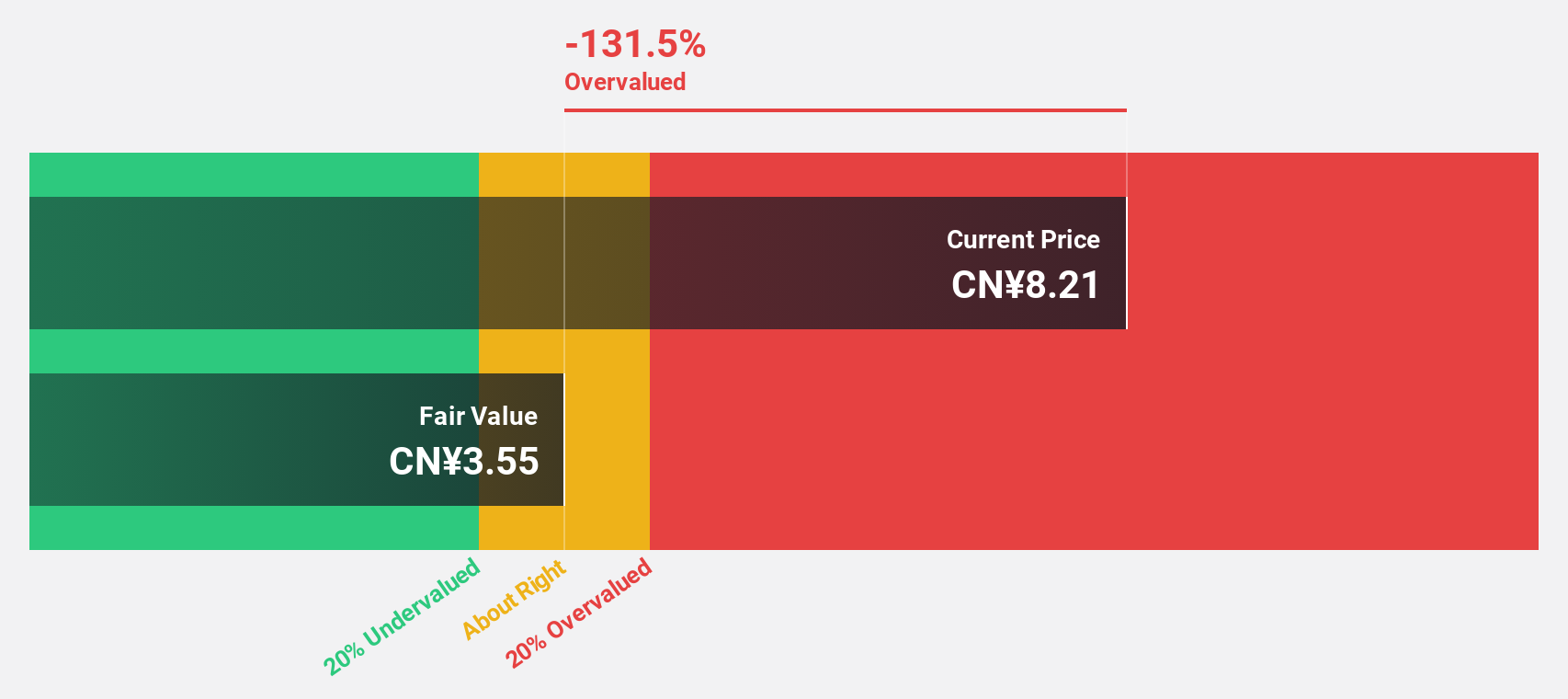

Estimated Discount To Fair Value: 22.7%

Bichamp Cutting Technology (Hunan) Co., Ltd. is trading at CN¥16.98, well below its estimated fair value of CN¥21.96, indicating a significant undervaluation based on discounted cash flows. Despite recent volatility and past shareholder dilution, the company's earnings are projected to grow 22.88% annually over the next three years, outpacing market revenue growth rates with a forecasted increase of 23% per year. Recent inclusion in the S&P Global BMI Index may enhance visibility among investors.

- The analysis detailed in our Bichamp Cutting Technology (Hunan) growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Bichamp Cutting Technology (Hunan).

Next Steps

- Reveal the 109 hidden gems among our Undervalued Chinese Stocks Based On Cash Flows screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal