High Growth Tech in China Featuring Three Prominent Stocks

Amidst a backdrop of waning optimism about Beijing's stimulus measures, Chinese equities have experienced notable declines, with the Shanghai Composite Index and the blue-chip CSI 300 both losing ground over a holiday-shortened week. In this environment, identifying high-growth tech stocks in China involves looking for companies that demonstrate resilience through innovative strategies and robust business models capable of navigating current economic challenges.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi'an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Suzhou TFC Optical Communication | 32.62% | 32.32% | ★★★★★★ |

| Zhongji Innolight | 32.62% | 31.72% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.74% | 28.58% | ★★★★★★ |

| Cubic Sensor and InstrumentLtd | 24.24% | 38.87% | ★★★★★★ |

| Eoptolink Technology | 43.31% | 44.06% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 37.55% | 103.97% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Zhejiang Wazam New MaterialsLTD (SHSE:603186)

Simply Wall St Growth Rating: ★★★★★☆

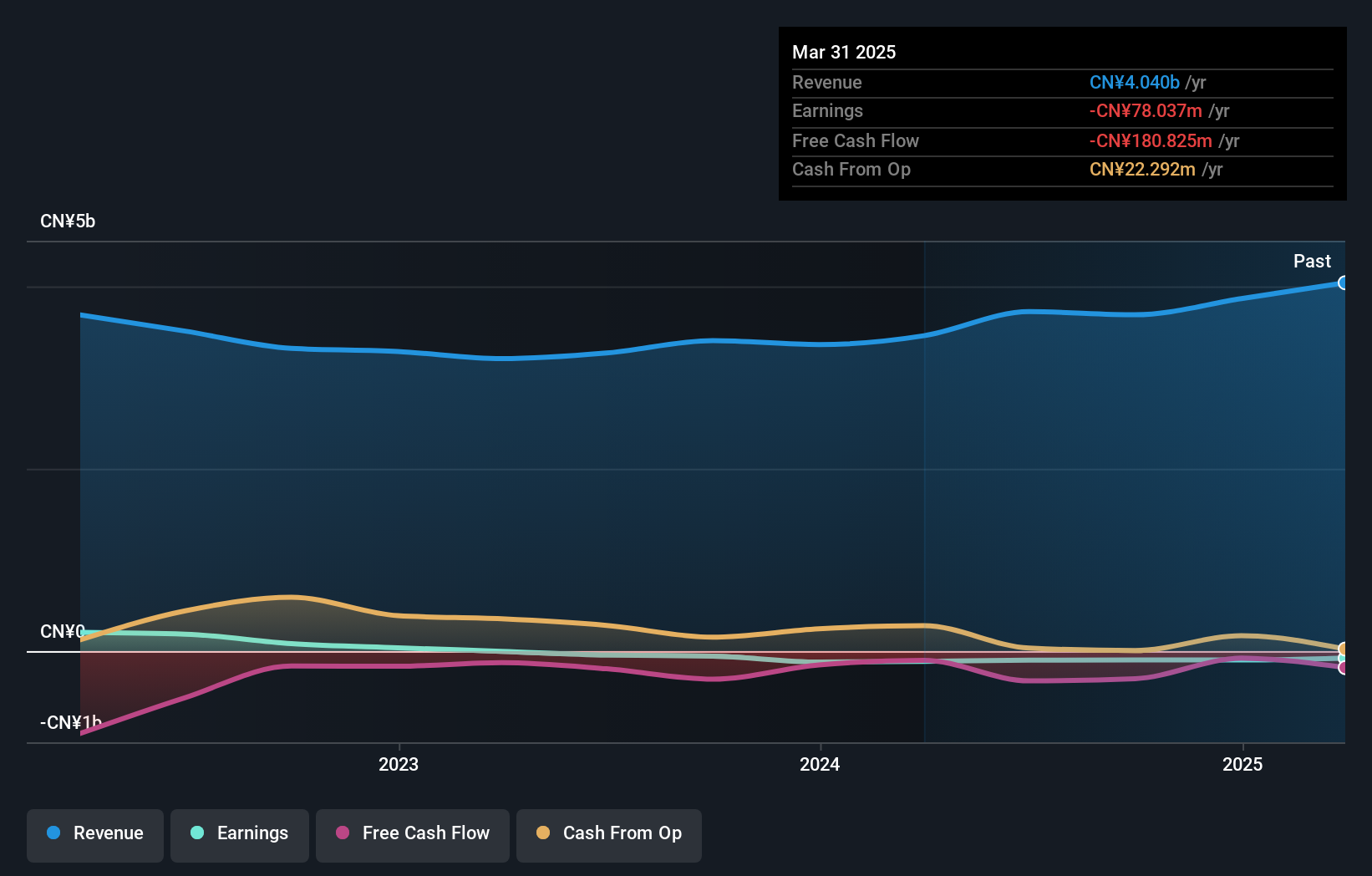

Overview: Zhejiang Wazam New Materials Co., LTD. is involved in the design, development, production, and sale of copper clad laminates, adhesive sheets, composite materials, and membrane materials with a market capitalization of CN¥3.85 billion.

Operations: Wazam New Materials focuses on producing and selling copper clad laminates, adhesive sheets, composite materials, and membrane materials. The company operates within a market valued at CN¥3.85 billion.

Zhejiang Wazam New Materials Co., LTD. has demonstrated a robust turnaround in its recent financial performance, with revenue soaring to CNY 1.94 billion, up from CNY 1.58 billion the previous year, and transforming a net loss into a profit of CNY 9.97 million. This growth trajectory is underscored by an expected annual revenue increase of 22.4%, significantly outpacing the Chinese market average of 13.2%. The company's commitment to innovation is evident from its R&D investments, crucial for sustaining its competitive edge in the high-tech materials sector. Despite current unprofitability and high share price volatility, forecasts suggest Zhejiang Wazam is on a path to profitability with earnings projected to surge by approximately 168% annually over the next three years, positioning it potentially as an emerging leader in China's tech-driven markets.

Jilin OLED Material Tech (SHSE:688378)

Simply Wall St Growth Rating: ★★★★★☆

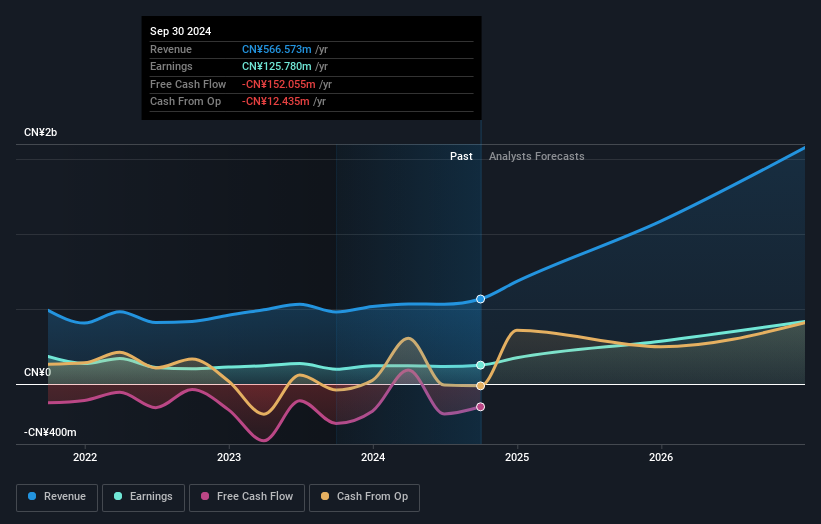

Overview: Jilin OLED Material Tech Co., Ltd. focuses on the research, development, production, and sale of organic electroluminescent materials and equipment for China's new display industry, with a market capitalization of CN¥4.60 billion.

Operations: Jilin OLED Material Tech Co., Ltd. generates revenue primarily through the sale of organic electroluminescent materials and equipment, catering to China's burgeoning display industry. The company has a market capitalization of CN¥4.60 billion, reflecting its significant role in this sector.

Jilin OLED Material Tech, amidst a challenging backdrop with a -14.2% dip in earnings last year, still projects a vibrant future with expected annual revenue and profit surges of 42.2% and 46.4%, respectively, outpacing the Chinese market projections of 13.2% and 23.3%. This growth is underpinned by significant R&D investments, which have consistently been above industry norms to fuel innovations in OLED technology—a critical factor for maintaining competitiveness in the fast-evolving tech landscape. Despite recent earnings contraction and high share price volatility, these robust growth forecasts paired with strategic focus on high-demand sectors position Jilin OLED for potential leadership in China’s tech scene.

- Click to explore a detailed breakdown of our findings in Jilin OLED Material Tech's health report.

Assess Jilin OLED Material Tech's past performance with our detailed historical performance reports.

China Leadshine Technology (SZSE:002979)

Simply Wall St Growth Rating: ★★★★★☆

Overview: China Leadshine Technology Co., Ltd. is a company that designs, manufactures, and sells motion control equipment and components in China, with a market cap of CN¥7.68 billion.

Operations: Leadshine Technology focuses on the design, manufacturing, and sales of motion control equipment and components in China. The company generates revenue primarily from these product lines, contributing significantly to its market presence.

Amidst a robust backdrop of innovation, China Leadshine Technology has demonstrated commendable growth, with half-year revenues climbing to CNY 823.17 million from CNY 712.96 million the previous year and net income surging by over 54% to CNY 116.36 million. This financial upswing is propelled by a sharp focus on R&D, where expenses are strategically aligned to foster advancements in technology sectors critical for long-term competitiveness. Notably, the company's revenue and earnings are expected to grow at an impressive rate of 24.6% and 32.1% per year respectively, outstripping broader market projections of 13.2% and 23.3%. Despite recent dividend cuts which reflect a strategic reallocation towards growth investments rather than shareholder payouts in the short term, Leadshine's aggressive investment in innovation positions it well within China’s high-tech landscape for potential future gains.

Where To Now?

- Discover the full array of 256 Chinese High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal