3 High Growth Chinese Stocks With Strong Insider Ownership

As Chinese equities recently experienced a downturn amid waning optimism about Beijing's stimulus measures, investors are increasingly focused on identifying resilient opportunities within the market. In this context, growth companies with strong insider ownership can offer potential advantages, as insider confidence may signal alignment with shareholder interests and a commitment to long-term success.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 17.9% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 20.6% | 24.6% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 38.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| UTour Group (SZSE:002707) | 22.8% | 28.7% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Here's a peek at a few of the choices from the screener.

Ficont Industry (Beijing) (SHSE:605305)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ficont Industry (Beijing) Co., Ltd. manufactures and supplies wind turbine tower internals and safety systems for wind turbine manufacturers both in China and internationally, with a market cap of CN¥5.90 billion.

Operations: The company's revenue segment includes Construction Machinery & Equipment, generating CN¥1.23 billion.

Insider Ownership: 27.9%

Ficont Industry (Beijing) has demonstrated robust growth, with recent earnings rising significantly from CNY 81.76 million to CNY 140.43 million year-over-year, and revenue increasing to CNY 570.25 million. The company is trading at a substantial discount to its estimated fair value and is expected to continue outpacing the market with projected revenue growth of 25.3% annually. However, its return on equity is forecasted to be modest at 15.3% in three years.

- Click to explore a detailed breakdown of our findings in Ficont Industry (Beijing)'s earnings growth report.

- Upon reviewing our latest valuation report, Ficont Industry (Beijing)'s share price might be too pessimistic.

Guangdong Greenway TechnologyLtd (SHSE:688345)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangdong Greenway Technology Co., Ltd operates in the research, development, production, sale, and servicing of lithium-ion battery packs and batteries across China and internationally with a market cap of CN¥1.92 billion.

Operations: The company's revenue is primarily derived from the production and sales of lithium battery-related products, amounting to CN¥1.79 billion.

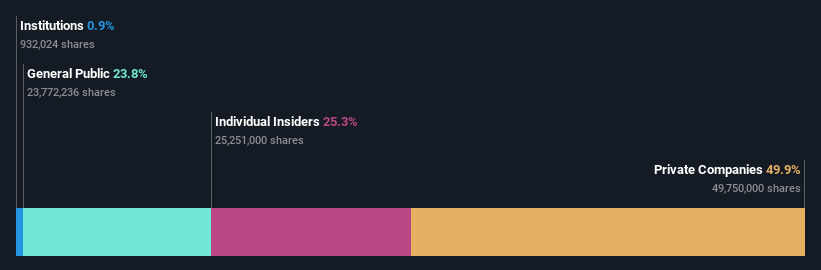

Insider Ownership: 25.3%

Guangdong Greenway Technology Ltd. has experienced a challenging period, with recent half-year results showing a decline in sales and revenue, leading to a net loss of CNY 22.57 million. Despite this, the company is forecasted to achieve profitability within three years and is expected to outpace the market with annual revenue growth projected at 18.9%. The share price has been highly volatile recently, but insider ownership remains stable without significant buying or selling activity reported in the past three months.

- Unlock comprehensive insights into our analysis of Guangdong Greenway TechnologyLtd stock in this growth report.

- According our valuation report, there's an indication that Guangdong Greenway TechnologyLtd's share price might be on the expensive side.

Bichamp Cutting Technology (Hunan) (SZSE:002843)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bichamp Cutting Technology (Hunan) Co., Ltd. operates in the cutting tool industry, focusing on manufacturing and selling saw blades and related products, with a market cap of CN¥4.12 billion.

Operations: Bichamp Cutting Technology (Hunan) Co., Ltd. generates its revenue primarily from the manufacture and sale of saw blades and related cutting products.

Insider Ownership: 31.8%

Bichamp Cutting Technology is trading below its estimated fair value, with earnings expected to grow significantly at 22.9% annually over the next three years, though slightly slower than the market. Revenue growth is forecasted at 23%, outpacing the broader CN market. Despite recent shareholder dilution and a volatile share price, insider ownership remains substantial without notable buying or selling activity recently. The company was added to the S&P Global BMI Index in September 2024.

- Click here and access our complete growth analysis report to understand the dynamics of Bichamp Cutting Technology (Hunan).

- Our expertly prepared valuation report Bichamp Cutting Technology (Hunan) implies its share price may be lower than expected.

Where To Now?

- Investigate our full lineup of 381 Fast Growing Chinese Companies With High Insider Ownership right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal