Risks To Shareholder Returns Are Elevated At These Prices For SurplusGLOBAL, Inc. (KOSDAQ:140070)

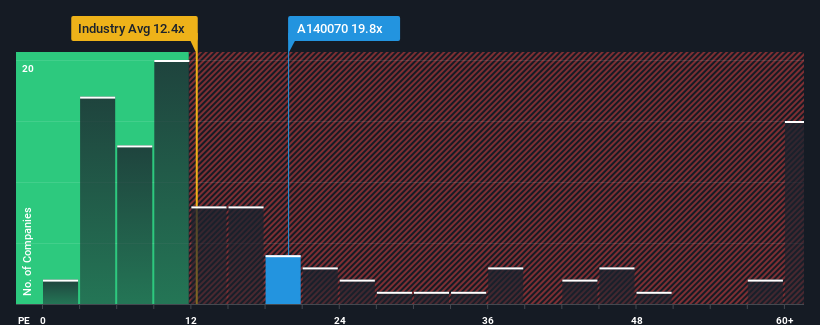

With a price-to-earnings (or "P/E") ratio of 19.8x SurplusGLOBAL, Inc. (KOSDAQ:140070) may be sending very bearish signals at the moment, given that almost half of all companies in Korea have P/E ratios under 11x and even P/E's lower than 6x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For instance, SurplusGLOBAL's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

See our latest analysis for SurplusGLOBAL

Is There Enough Growth For SurplusGLOBAL?

In order to justify its P/E ratio, SurplusGLOBAL would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 64% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 62% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 32% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that SurplusGLOBAL is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

What We Can Learn From SurplusGLOBAL's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of SurplusGLOBAL revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 4 warning signs for SurplusGLOBAL (2 are concerning!) that you need to take into consideration.

Of course, you might also be able to find a better stock than SurplusGLOBAL. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal