3 Top Chinese Dividend Stocks Offering Up To 6.7% Yield

As Chinese equities recently faced declines amid fading optimism about Beijing's stimulus measures, the Shanghai Composite Index and the blue-chip CSI 300 both experienced notable losses. Despite these challenges, investors continue to seek opportunities in dividend stocks that offer stability and income potential in a volatile market environment. In such conditions, a good dividend stock is characterized by consistent payouts and strong fundamentals that can withstand economic uncertainties.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Midea Group (SZSE:000333) | 3.95% | ★★★★★★ |

| Kweichow Moutai (SHSE:600519) | 3.22% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.20% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.34% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.24% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.53% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.50% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.35% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.74% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.11% | ★★★★★★ |

Click here to see the full list of 206 stocks from our Top Chinese Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

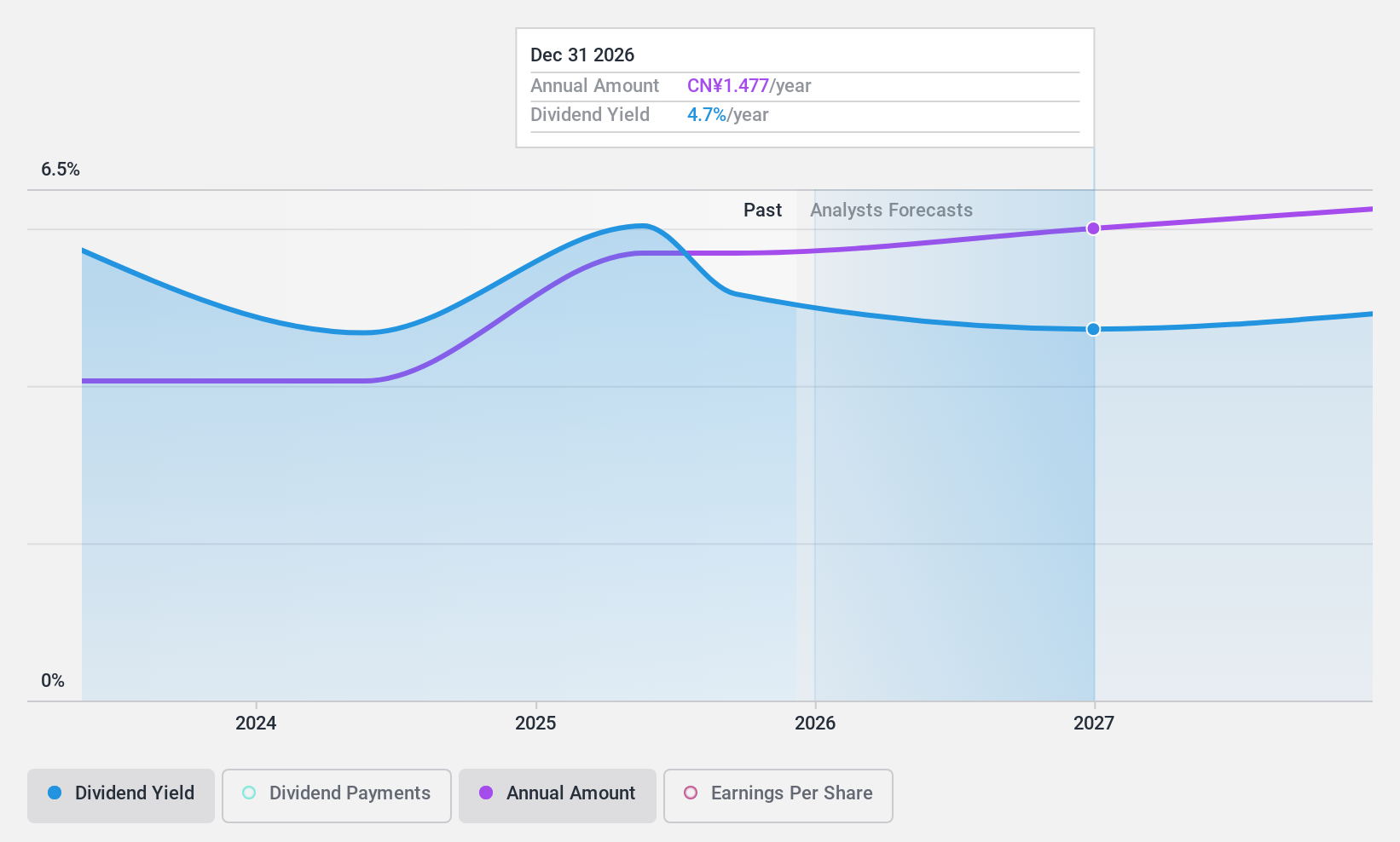

Yunnan Yuntianhua (SHSE:600096)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yunnan Yuntianhua Co., Ltd. operates in phosphate ore mining, chemical fertilizers, engineering materials, agriculture, and trade and logistics sectors in China with a market cap of CN¥41.36 billion.

Operations: Yunnan Yuntianhua Co., Ltd.'s revenue is derived from its operations in phosphate ore mining, chemical fertilizers, engineering materials, agriculture, and trade and logistics within China.

Dividend Yield: 4.4%

Yunnan Yuntianhua presents a mixed dividend profile. Despite trading at 72.4% below its estimated fair value, the company has an unstable dividend track record with volatile payments over the past decade. However, dividends are well-covered by earnings and cash flows, with payout ratios of 34.9% and 21.8%, respectively. The recent earnings report shows net income growth to CNY 4.42 billion for nine months ending September 2024, suggesting potential financial stability despite declining sales revenue.

- Navigate through the intricacies of Yunnan Yuntianhua with our comprehensive dividend report here.

- Our valuation report unveils the possibility Yunnan Yuntianhua's shares may be trading at a discount.

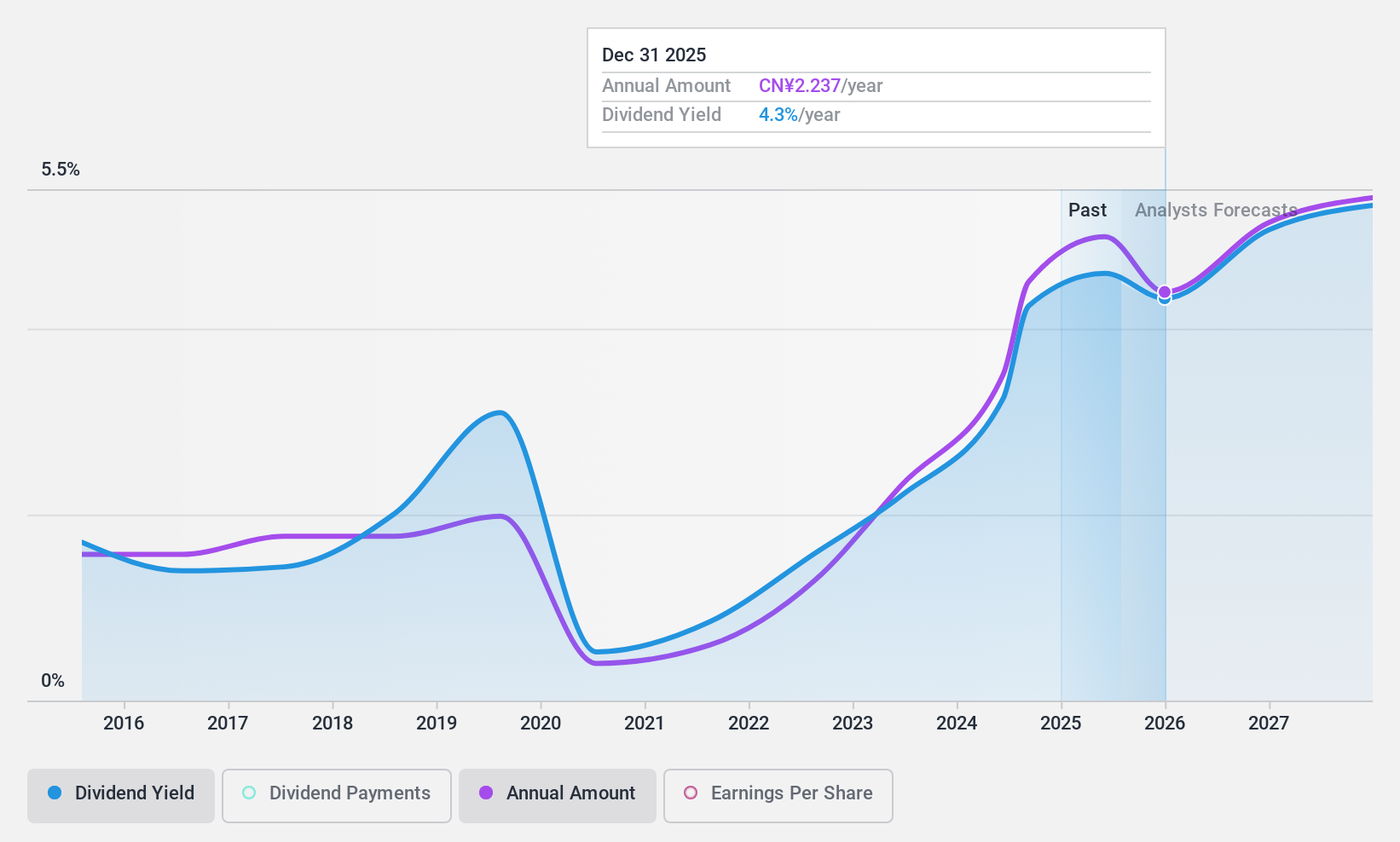

Dong-E-E-JiaoLtd (SZSE:000423)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dong-E-E-Jiao Co., Ltd. engages in the research, development, production, and sale of Ejiao along with Chinese patent medicines and health foods, with a market cap of CN¥37.85 billion.

Operations: Dong-E-E-Jiao Co., Ltd. generates revenue of CN¥5.30 billion from the operation of Ejiao and its series of products.

Dividend Yield: 3.9%

Dong-E-E-Jiao Ltd. offers a high dividend yield of 3.89%, placing it among the top 25% of dividend payers in China, yet its dividends are not well-covered by earnings, indicated by a payout ratio of 138.6%. Despite trading at an attractive value below estimated fair value, its dividends have been volatile over the past decade. Recent earnings show growth with net income reaching CNY 738.42 million for H1 2024, but sustainability concerns remain due to coverage issues.

- Get an in-depth perspective on Dong-E-E-JiaoLtd's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Dong-E-E-JiaoLtd is trading behind its estimated value.

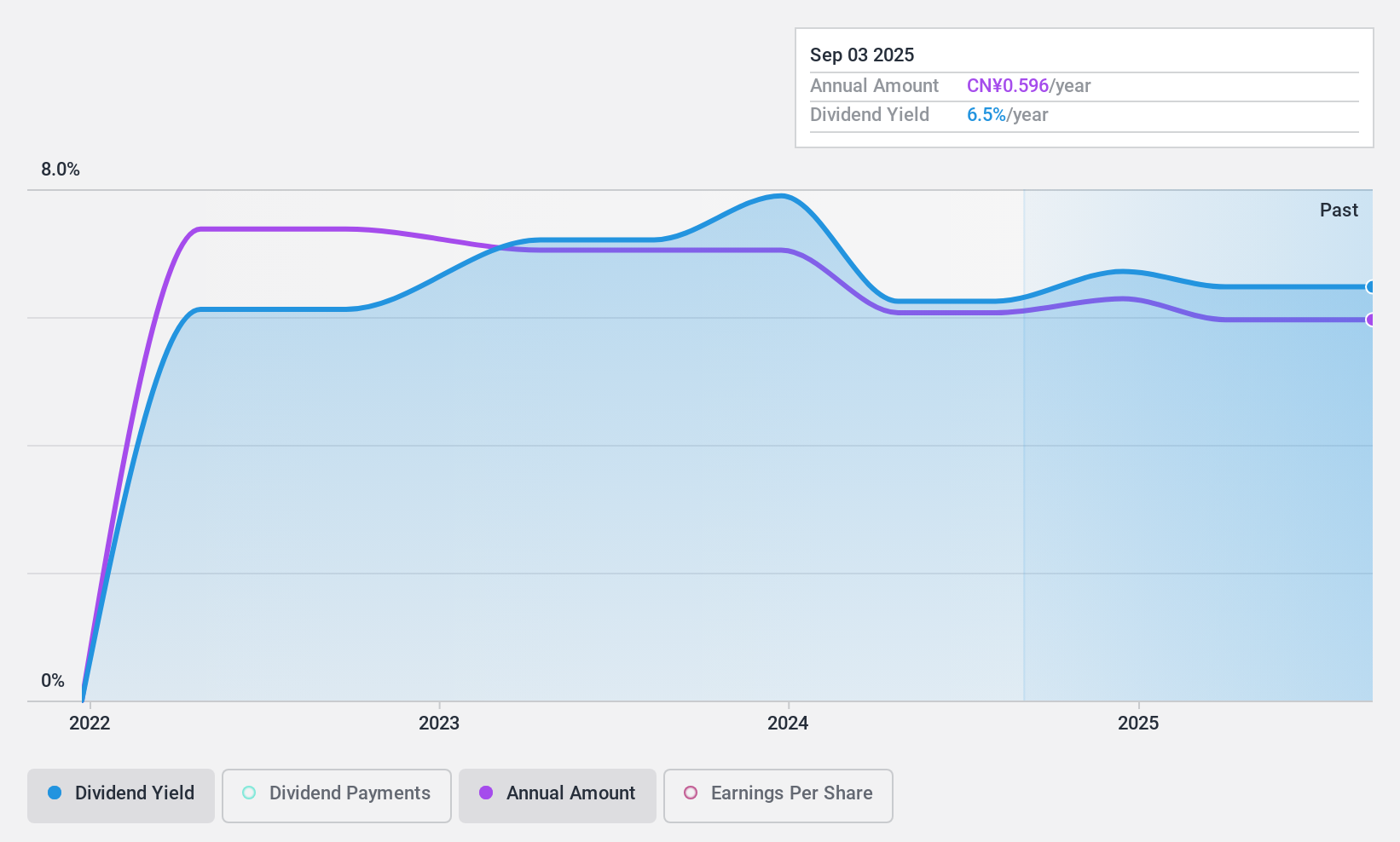

Ping An Guangzhou Comm Invest Guanghe Expressway (SZSE:180201)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ping An Guangzhou Comm Invest Guanghe Expressway Close-end Infrastructure Fund operates as an infrastructure fund with a market cap of CN¥65.40 billion.

Operations: Ping An Guangzhou Comm Invest Guanghe Expressway generates revenue of CN¥772.26 million from its transportation infrastructure segment.

Dividend Yield: 6.7%

Ping An Guangzhou Comm Invest Guanghe Expressway offers a dividend yield of 6.73%, ranking it in the top 25% of China's dividend payers, but its dividends have been unreliable and volatile over the past three years. The company's payout ratios suggest dividends are covered by earnings (87.3%) and cash flows (70.6%), yet recent earnings show a decline with net income at CNY 119.81 million for H1 2024, down from CNY 136.09 million year-on-year, raising sustainability concerns despite trading below fair value estimates.

- Click to explore a detailed breakdown of our findings in Ping An Guangzhou Comm Invest Guanghe Expressway's dividend report.

- Our valuation report here indicates Ping An Guangzhou Comm Invest Guanghe Expressway may be undervalued.

Key Takeaways

- Click this link to deep-dive into the 206 companies within our Top Chinese Dividend Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal